Dear colleagues.

For the Euro / Dollar pair, the potential for the top to the level of 1.2031 has expanded. For the Pound / Dollar pair, the upward trend is expected after the breakdown of 1.3425. For the Dollar / Franc pair, the following targets for the bottom were determined from the medium-term downward structure on December 8. For the Dollar / Yen pair, the continuation of the upward movement is expected after the breakdown of 113.50. For the Euro / Yen pair, the price is in the correction zone from the ascending structure on December 15. According to the Pound / Yen pair, the continuation of the development of the upward structure from December 15 is expected after the passage at the price of the noise range of 151.89 - 152.10.

Forecast for December 28:

Analytical review of currency pairs in the H1 scale:

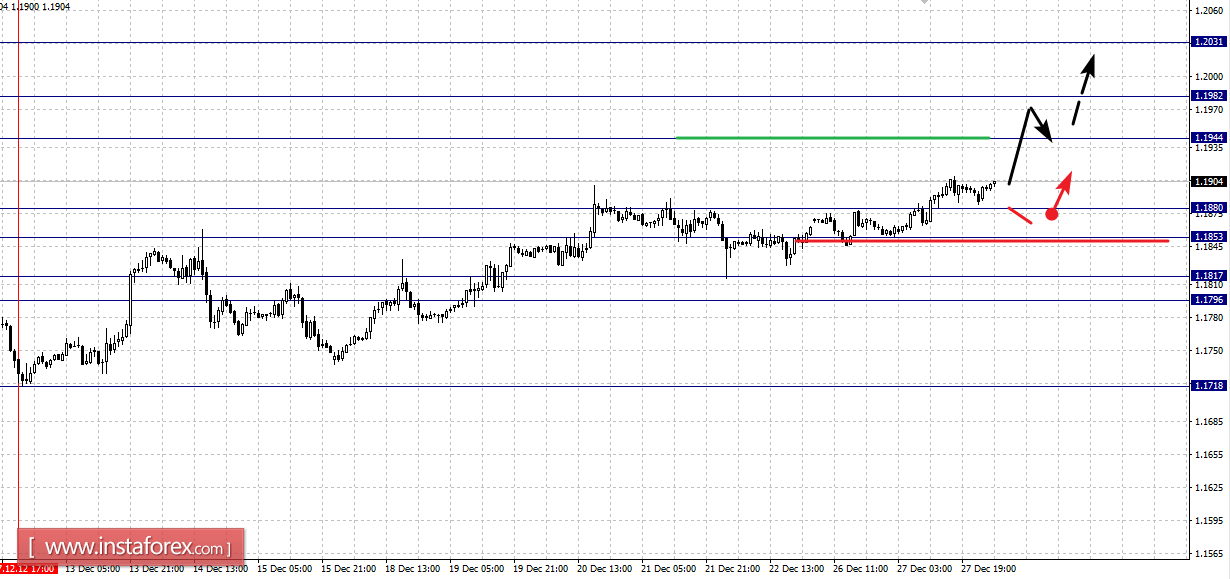

For the EUR / USD pair, the key levels on the H1 scale are 1.2031, 1.1982, 1.1944, 1.1880, 1.1853, 1.1817 and 1.1796. Here, we follow the upward cycle from December 12. Currently, a move to the level of 1.1944 is expected, as well as in the corridor 1.1944 - 1.1982 short-term upward movement. The potential value for the top is the level of 1.2031, after which expecting for a rollback to correction.

Short-term downward movement is possible in the corridor of 1.1880-1.1853, the breakdown of the last value will lead to an in-depth correction, with the target at 1.1817, the range of 1.1817-1.1796 is the key support for the top.

The main trend is the ascending structure of December 12.

Trading recommendations:

Buy: 1.1944 Take profit: 1.1980

Buy: 1.1984 Take profit: 1.2030

Sell: 1.1880 Take profit: 1.1855

Sell: 1.1850 Take profit: 1.1820

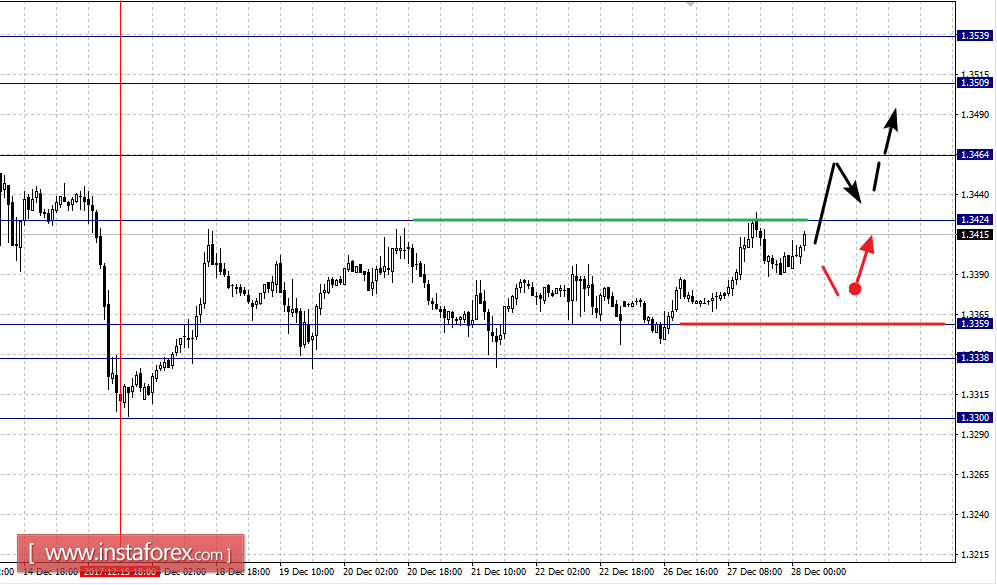

For the Pound / Dollar pair, key levels on the H1 scale are 1.3539, 1.3509, 1.3464, 1.3424, 1.3359, 1.3338 and 1.3300. Here, the main structure can be considered as the ascending pattern from December 15. The continuation of the upward movement is expected after the breakdown of 1.3424. In this case, the target is 1.3464 level, near the consolidation of the price. Breaking level 1.3464 should be accompanied by a clear upward movement, with the target seen at 1.3509. The potential value for the top is the level of 1.3539, after which we expect a pullback downwards.

Short-term downward movement is possible in the corridor of 1.3359 - 1.3338, the breakdown of the last value will have to form a downward structure, with the target at 1.3300.

The main trend is the ascending structure of December 15.

Trading recommendations:

Buy: 1.3426 Take profit: 1.3462

Buy: 1.3466 Take profit: 1.3505

Sell: 1.3357 Take profit: 1.3338

Sell: 1.3336 Take profit: 1.3303

For the Dollar / Franc pair, the key levels on the H1 scale are 0.9911, 0.9890, 0.9875, 0.9832, 0.9810 and 0.9790. Here, the following goals can be identified from the medium-term downward structure on December 8. At the moment, a move to the 0.9832 area is expected, by which the level is near the consolidation. Breaking down the level of 0.9830 will lead to the development of a downward trend, with the target shown at 0.9810. The potential value for the bottom is the level of 0.9790, a rollback upward is expected upon reaching the region.

Short-term upward movement is possible in the range of 0.9875 - 0.9890, the breakdown of the last value will lead to an in-depth correction, with the target at 0.9910.

The main trend is the downward structure of December 8.

Trading recommendations:

Buy: 0.9875 Take profit: 0.9890

Buy: 0.9892 Take profit: 0.9910

Sell: 0.9830 Take profit: 0.9812

Sell: 0.9808 Take profit: 0.9792

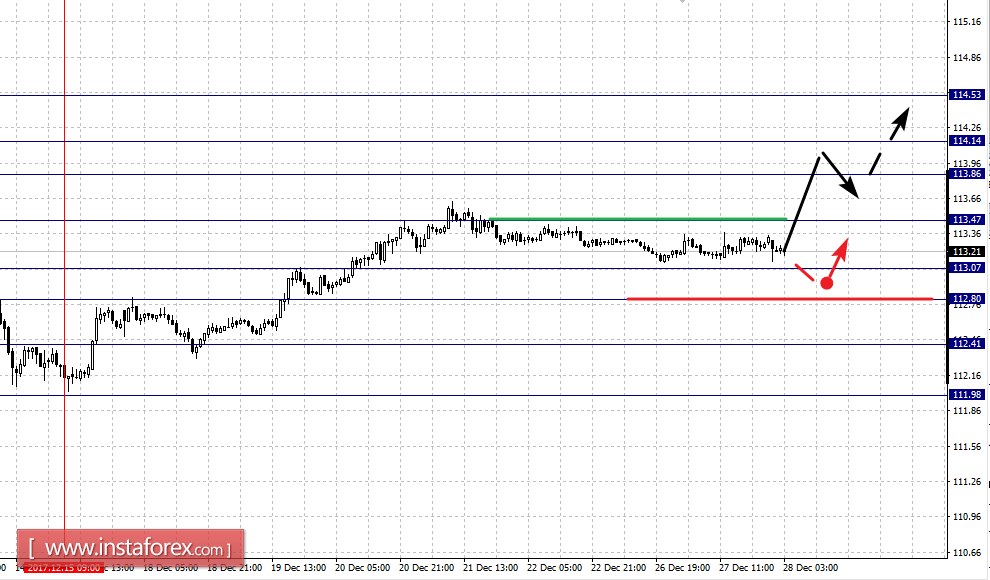

For the Dollar / Yen pair, the key levels on the scale are 114.53, 114.14, 113.86, 113.47, 113.07, 112.80 and 112.41. Here, the continuation of the development of the upward structure from December 15 is expected after the breakdown of 113.47. In this case, the target is the 113.86 level, in the corridor 113.86 - 114.14 consolidation. The potential value for the top is the level 114.53, a downward pullback is expected upon reaching that level.

Short-term downward movement is possible in the corridor 113.07 - 112.80, the breakdown of the last value will lead to an in-depth correction, with the target at 112.41 which is the key support for the top.

The main trend: the upward structure of December 15.

Trading recommendations:

Buy: 113.48 Take profit: 113.84

Buy: 114.16 Take profit: 114.50

Sell: 113.05 Take profit: 112.82

Sell: 112.78 Take profit: 112.45

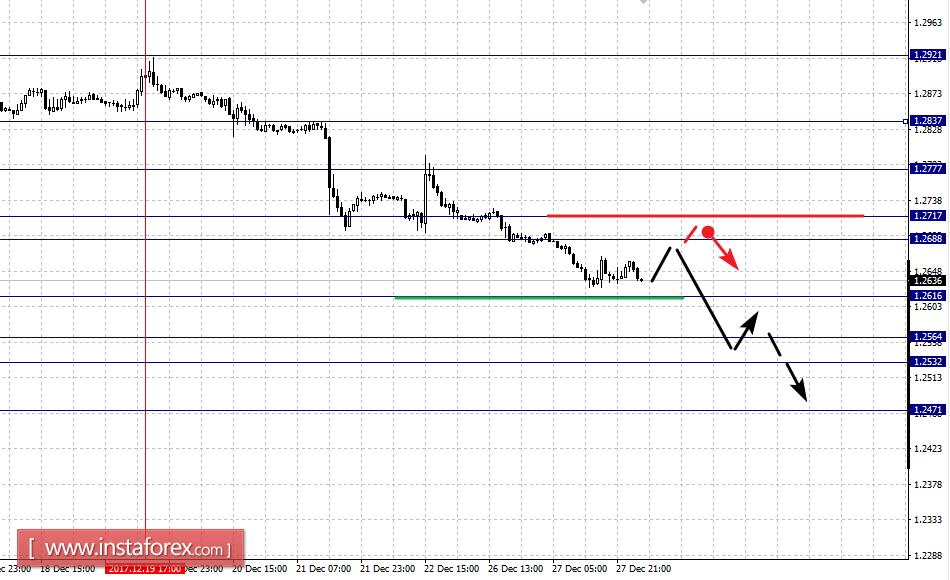

For the Canadian Dollar / Dollar pair, the key levels on the H1 scale are 1.2837, 1.2777, 1.2717, 1.2688, 1.2616, 1.2564, 1.2532 and 1.2471. Here, the continuation of the development of the downward structure from December 19 is expected after the breakdown of 1.2616. In this case, the target is 1.2564, in the corridor 1.2564 - 1.2532 consolidation. The potential value for the bottom is the level of 1.2471, a rollback to the top is expected upon reaching that zone.

Short-term upward movement is possible in the corridor of 1.2688 - 1.2717, the breakdown of the last value will lead to an in-depth correction. The target is located at 1.2777 which is the key support for the downward structure, its passage by the price will have to build the potential for the top, and the objective is -1.2837.

The main trend is the downward structure of December 19.

Trading recommendations:

Buy: 1.2718 Take profit: 1.2775

Buy: 1.2778 Take profit: 1.2835

Sell: 1.2614 Take profit: 1.2566

Sell: 1.2530 Take profit: 1.2475

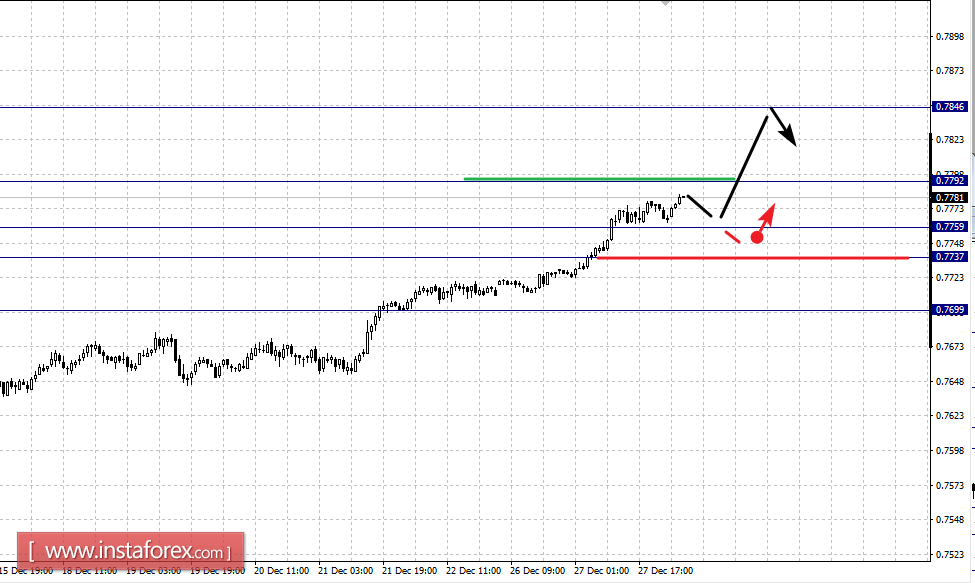

For the Australian Dollar / Dollar pair, the key levels on the H1 scale are 0.7846, 0.7792. 0.7759, 0.7737 and 0.7699. Here the price is close to the limit values. Continued upward movement is expected after the breakdown of 0.7792. In this case, the potential target is 0.7846 level by which a correction is expected.

Short-term downward movement is possible in the corridor 0.7759 - 0.7737, the breakdown of the last value will lead to an in-depth correction, here the target is 0.7700.

The main trend is the upward cycle from December 8.

Trading recommendations:

Buy: 0.7794 Take profit: 0.7840

Buy: Take profit:

Sell: 0.7755 Take profit: 0.7740

Sell: 0.7735 Take profit: 0.7705

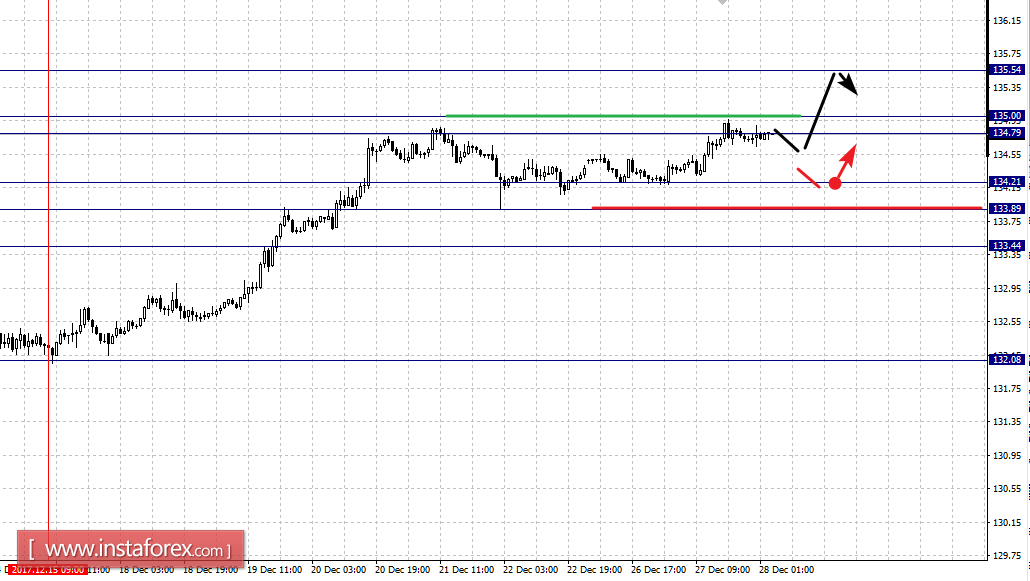

For the Euro / Yen pair, the key levels on the scale of H1 are 135.54, 135.00, 134.79, 134.21, 133.89 and 133.44. Here, the continuation of the development of the upward structure from December 15 is expected after passing through the price of the noise range at 134.79 - 135.00. In this case, the potential target is 135.54 and a downward pullback is expected upon reaching this level.

Short-term downward movement is possible in the corridor of 134.21 - 133.89, the breakdown of the last value will lead to an in-depth correction, with the target at 133.45 level considered as the key support for the top.

The main trend is the ascending cycle of December 15.

Trading recommendations:

Buy: 135.05 Take profit: 135.50

Buy: Take profit:

Sell: 134.20 Take profit: 133.90

Sell: 133.85 Take profit: 133.45

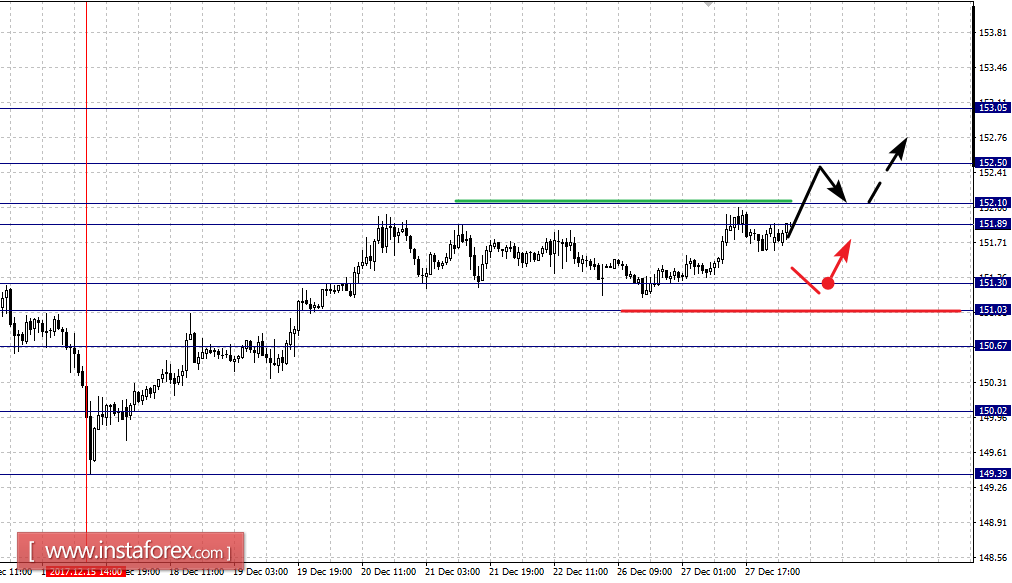

For the Pound / Yen pair, the key levels on the H1 scale are 153.05, 152.50, 152.10, 151.89, 151.30, 151.03, 150.67 and 150.02. Here, we continue to follow the upward structure of December 15. The continuation of the upward movement is expected after the passage at the price of the noise range 151.89 - 152.10. In this case, the target is 152.50. The potential value for the top is the level 153.05, an exit from the correction is expected upon reaching this level.

Short-term downward movement is possible in the corridor 151.30 - 151.03, the breakdown of the last value will lead to an in-depth movement, with the target at 150.67 level which is the key support for the top.

The main trend is the upward structure from December 15, the correction stage.

Trading recommendations:

Buy: 152.10 Take profit: 152.50

Buy: 152.53 Take profit: 153.00

Sell: 151.30 Take profit: 151.05

Sell: 151.00 Take profit: 150.70

* The presented market analysis is informative and does not constitute a guide to the transaction.