EUR / USD pair

To open long positions for EUR/USD pair, you need:

A breakout and consolidation above 1.1956 may lead to the formation of a further upward trend with an exit at 1.1980 and an update of 2001/01, where fixing profits are recommended. In case of a decline in the euro in the morning, long positions can be viewed from the support level of 1.1937. However, it is best to buy immediately after a rebound from 1.1909.

To open short positions for EUR / USD pair, you need:

The formation of a false breakout and the failure to consolidate above 1.1956 would be a good signal for the opening of short positions in EUR/USD pair with a view to reducing to the level of 1.1937. At the same time, this allows to access further a more important range of support at 1.1909, where fixing profits are recommended. The main purpose of the major sellers will be the update of 1.1866.

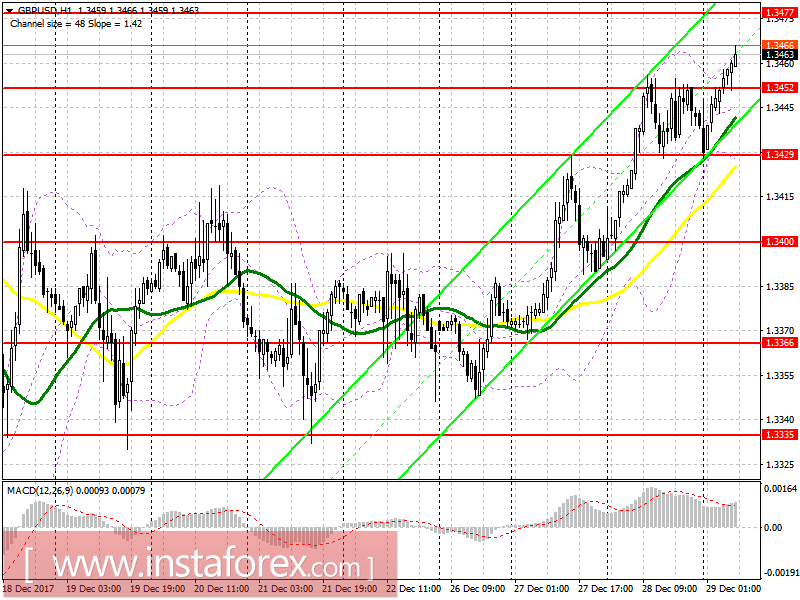

GBP / USD pair

To open long positions for GBP/USD pair, you need:

While the trade is conducted above 1.3452, a renewal of resistance 1.3479 is expected where fixing profits are recommended. In case of a return under 1.3452, long positions should be opened immediately to a rebound after the test 1.3429.

To open short positions for GBP/USD pair, you need:

A false breakout and a return at the level of 1.3479 will be a good signal for the opening of short positions, with a decline to 1.34522. Securing under this area can completely return the GBP/USD pair to the day-opening level area to support 1.3429, where fixing profits are recommended.

Fears of indicators

- MA (average sliding) 50 days - yellow

- MA (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

To familiarize with the basic concepts and the general rules of my TS is possible here.