EUR/USD, GBP/USD

The new investment year began. It started quietly, without the strong jolts, which we assumed in the last days of December. However, this does not mean that the strong movements of currencies against the dollar are ruled out, as well as the fact that the dollar will begin to strengthen in the first days of January. The situation is balanced despite a neutral opening of the markets. The situation is peculiar and today is a holiday in Japan.

On Sunday, the indicators of business activity in China for December was released. Manufacturing PMI declined from 51.8 to 51.6, Non-Manufacturing PMI increased from 54.8 to 55.0. Today, the assessment of Manufacturing PMI from Caixin helped investors turn to Sunday indicators - here the index grew from 50.8 to 51.5. Data had an effect: the Shanghai Composite in the Asian session is growing by 1.06%. South Korean Kospi SEU adds 0.22%. The Australian S&P/ASX 200 is down 0.17%.

For the euro area, the United Kingdom and the United States, PMI manufacturing data will also be released today. However, this is the final assessment for December, and no significant changes are expected; for the euro area at 60.6 (unchanged), for Great Britain 58.0 against 58.2, for the USA (according to Markit) 55.0 - unchanged.

Tomorrow, the ISM Institute's estimate Manufacturing PMI will be released- a forecast of 58.3 versus 58.2 in November. Construction costs are expected to increase by 0.8%. Also on Wednesday, the minutes will be published from the last FOMC meeting of the Fed. In them, new information is not expected, although there are already rumors about an imminent revision of the rate hike in the new year from three to four.

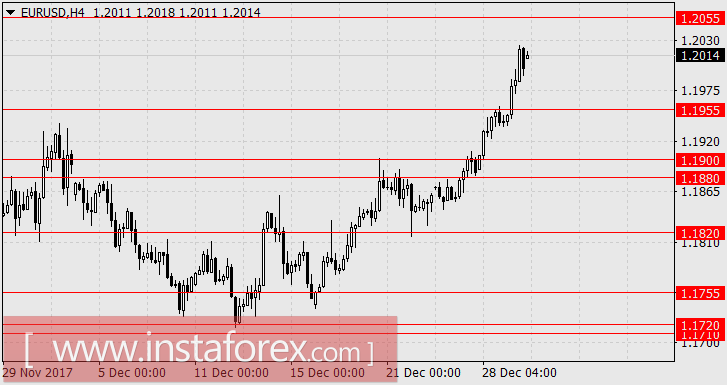

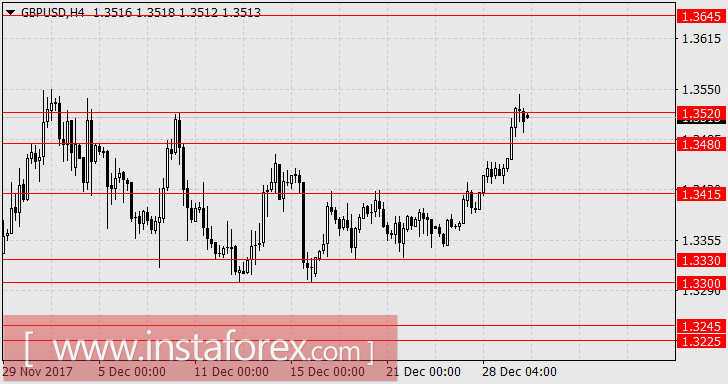

Therefore, we do not expect sharp fluctuations in the market for today. Tomorrow, two scenarios are possible - the first one - intensive growth to collect stops orders, as described in the previous review (growth of the euro to 1.2110 and a pound in the range of 1.3520-1.3645), the second - the beginning of a sharp strengthening of the dollar. In this case, market participants will be able to appeal to fairly optimistic expectations for employment in the US on Friday.

AUD/USD

The Australian Manufacturing PMI estimate from AIG today showed a decline from 57.3 to 56.2. The stock index of S&P/ASX 200 loses 0.17% against the background of the growth of the Chinese market, and this is a sign of the heightened attention of Australian investors towards the main events in the US - the adoption of tax reform, raising the limit of public debt, the closest data. Today, the Australian business press modestly notes the growth of Chinese PMI and focuses on the US budget and Friday's decline in stock indices (S&P 500 -0.52%, Nasdaq -0.67%). In the morning, non-ferrous metals are traded in different directions. Clearly, the Australian dollar will follow in accordance with the movement of the euro and the pound.

In the current situation, we are waiting for trading in the range of 0.7750-0.7825.