Dear colleagues.

For the EUR/USD pair, there is an increasing potential for the upward cycle to reach the level of 1.2138. For the GBP/USD pair, there is upside potential also expanded to the level of 1.3707, where a downward movement is considered as a correction. For the USD/CHF pair, it continues the development of the downward medium-term cycle of December 8. For the EUR/JPY pair, the subsequent goals for the top were determined from the local upward structure on December 22. For the GBP/JPY pair, the subsequent objectives for the top were determined from the local structure on December 26 and the uptrend development is expected after the breakdown at the level of 152.80.

Forecast for January 3:

Analytical review of currency pairs on the H1 chart:

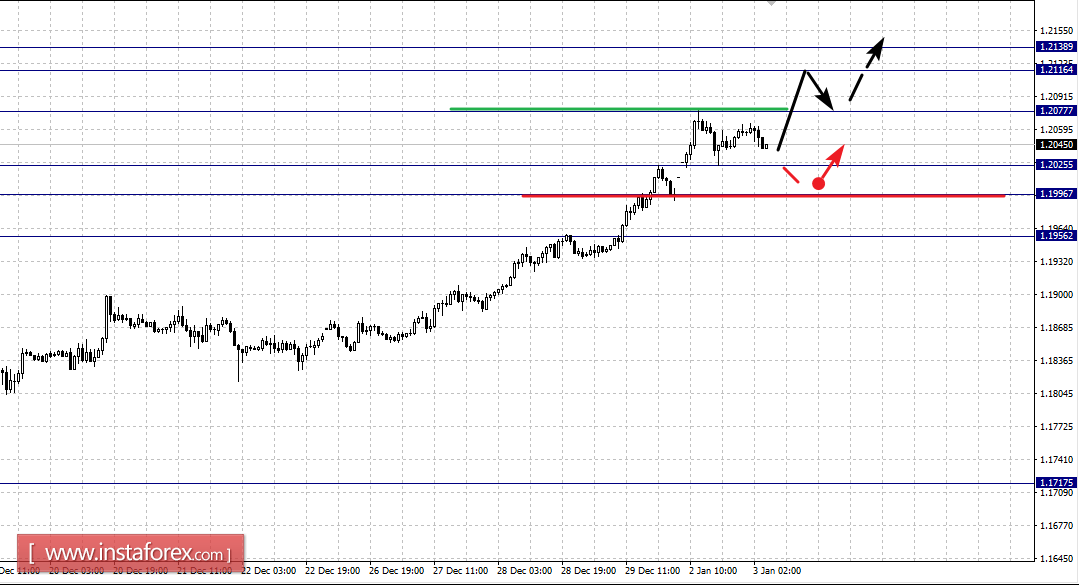

For the EUR/USD pair, the key levels on the H1 scale are 1.2137, 1.2116, 1.2077, 1.2025, 1.1996 and 1.1957. Here, we follow the upward cycle of December 12. The continuation of the upward movement is expected after the breakdown of 1.2077. In this case, the target is 1.2116 with the potential value for the top at the level of 1.2137. When this level has been achieved, a correction is expected after.

A short-term downward movement is possible in the area of 1.2025 - 1.1996 and a breakdown of the last value will lead to in-depth correction with the target level of 1.1957.

The main trend is the ascending structure of December 12.

Trading recommendations:

Buy: 1.2078 Take profit: 1.2115

Buy Take profit:

Sell: 1.2023 Take profit: 1.1998

Sell: 1.1994 Take profit: 1.1960

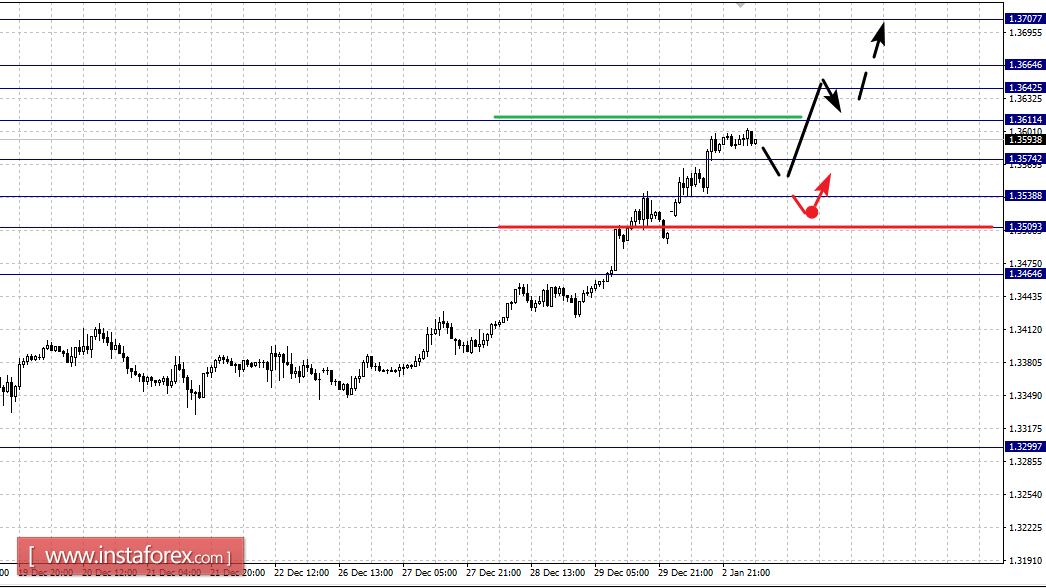

For the GBP/USD pair, the levels on the H1 scale are 1.3707, 1.3664, 1.3643, 1.3611, 1.3575, 1.3539, 1.3509 and 1.3464. Here, the development of the upward cycle from December 15 continues and a breakdown at the level of 1.3611 is expected after. The potential value for the top is the level of 1.3707 and a downward pullback is expected upon reaching this value.

The correction is expected to continue after the breakdown at the level of 1.3575 with the target of .3539 in the area of consolidation at 1.3539 - 1.3509. A breakdown at the level of 1.3509 will lead to an in-depth movement with the target of 1.3464, where the initial conditions for the upward cycle are expected to formalize.

The main trend is the ascending structure of December 15.

Trading recommendations:

Buy: 1.3612 Take profit: 1.3640

Buy: 1.3665 Take profit: 1.3705

Sell: 1.3572 Take profit: 1.3540

Sell: 1.3507 Take profit: 1.3466

For the USD/CHF pair, the key levels on the H1 scale are: 0.9832, 0.9787, 0.9755, 0.9731, 0.9697, 0.9646 and 0.9612. Here, we follow the downward structure of December 8. A continued downward movement is expected after the breakdown at the level of 0.9694, which is near the area of consolidation. The potential value for the bottom is the level of 0.9612and an upward pullback is expected upon reaching this value.

A short-term upward movement is possible in the area of 0.9731 - 0.9755 and a breakdown of the last value will lead to in-depth correction with the target level of 0.9787. The initial conditions for the upward cycle are expected to formalize at the level of 0.9832.

The main trend is the downward structure of December 8.

Trading recommendations:

Buy: 0.9731 Take profit: 0.9754

Buy: 0.9757 Take profit: 0.9785

Sell: 0.9695 Take profit: 0.9648

Sell: 0.9644 Take profit: 0.9612

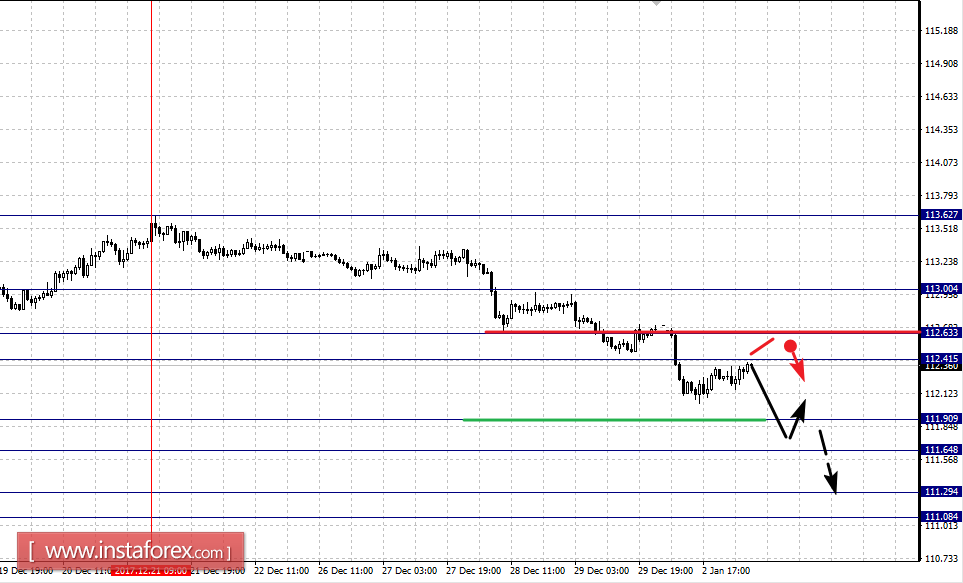

For the USD/JPY pair, the key levels on the H1 scale are 113.02, 112.67, 112.46, 111.98, 111.72, 111.35 and 111.14. Here, we follow the downward structure of December 21. A short-term downward movement is possible in the range of 111.98 - 111.72 while the breakdown of the last value should be accompanied by a pronounced movement to the level of 111.35. When this level has been reached, a consolidation is expected in the area of 111.35 - 111.14.

A short-term upward movement is possible in the area of 112.46 - 112.67. A breakdown of the last value will lead to in-depth correction with the target level of 113.00, which is the key support for the downward structure.

The main trend: the downward structure of December 21.

Trading recommendations:

Buy: 111.96 Take profit: 111.73

Buy: 111.70 Take profit: 111.37

Sell: 112.46 Take profit: 112.65

Sell: 112.69 Take profit: 113.00

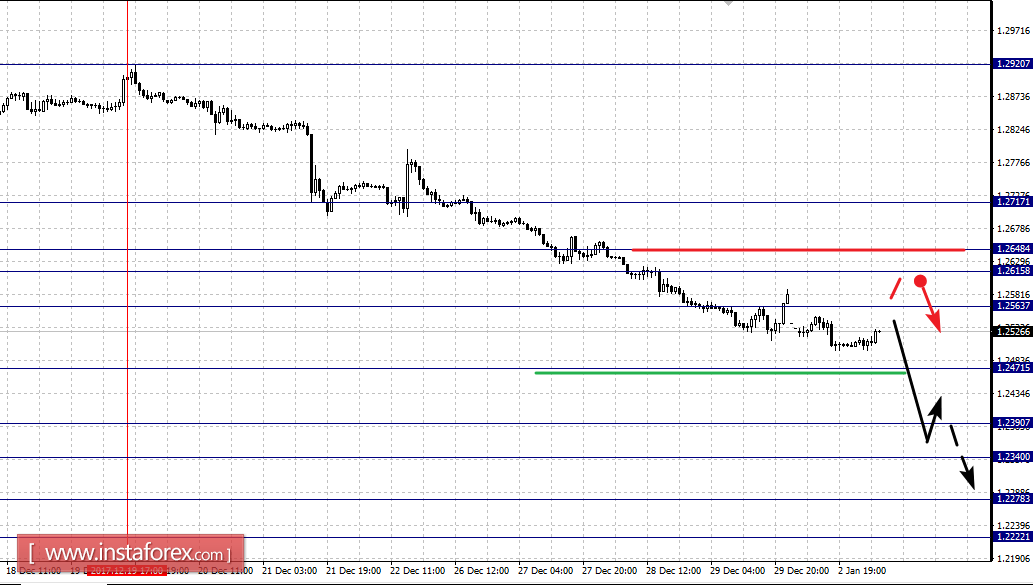

For the USD/CAD pair, the key levels on the H1 scale are 1.2649, 1.2616, 1.2568, 1.2532, 1.2471, 1.2391, 1.2342, 1.2277 and 1.2222. Here, the continuation of the development of the downward structure from December 19 is expected after the breakdown of the level of 1.2470. In this case, the target is 1.2391 within the area of 1.2391 - 1.2342, a short-term downward movement and consolidation are expected. A breakthrough at the level of 1.2340 should be accompanied by a pronounced downward movement to the level of 1.2277. The potential value for a downtrend is the level of 1.2222.

A short-term upward movement is possible in the area of 1.2532 - 1.2568. A breakdown of the last value will lead to in-depth correction with the target level of 1.2616. The key support for the downward structure is found in the area of 1.2616 - 1.2649.

The main trend is the downward structure of December 19.

Trading recommendations:

Buy: 1.2532 Take profit: 1.2566

Buy: 1.2570 Take profit: 1.2614

Sell: 1.2468 Take profit: 1.2395

Sell: 1.2390 Take profit: 1.2344

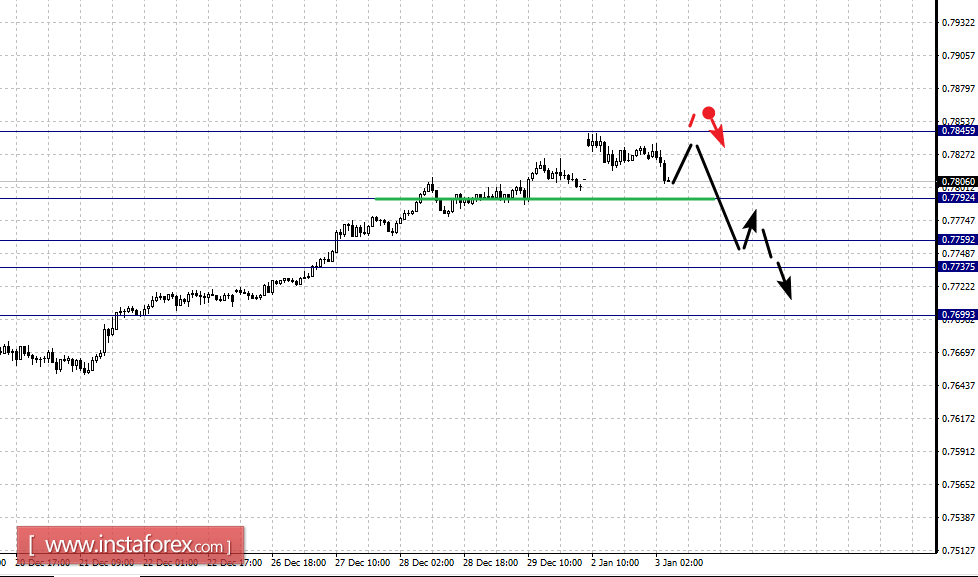

For the AUD / USD, the key levels on the scale of H1 are 0.7846, 0.7792. 0.7759, 0.7737 and 0.7699. Here, the price is near the limit for the top of the level of 0.7846, which would lead to a correction. The development of the downward movement is possible after the breakdown of 0.7792. In this case, the first target is 0.7759 in the area of 0.7759 - 0.7737 with a short-term downward movement, and consolidation. The potential value for the downward structure is the level of 0.7699, where the initial conditions are for the development of the trend.

The main trend is the upward cycle from December 8 and a correction is expected.

Trading recommendations:

Buy: Take profit:

Buy: Take profit:

Sell: 0.7790 Take profit: 0.7765

Sell: 0.7735 Take profit: 0.7705

For the EUR/JPY pair, the key levels on the H1 scale are 137.39, 136.95, 136.30, 135.74, 134.93, 134.55 and 133.89. Here, the subsequent goals for the top are determined based on a local upward structure on December 25. A short-term upward movement is possible in the area of 135.74 - 136.30, and a breakdown of the last value should be accompanied by a pronounced upward movement with a target at 136.95. The potential value for the top is the level of 137.39 and a correction is expected upon reaching this value.

A short-term downward movement is possible in the area of 134.93 - 134.55. A breakdown of the last value will lead to in-depth correction with the target level of 133.89, this level is the key support for the top.

The main trend is the local upward cycle of December 25.

Trading recommendations:

Buy: 135.75 Take profit: 136.25

Buy: 136.35 Take profit: 136.95

Sell: 134.90 Take profit: 134.57

Sell: 134.50 Take profit: 133.90

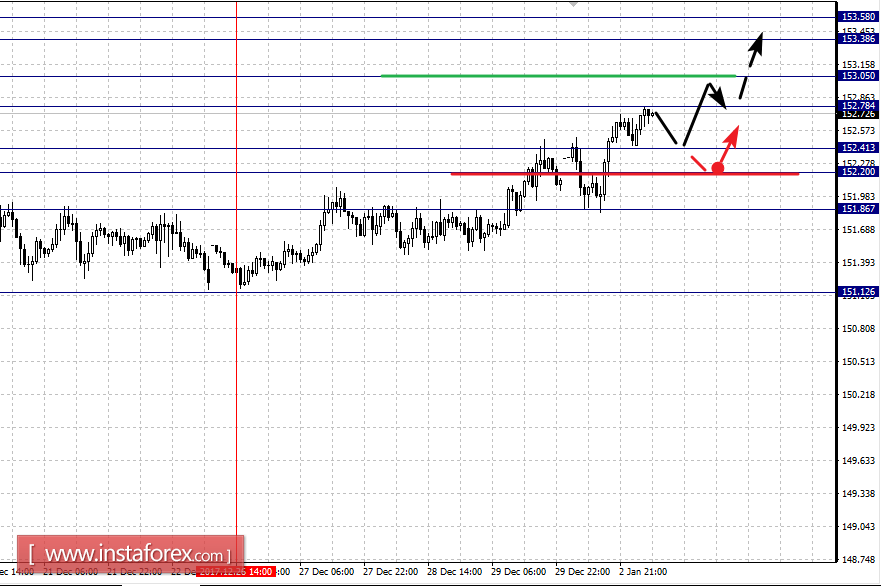

For the GBP/JPY pair, the key levels on the H1 scale are 153.58, 153.38, 153.05, 152.78, 152.41, 152.20 and 151.86. Here, the subsequent goals of the upward movement are determined from the local structure on December 26. Short-term upward movement is expected in the area of 152.78 - 153.05. A breakdown of the last value will lead to a pronounced movement with the target of 153.38. The potential value for the top is the level 153.58 and a downward pullback is expected upon reaching this value.

A short-term downward movement is possible in the area of 152.41 - 152.20 and a breakdown of the last value will lead to an in-depth movement with the target level of 151.86, which is the key support for the top.

The main trend is the local upward structure of December 25.

Trading recommendations:

Buy: 152.80 Take profit: 153.05

Buy: 153.10 Take profit: 153.35

Sell: 152.40 Take profit: 152.25

Sell: 152.18 Take profit: 151.88