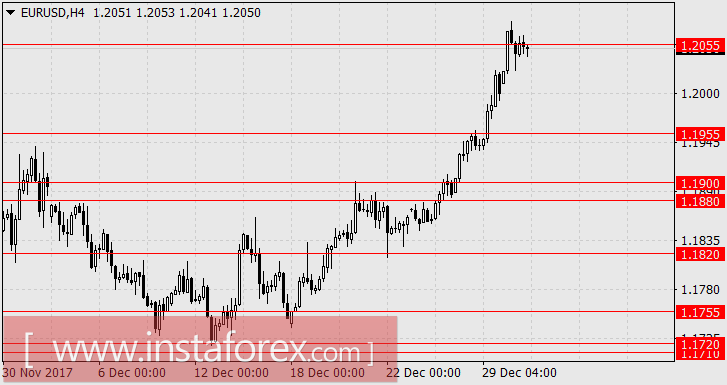

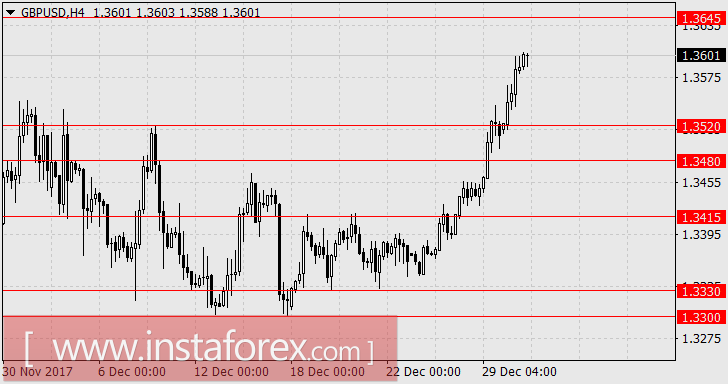

EUR / USD, GBP / USD

On Tuesday, there was no news released from the US and the single European currency gained 56 points under the pressure of rising yields of European government bonds. This further began to respond to the decline in costs of 30 billion euros in Europe. Thus, Spain's 3-year government bonds increased in yields from 0.005% to 0.030%, while 6-year bonds grew from 0.656% to 0.736%, and German 6-years bond raised from -0.098% to -0.075%. The yields of US bonds for 5-year-olds, increased from 2.206% to 2.248%, which was created by the effect of increasing appetite for risk and the growth of the euro. The 0.83% added, and Russell 2000 + 1.07%.

The final estimate of the eurozone manufacturing. PMI for December remained unchanged at 60.6 points. While the UK Manufacturing PMI is weakened, as the index dropped from 58.2 to 56.3 with expectations for 58.0. The American Manufacturing PMI turned out to be the best in this comparison, showing growth from 55.0 to 55.1 with the index expected to be unchanged. Meanwhile, the British pound was steadily pulling up and the growth gained 78 points. Investors had to wait for the Fed's protocols to be released tonight and the labor data on Friday.

Today, the business activity index in the UK construction sector (Construction PMI) showed a decrease in the forecast from 53.1 to 52.8, but psychologically, investors were already this. The labor data in Germany for December may interest in the market as a result of a loss of 14 thousand after -18 thousand in the previous month. The unemployment rate is 5.6%. A good incentive for the growth of the euro is fraught with unemployment in Spain, showing a forecast of -60.3 thousand against the growth of the unemployed by 7.3 thousand in November.

At 7:00 PM London time, the main event of the day is the publication of the minutes from the last FOMC meeting of the Fed. Further reduction of hawkish rhetoric in these documents is not expected, as American business media released such news for the reason that there were no such hints from the financial politicians themselves. Everyone should be cautious about this. The euro is expected at 1.1955, while the pound sterling is expected in the range of 1.3480-1.3520.

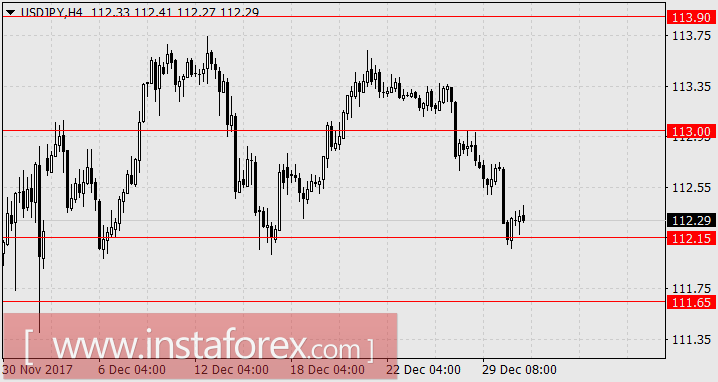

USD / JPY

The Japanese yen fell on the optimistic growth of stock markets. The Dow Jones added 0.42% yesterday. The stock market of Japan is closed for New Year holidays until tomorrow. Nevertheless, currency control remains. We are expecting for the yen to rise to 113.00.

AUD / USD

After the general trend, the growth rate of 20 points demonstrates restraint of investors over significant data from the US. Regional macroeconomic indicators that came in mixed. As the Chinese Manufacturing PMI for December increased from 50.8 to 51.8, and Australian Manufacturing PMI according to AIG fell from 57.3 to 56.2.

The cost of iron ore jumped by 1.52%, but all major industrial metals and oil in price declined.

The moderation of Australian investors may be in anticipation of Friday's trade balance for November, the forecast for which is $ 0.55 billion versus $ 0.10 billion in November, and the dynamics of the "Australian" moderation. Probably a decrease to 0.7750.

* The presented market analysis is informative and does not constitute a guide to the transaction.