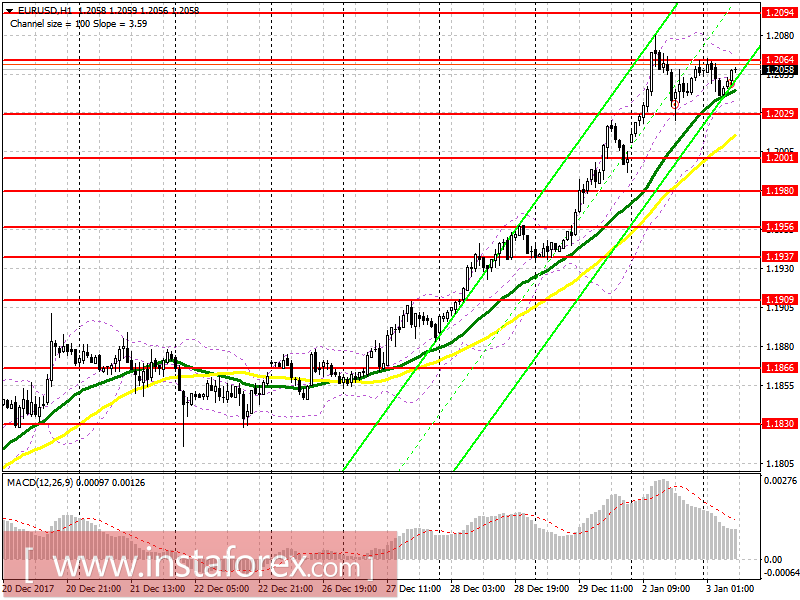

EUR / USD

To open long positions for EUR/USD:

Break and consolidation above 1.2064 may lead to the formation of a further upward trend with an exit at 1.2094 and an update of 1.2123, where I recommend fixing the profit. In the event of an unsuccessful consolidation above 1.2064 in the morning, long positions are best viewed from the support level 1.2029 or buy the euro immediately at a rebound of 1,2001.

To open short positions for EUR/USD, it is required:

The formation of a false breakout and the failure to consolidate at 1.2064 will be a good signal to open short positions in EUR / USD with a view to reducing to the level of 1.2029 and further access to a more important support range of 1.2001, where I recommend fixing profits. The main purpose of the large sellers will be the update 1.1980. In the case of growth above 1.2064, you can open short positions on the euro after the test 1.2094 or on a rebound from 1.2123.

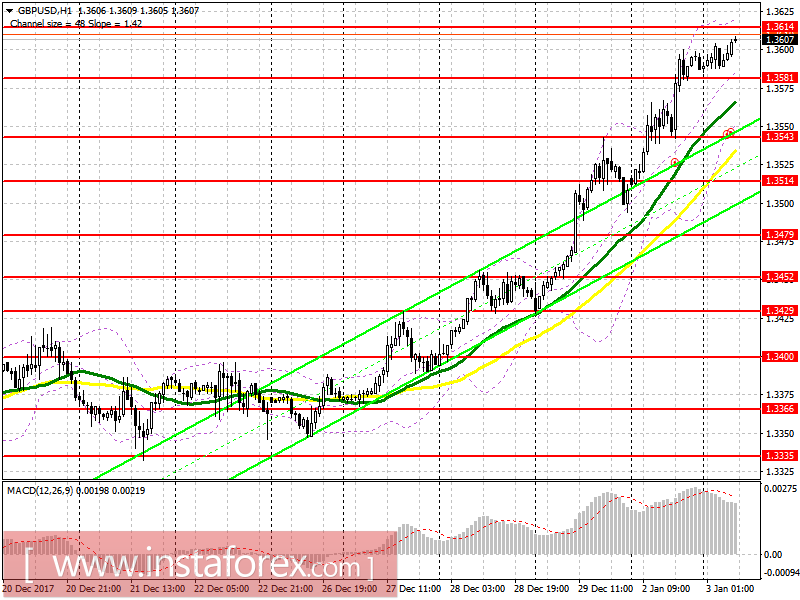

GBP / USD

To open long positions in GBP/USD:

Breakout and consolidation at 1.3614 will be a good signal for the continuation of GBP / USD growth, the main goal of which will be to update the monthly highs around 1.3648 and 1.3711, where I recommend fixing profit. In the event of an unsuccessful breakout of 1.3614, long positions are best postponed until the upgrade is 1.3581 or buy a pound for a rebound from 1.3543.

To open short positions for GBP/USD, it is required:

False breakdown and return at 1.3614 will be a good signal to open short positions with a decline to 1.3581, and consolidation under this area can completely return GBP / USD to the day opening level to support 1.3543, where I recommend fixing profit. In the case of a pound rising above 1.3614, consider short positions can immediately be rebounded from 1.3648.

Indicators

MA (medium sliding) 50 days - yellow

MA (medium sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20