After a good growth in 2017, many economic and analytical agencies have seriously started talking about continuing to accelerate the growth of the European economy this year. If the eurozone countries continue to show such good results, it is unlikely that the European Central Bank will drag out with the curtailment of the program for the redemption of bonds and the first increase in the interest rate since the crisis.

Meanwhile, the growth of the euro persists, as good fundamental statistics continue to inspire large investors to purchase risky assets.

Yesterday, for example, it became known that the index of supply managers for the manufacturing sector of the eurozone in December reached another record high.

According to the report of the statistical agency, the IHS Markit, the index rose to 60.6 points in December last year against 60.1 points in November. These data are fully coincident with the expectations of economists, which indicates a fairly good position in the sector of European producers. As noted in the report, growth occurred at the expense of countries such as Germany and Austria. Good indicators of the manufacturing sector were also observed in France.

In the US, the PMI growth was also noted.

According to the report, the index of supply managers for the U.S. manufacturing sector in December 2017 increased to 55.1 points against 53.9 points in November. As noted in the IHS Markit report, growth occurred against the backdrop of increased demand. Let me remind you that values above 50 on the index indicates an increase in activity. Markit also drew attention to the fact that the growth of optimism in business revolves at the end of the year, which will allow the expectation of growth in 2018 as well.

As for the technical picture of the EUR/USD pair, the continuation of the upward trend of the trading instrument will depend on whether the buyers will cope with the level of 1.2070 in the near future and the growth in euro that was observed at the end of the year against the backdrop of low trading volume had real force. It is best to consider long positions after a small correction from the larger support levels of 1.2000 and 1.1955.

Despite the weak data activity in the UK manufacturing sector, the British pound continued its growth against the U.S. dollar.

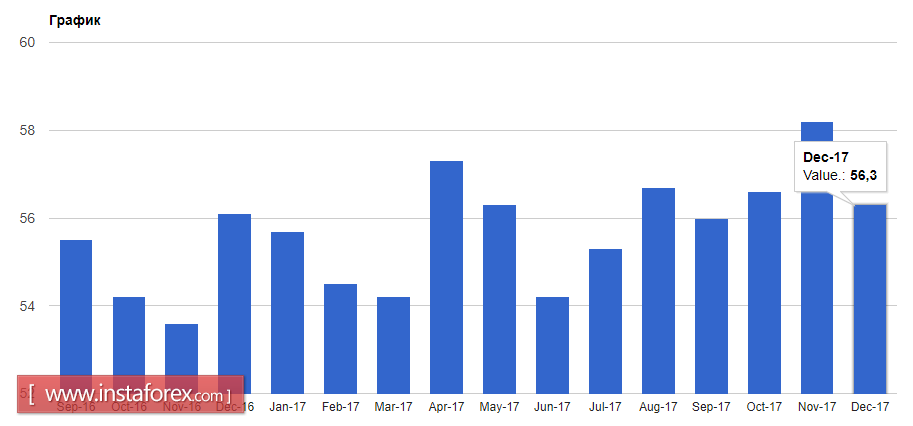

According to the IHS Markit Ltd. report, the purchasing managers' index for the U.K. manufacturing sector dropped to 56.3 points in December 2017 from 58.2 points in November. However, values above 50 still indicate an increase in activity. Economists expected that the index would be 57.9 points in December.