EUR / USD, GBP / USD.

On Wednesday, January 3rd, the behavior of the dollar was in line with our forecasts, and if we correctly interpret the current market situation, the initial growth from the market opening was just a continuation of the speculative game from the last days of December. A characteristic feature was that major players began to massively close positions on good employment data in the euro area countries. In Spain, the number of unemployed fell by 61.5 thousand against the forecast of -58.7 thousand and growth of 7.3 thousand in November. In Germany, the unemployed declined by 29 thousand with the expectation of 12 thousand. With this, the unemployment rate in November was revised downward from 5.6% to 5.5%, this indicator was preserved in December. In the UK, the index of business activity in the construction sector in December fell from 53.1 to 52.2, the forecast assumed a decrease to 52.8.

Later, American data came out, which surpassed the forecasts. The December index of business activity in the manufacturing sector from ISM was 59.7 versus 58.2 in November, the forecast assumed a decrease to 58.1. The expenses for construction in November increased by 0.8% against expectations of 0.6%.

The Fed's protocols in the number of factors looked balanced. The forecasts to reduce unemployment and inflation for 2018 were prospectively evaluated at the levels of 2017. The experts do not expect a crisis in the new year. The forecasts on the rate of increase also looked neutral - "some" members of the committee consider the forecast for rates (3 increases) increased, "some" reduced. As a result, the dollar has not received the necessary momentum. But it became known and another business media that disseminated information about the alleged desire of the Fed to limit itself to two promotions, as we said in the previous review, found themselves in an uncomfortable position and did not achieve their intended goals. This keeps the potential for further strengthening of the dollar.

Today, in the euro area, the United Kingdom, and the United States, there are indicators of business activity in the service sector (Services PMI). For the euro area, this will be the final estimate for December. The forecast is unchanged at 56.5. The UK is expected to grow from 53.8 to 54.1. For the US, the forecast remains unchanged at 52.4. But other indicators are not in favor of the pound; the number of issued mortgages for November is expected to decrease from 64.5 to 64.0 thousand, the net volume of new loans issued to individuals while on the growth trajectory. A forecast of 4.9 billion pounds against 4.8 billion a month earlier, but the main reason in the US data, where the increase in jobs in the private sector from ADP for December is projected to increase from 190 thousand to 191 thousand, the weekly number of applications for unemployment benefits is expected to decrease from 245 thousand to 241 thousand, indicating the prospects for strong "non-pharma" emerging On Friday.

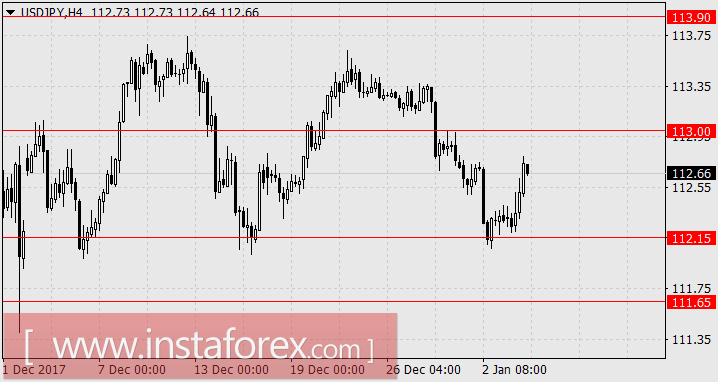

As a result, we are waiting for the euro in the range of 1.1880-1.1900, pound sterling in the range of 1.3300 / 30, intermediate target 1.3415.

USD / JPY.

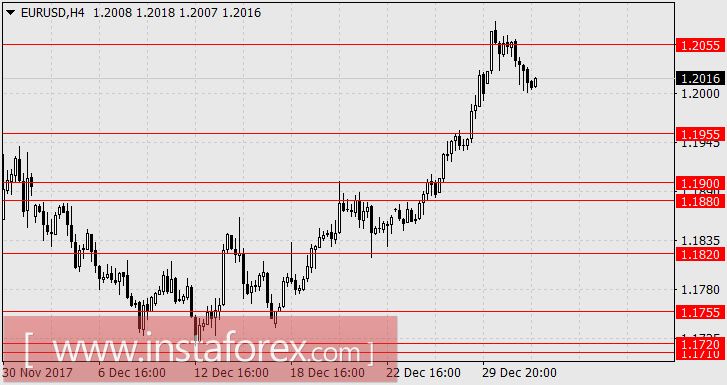

Today in Japan, the first working day this year, began with the active growth of the yen against the background of a general strengthening of the dollar growth in stock markets. The American S & P500 increased by 0.64%, the Japanese Nikkei225, taking into account the protracted weekend, opened trading with a gap and currently shows an increase of 2.62%. Japan's business activity index for December declined from 54.2 to 54.0, but the Chinese Services PMI from Caixin blocked this slight Japanese index decline by strong growth to 53.9 from 51.9, the highest value since August 2014.

The head of investors was supported by the head Central Bank of Haruhiko Kuroda, stating a stable economic trend and the bank's intention to continue the policy of mitigation.

We look forward to the growth of USD / JPY along with the entire market, the target is 113.90.