Yesterday's publication of the minutes of the Fed's December meeting did not lead to any significant market changes in the EURUSD pair, as the answers the traders and investors counted on were not received.

The Fed reports indicated that the Fed leadership anticipates the possibility of tax cuts, which will lead to a faster rate of rate hikes in 2018. However, more specific terms were not announced. Although, many experts were confident that the committee would already raise rates in 1st quarter of this year.

The leaders of the Fed also noted that they expect a moderate stimulus from the changes in tax legislation and the growth of consumer spending against this background.

The issue of inflation remains more than relevant at the beginning of this year. Most managers foresee the possibility that low inflation will slow the pace of rate hikes this year but at present, the risks remain balanced. This only requires more careful monitoring of price pressures.

The protocols also contained many estimates from the experts of the Fed.

So, according to the forecast, the basic inflation will grow faster in 2018 as the time factors decrease. Fed experts also expect that GDP will grow at a steady pace in the second half of 2017 and will remain in force in 2018. As for the unemployment rate, the Fed economists predict a decline in its level in the next few years.

Data on manufacturing activity in the US, which were published yesterday in the afternoon, also did not lead to a significant strengthening of the US dollar despite good performance.

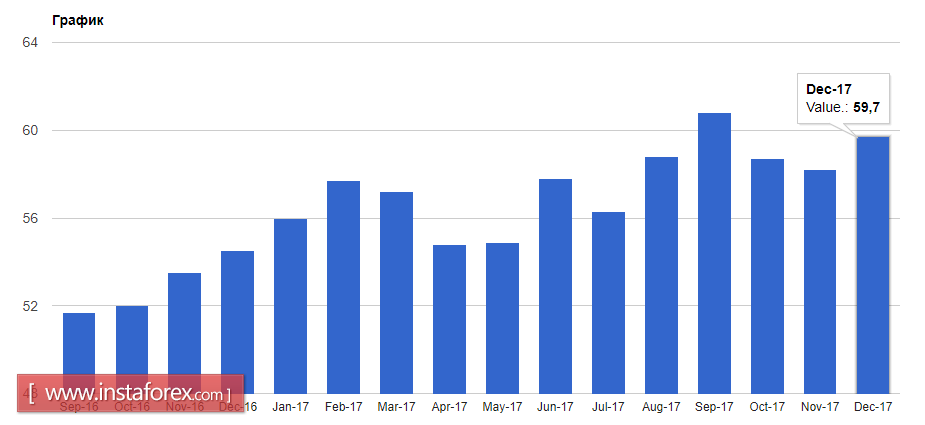

According to the report, the Institute for Supply Management purchasing managers' index for the manufacturing sector in December 2017 increased to 59.7 points from 58.2 points in November. The values of the index resulting above 50 indicate an increase in activity. Economists had expected that the index would be at 58.0 points in December.

As for the technical picture of EURUSD pair, the resumption of the growth of risky assets is only possible if it overcomes the level of 1.2035, which will lead to the demolition of a number of stop orders and a larger upward trend with an update of 1.2080 and an exit to new monthly highs near 1.2125 and 1.2170. In case of maintaining pressure on the euro, a downward correction in the trading instrument may lead to a test of 1.1950 and a return to 1.1910.