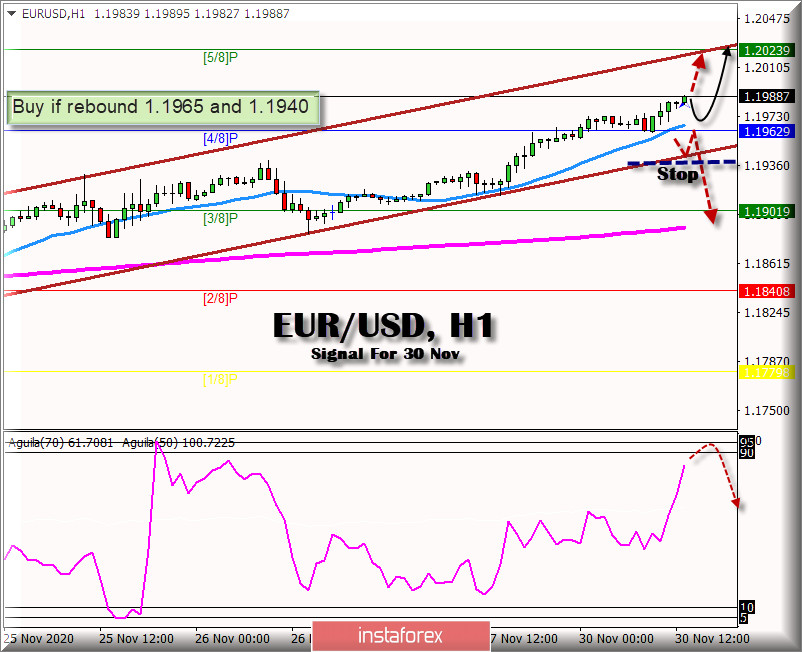

In the early US session, the EUR/USD pair is trading close to the psychological level of 1.20 and approaching the 5/8 level of the Murrey (green line) resistance zone.

The main bullish driver for EUR/USD is the weakness of the US dollar. USDX is holding below 91.50, its the lowest level since 2018. The downward pressure for the US dollar continues, which could favor the euro in the coming hours.

There are two scenarios possible: under the first one, we expect to see strong overbought conditions. So, we must be careful if we expect the euro to reach the 1.2027 level. Under the second scenario, we expect a retracement below 1.1987, which would give the pair a break until it reaches the 1.1935 support zone for further bullish momentum.

In the early New York session, the market sentiment shows that there are 76% of investors who are selling this pair, which would give the market more bullish strength for the next few days. Therefore, before we get into a new bullish wave, we must wait for a correction, and then buy the pair again.

Our recommendation on 1 hour charts is to buy only if the pair bounces off 1.1962 or 1.1940. On the other hand, if the pair retraces below 1.1987, it would be a good opportunity to sell in the correction with a stop loss above 1.2012.

Trading tip for EUR/USD for November 30

Buy if the pair rebounds around EMA 21 at 1.1960 with take profit at 1.1997 and 1.2027 and stop loss below 1.1930.

Buy if the pair rebounds around 1.1935 (trend line) with take profit at 1.1970 and 1.1995 and stop loss below 1.1901.

Sell if the pair breaks below 1.1987 with take profit at 1.1936 (trend line) and 1.1901 (3/8 Murrey) and stop loss above 1.2015.