EUR / USD, GBP / USD.

On Thursday, the situation on the markets has turned up. The euro area came out with good data and euro investors were selling. Retail sales in Italy in November rose by 1.1% against the forecast of 0.8% while industrial production in the euro area for the same month added 1.0% against expectations of 0.8%. However, with the publication of the minutes from the last meeting of the ECB, which as a whole came out neutral, the market turned up. We did not find any explicit optimistic provisions of the protocol and on the contrary, it clearly stated: "There is a possibility that the prevailing strong cyclical dynamics (economy) can lead to surprises in the near future. On the other hand, the risks mainly stem from global factors associated with current geopolitical and internal political uncertainties." The inflation expectations of the committee members did not change. They also reacted cautiously to the sphere of employment. However, investors have decided that another reason for attacking the dollar in the near future may not happen. As a result, the euro rose by 84 points while the British pound grew by 32 points.

Yesterday, the Representatives of the People's Bank of China denied rumors about the intentions of the Central Bank to review the policy of investing in US government bonds. The situation was resolved faster than expected.

Data on the US came out weaker than forecasts, which also played into the hands of euro buyers. The weekly report on the number of applications for unemployment benefits showed an increase in applications from 250 thousand to 261 thousand with the expectation of a decrease to 246 thousand. The producer price index for December showed -0.1% against expectations of 0.2%. However, the report on the execution of the US budget showed that in the December study, the result was at -23.2 billion dollars against the forecast of -34.5 billion. The stock index of the S & P500 grew by 0.70%.

Today, the main event will be data on retail sales and consumer prices in the US. The December estimate of retail sales is expected to increase by 0.5% after the November reading of 0.8%. Meanwhile, base retail sales (excluding motor vehicles) are expected to increase by 0.3% after it added 1.0% in November. The dynamics of the index, therefore, is expected to be moderately strong after such a powerful previous data. The base CPI for December is expected to increase by 0.1% with the total CPI at 0.2%. Inventories of companies in November are projected to increase by 0.4%.

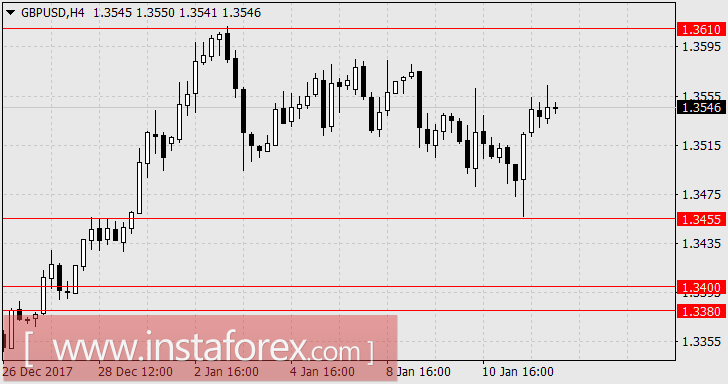

The euro got two strong blows in two days but we do not expect a third. Now, we are waiting for the euro to return to 1.1955 and further down to the range of 1.1880-1.1900. The pound sterling is waiting for 1.3455 and in the range of 1.3380-1.3400.

USD / JPY

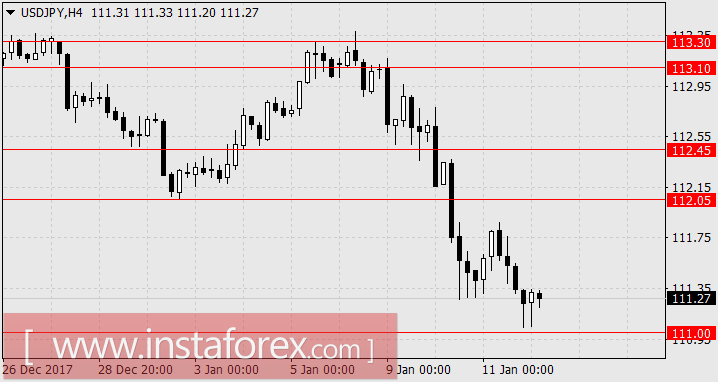

Against the backdrop of political turmoil, the Japanese yen practically reached the level of 111.00, from which it was bought at the end of November last year on the dangers of a more serious collapse. The situation is repeated, and as in November, we expect the market to turn with the support of the stock market. Yesterday, the Dow Jones added 0.81%, setting another historic record (25574). The Japanese Nikkei 225 is still recovering. The change from the opening of the session is about zero but other indices of the ATR are growing: S&P / ASX 200 + 0.11%, China A50 + 0.39%, IDX Composite + 0.10%.

The current weakness of the Japanese market has a fundamental justification. The balance of payments in the November valuation, excluding seasonal fluctuations, declined from 2.176 trillion yen to 1.347 trillion yen, while expecting a weaker decline to 1.836 trillion yen. The volume of bank lending in December shrank from 2.7% y / y to 2.5% y / y (522.05 trillion yen). The positive point here is that lending to foreign banks increased by 7.4%, which shows the mood of investors to further weaken the Japanese currency.

Chinese indicators today help investors to keep the situation under control. The trade balance for December amounted to 54.7 billion dollars against the forecast of 30.0 billion. Exports increased to 10.9% y / y against the forecast of 9.1% (November index was higher: 12.3% y / y). Imports fell to 4.5% y / y against expectations of 13.0% y / y.

We are waiting for the yen in the range of 112.05 / 45.