Right now, a bear market can be more dangerous to invest in, as many equities lose value and prices become volatile.

The EUR/USD pair gained strong upside momentum and managed to settle above the support at 1.2053.

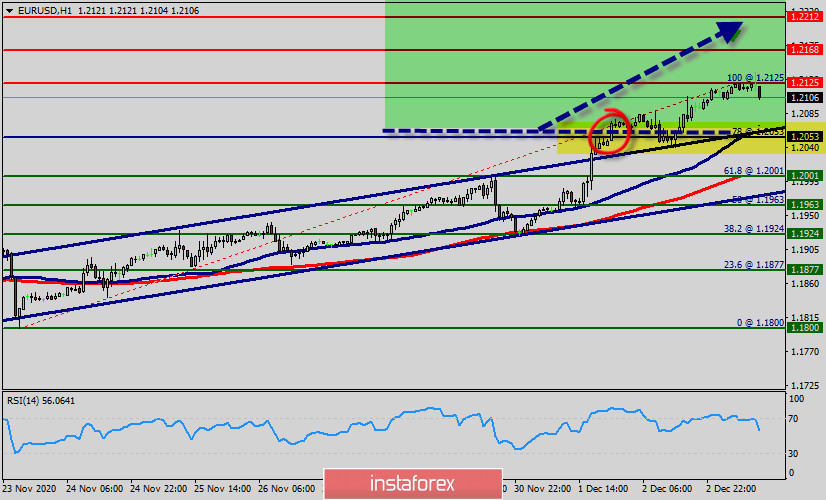

The EUR/USD pair is moving so fast that's it's high time to take a look at the H1 chart to evaluate it.

The EUR/USD pair continues moving in a bullish trend from the support levels of 1.2053 and 1.2001. Currently, the price is in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market.

As the price is still above the moving average (100), immediate support is seen at 1.2053, which coincides with a golden ratio (78% of Fibonacci).

This level has served as a major support level for the EUR/USD pair in early 1.2053, and I'd expect a lot of interest from traders if the EUR/USD pair gets to the test of this level.

At this point, the EUR/USD pair managed to get above the support at 1.2053 and is moving towards the first resistance level at 1.2125.

If the EUR/USD pair manages to settle above this level, it will head towards the next resistance at 1.2168. A successful test of this resistance level will push EUR/USD towards the resistance at 1.2168.

Although some investors can be "bearish," the majority of investors are typically "bullish." The stock market, as a whole, has tended to post positive returns over long time horizons.

Consequently, the first support is set at the level of 1.2053. So, the market is likely to show signs of a bullish trend around the spot of 1.2053 - 1.2070.

In other words, buy orders are recommended above the major support (1.2053) with the first target at the level of 1.2125. Furthermore. We should see the pair climbing towards the double top (1.2125) to test it.

Therefore, strong double top will be formed at the level of 1.2125 providing a clear signal to rebuy with the targets seen at 0.6768. if the trend is able to breakout through the first resistance level of 1.2125. The pair will move upwards continuing the development of the bullish trend to the level 1.2165 (daily resistance 2).

Also, it might be noted that the level of 1.2212 (R3) is a good place to take profit because it will form a double top.

On the other hand, in case a reversal takes place and the EUR/USD pair breaks through the support level of 1.2001, a further decline to 1.1877 can occur which would indicate a bearish market.