Dear colleagues.

For the pair EUR / USD, the continuation of the upward trend development from January 9 is expected after the breakdown of the level of 1.2295. In general, correction movement is possible today. For the Pound / Dollar pair, the price is in the range of the limiting values for the ascending structure from January 11, so we expect a correction. On the Dollar / Franc pair, we follow the downward structure from January 10 and we continue to move downwards after the breakdown of 0.9605. For the pair Dollar / Yen, the price forms a long-term downward structure from January 8. For the pair Euro / Yen, the continuation of the upward movement is expected after the passage at the price of the noise range of 136.16 - 136.46. For the Pound / Yen pair, we are monitoring the formation of the potential for the top of November 11.

Forecast for January 15:

Analytical review of currency pairs in the scale of H1:

For the pair Euro / Dollar, the key levels on the scale of H1 are: 1.2411, 1.2359, 1.2336, 1.2294, 1.2240, 1.2212 and 1.2169. Here, we continue to follow the upward structure of January 9. The continued upward movement is expected after the breakdown of the level of 1.2294. In this case, the target is 1.2336 and from the range 1.2336 - 1.2359, the probability of a turn into the corrective zone is high. The potential value for the top is the level of 1.2411.

The short-term downward movement is possible in the corridor of 1.2240 - 1.2212. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2169 and this level is the key support for the top. The passage by the price will have to develop a downward trend. In this case, the potential target is 1.2098.

The main trend is the ascending structure of January 9.

Trading recommendations:

Buy: 1.2296 Take profit: 1.2334

Buy 1.2360 Take profit: 1.2410

Sell: 1.2240 Take profit: 1.2214

Sell: 1.2210 Take profit: 1.2175

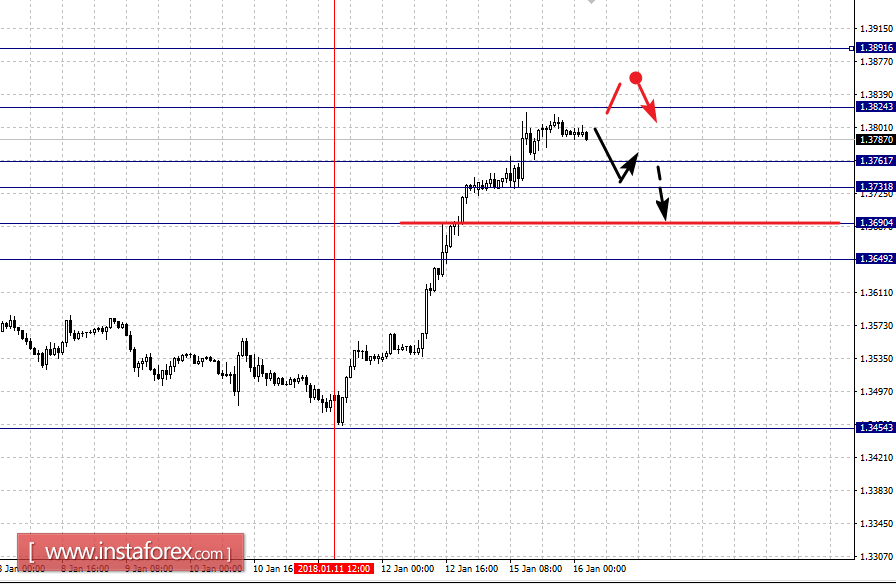

For the Pound / Dollar pair, the key levels on the scale of H1 are: 1.3891, 1.3824, 1.3761, 1.3731, 1.3690 and 1.3649. Here, the price is near the limit values and we expect a correction. The break of level 1.3824 should be accompanied by an unstable movement. Here, the potential target is 1.3891. However, we do not recommend trading for this value.

The short-term downward movement is possible in the corridor of 1.3761 - 1.3731 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3690 and this level is the key support for the top. We consider the level of 1.3649 to be the potential value for the downward movement, to which we expect the initial conditions for the descending cycle to be formalized.

The main trend is the ascending cycle of January 11.

Trading recommendations:

Buy: 1.3826 Take profit: 1.3850

Buy: Take profit:

Sell: 1.3760 Take profit: 1.3733

Sell: 1.3730 Take profit: 1.3692

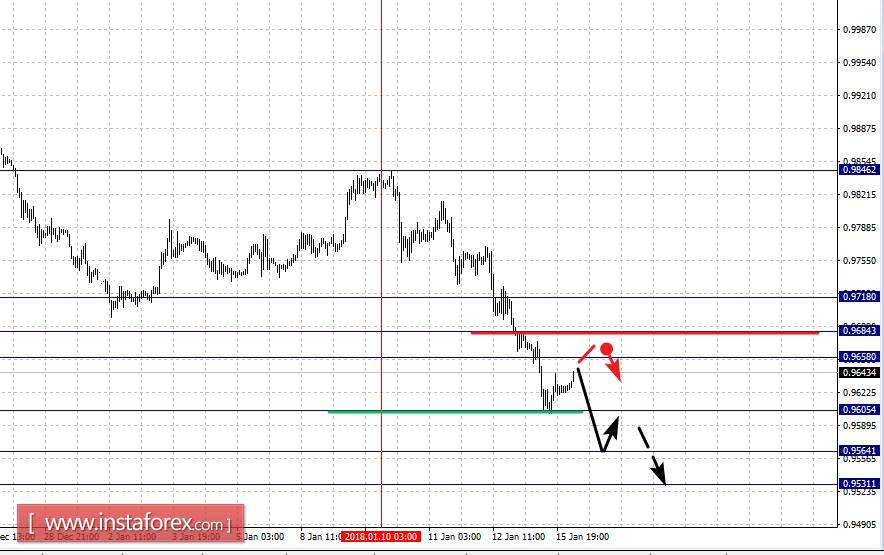

For the Dollar / Franc pair, the key levels on the scale of H1 are: 0.9718, 0.9684, 0.9658, 0.9605, 0.9564 and 0.9531. Here, we follow the downward structure of January 10. The continued downward movement is expected after the breakdown of 0.9605. In this case, the target is 0.9566. The potential value for the bottom is the level of 0.9531, upon reaching which we expect a rollback upward.

The short-term upward movement is possible in the corridor of 0.9658 - 0.9684 and the breakdown of the last value will lead to an in-depth movement. Here, the target is 0.9718.

The main trend is the downward structure of January 10.

Trading recommendations:

Buy: 0.9658 Take profit: 0.9682

Buy: 0.9686 Take profit: 0.9716

Sell: 0.9605 Take profit: 0.9566

Sell: 0.9562 Take profit: 0.9535

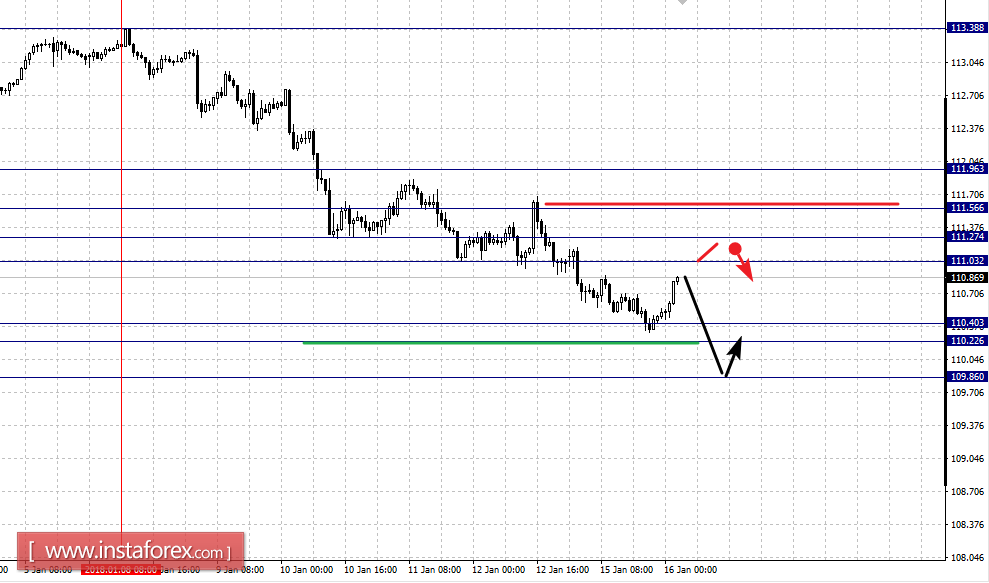

On the Dollar / Yen pair, the key levels on the scale of H1 are: 111.96, 111.56, 111.27, 111.03, 110.40, 110.22 and 109.86. Here, we continue to follow the downward structure from January 8. The continued downward movement is expected after passing through the noise range of 110.40 - 110.22. In this case, the target is 109.86 and from this level, we expect a rollback to the top. In general, it should be noted that on January 8, the price forms long-term initial conditions for the downward cycle.

The short-term upward movement is possible in the corridor of 111.03 - 111.27 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 111.56 and this level is the key support for the downward structure. The passage by the price will have an upward structure. In this case, the target is 111.96.

The main trend is the downward cycle from January 8.

Trading recommendations:

Buy: 111.03 Take profit: 111.25

Buy: 111.29 Take profit: 111.55

Sell: Take profit:

Sell: 110.20 Take profit: 109.88

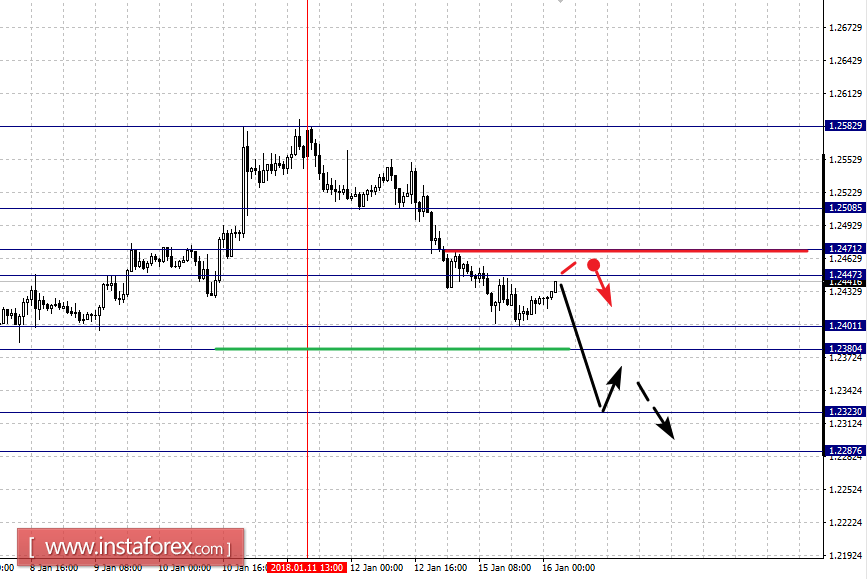

For the Canadian Dollar / Dollar pair, the key levels on the H1 scale are: 1.2508, 1.2471, 1.2447, 1.2401, 1.2380, 1.2323 and 1.2287. Here, we follow the downward structure of January 11. The short-term downward movement is expected in the corridor of 1.2401 - 1.2380 and the breakdown of the last value should be accompanied by a pronounced movement to the level of 1.2323. The potential value for the bottom is the level of 1.2287, upon reaching which we expect a departure to correction.

The short-term upward movement is possible in the corridor of 1.2447 - 1.2471 and the breakdown of the last value will lead to an in-depth movement. Here, the target is 1.2508.

The main trend is the downward structure of January 11.

Trading recommendations:

Buy: 1.2447 Take profit: 1.2470

Buy: 1.2475 Take profit: 1.2505

Sell: 1.2380 Take profit: 1.2330

Sell: 1.2320 Take profit: 1.2290

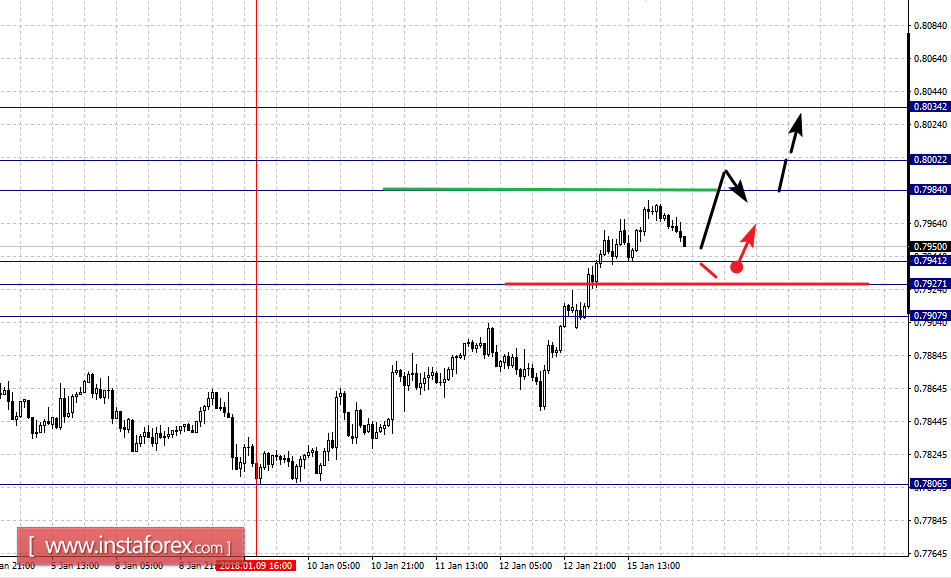

For the Australian Dollar / Dollar pair, the key levels on the scale of H1 are: 0.8034, 0.8002, 0.7984, 0.7941, 0.7927 and 0.7907. Here, we continue to follow the upward structure of January 9. The short-term upward movement is possible in the corridor of 0.7984 - 0.8002 and the breakdown of the last value will allow to count on the movement to the potential target of 0.8034, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 0.7941 - 0.7927 and breakdown of the last value will lead to an in-depth correction. Here, the target is 0.7907 and this level is the key support for the top.

The main trend is the ascending structure of January 9.

Trading recommendations:

Buy: 0.7985 Take profit: 0.8000

Buy: 0.8005 Take profit: 0.8030

Sell: 0.7940 Take profit: 0.7930

Sell: 0.7925 Take profit: 0.7908

For the EUR / JPY pair, the key levels on the scale of H1 are: 137.47, 137.06, 136.46, 136.16, 135.35, 135.03, 134.62 and 134.04. Here, we follow the upward structure of January 10. The continuations of the upward movement are expected after the passage at the price of the noise range of 136.161 136.46. In this case, the target is 137.06. The potential value for the top is the level of 137.47, upon which we expect consolidation, as well as a pullback to the bottom.

The short-term downward movement is possible in the corridor of 135.35 - 135.03 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 134.62 and this level is the key support for the top. Its passage by the price will have a downward structure. In this case, the target is 134.04.

The main trend is the ascending structure of January 10.

Trading recommendations:

Buy: 136.48 Take profit: 137.05

Buy: 137.08 Take profit: 137.45

Sell: 135.03 Take profit: 134.64

Sell: 134.60 Take profit: 134.06

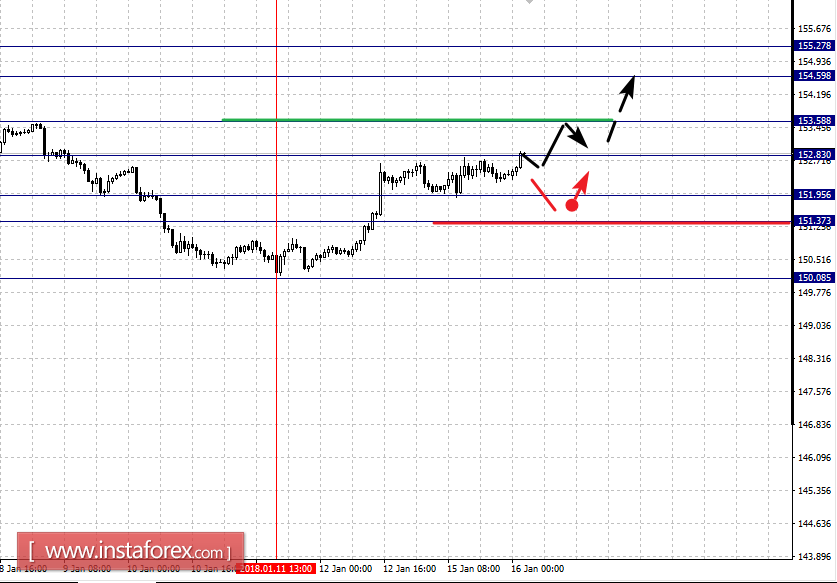

For the Pound / Yen pair, the key levels on the scale of H1 are: 155.27, 154.59, 153.58, 152.83, 151.95, 151.37 and 150.08. Here, the price forms the potential for the upward movement of January 11. The continued upward movement is expected after the breakdown of 152.83. In this case, the target is 153.58 and near this level is the consolidation of the price. The break of level 153.60 should be accompanied by a pronounced upward movement. Here, the target is 154.59. The potential value for the top is the level of 155.27, upon reaching which we expect a rollback to correction.

The short-term downward movement is possible in the corridor of 151.95 - 151.37 and the breakdown of the last value will have to form a downward structure. Here, the target is 150.10.

The main trend is the ascending structure of January 11.

Trading recommendations:

Buy: 152.85 Take profit: 153.50

Buy: 153.62 Take profit: 154.55

Sell: 151.95 Take profit: 151.45

Sell: 151.33 Take profit: 150.15