The rollback on the dollar yesterday did not happen, but it was clearly developed. The reason for this could be inflation data in the UK since the forecasts were seriously revised. Yesterday, it was assumed that inflation will accelerate from 3.1% to 3.2%, but currently, it is expected to slow down to 3.0%. In any case, whatever result would be negative for the British pound. The increase in inflation indicates that the Bank of England is losing control over the situation, and its slowdown is not particularly suited to investors. The pound will pull for itself and the single European currency.

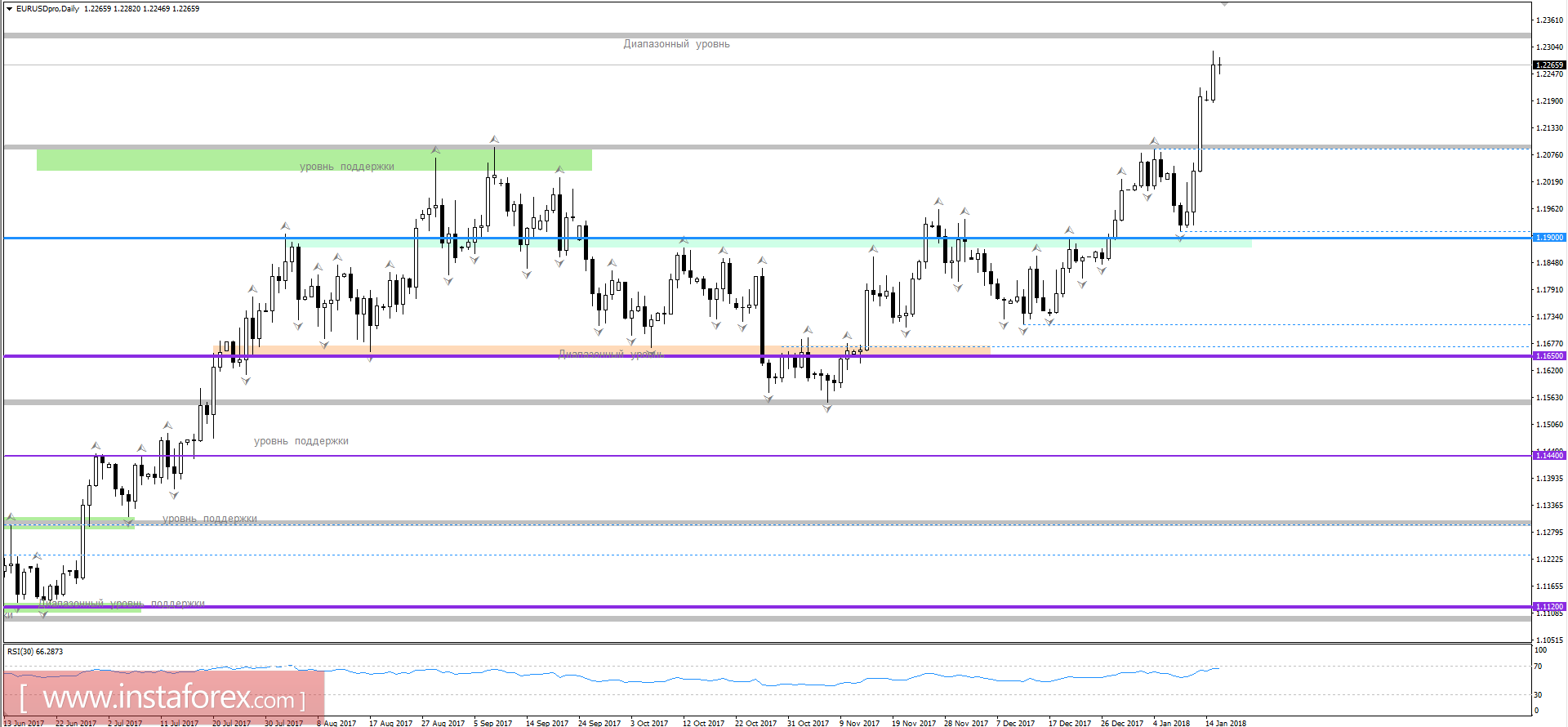

The euro/dollar currency pair continued its upward movement, moving close to the impulse candles. It is possible to assume that near the range level of 1.2330 will serve as a resistance for buyers, forming a stagnation around its area and a correction to the level of 1.2180 / 1.2100.

The pound/dollar currency pair demonstrated an impulse movement, but having reached the value of 1.3800, the quotation slowed down its movement. It is possible to assume for some stagnation, where the bears will try to pull the cup to their side, forming a correction with the first value of 1.3720 / 1.3660.

* The presented market analysis is informative and does not constitute a guide to the transaction.