Forecast :

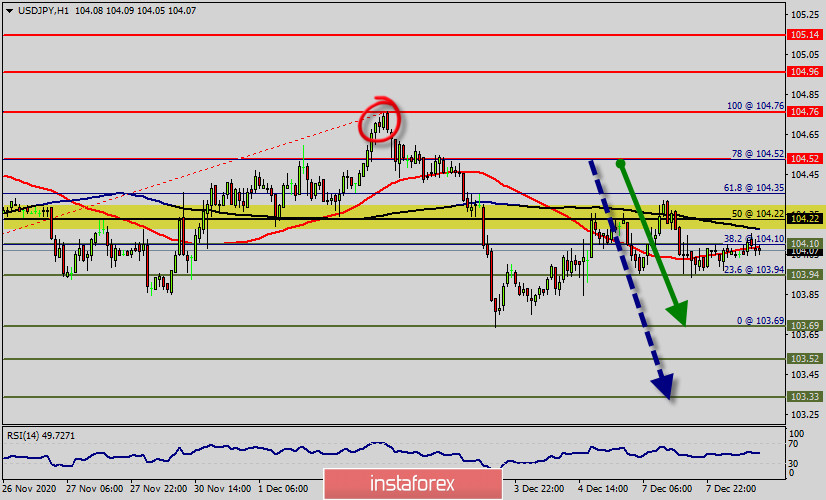

If the pair fails to pass through the level of 104.52, the market will indicate a bearish opportunity below the strong resistance level of 104.52. In this regard, sell deals are recommended lower than the 104.52 level with the first target at 103.69. It is possible that the pair will turn downwards continuing the development of the bearish trend to the level 103.33. However, stop loss has always been in consideration thus it will be useful to set it above the last double top at the level of 104.76.

The trend is still trading around the 104.22 price since last week. The 104.22 pair is representing key level on the H1 chart. Also, the level of 104.22 represents a daily pivot point for that it is acting as major resistance/support this week. Because the market's behavior is impacted and determined by how individuals perceive and react to its behavior, investor psychology and sentiment affect whether the market will rise or fall. The market performance and investor psychology are mutually dependent. In a bull market, investors willingly participate in the hope of obtaining a profit. The USD/JPY pair movement was debatable as it took place in a narrow sideways channel for a while. The market showed signs of instability. Amid the previous events, the price is still moving between the levels of 104.76 and 103.69. The pair is still in a downtrend, because the USD/JPY pair is trading in a bearish trend from the new resistance line of 104.76 towards the first support level at 104.22 in order to test it. The daily resistance and support are seen at the levels of 104.76 and 104.22 respectively. In consequence, it is recommended to be cautious while placing orders in this area. Thus, we should wait until the sideways channel has completed. The price spot of 104.76remains a significant resistance zone. Therefore, there is a possibility that the USD/JPY pair will move to the downside and the fall structure does not look corrective. Resistance is seen at the level of 104.76 today. So, sell below 104.76 with the first target at 103.69 to test yesterday's bottom. In overall, we still prefer the bearish scenario as long as the price is below the level of 103.69. Furthermore, if the USD/JPY pair is able to break out the bottom at 103.69, the market will decline further to 103.19. On the support side, the previous support at 104.22 will likely serve as the first resistance level for the USD/JPY pair. A move below this level will push the USD/JPY pair towards the next support at 102.77. However, it would also be sage to consider where to place a stop loss; this should be set above the second resistance of 104.96.