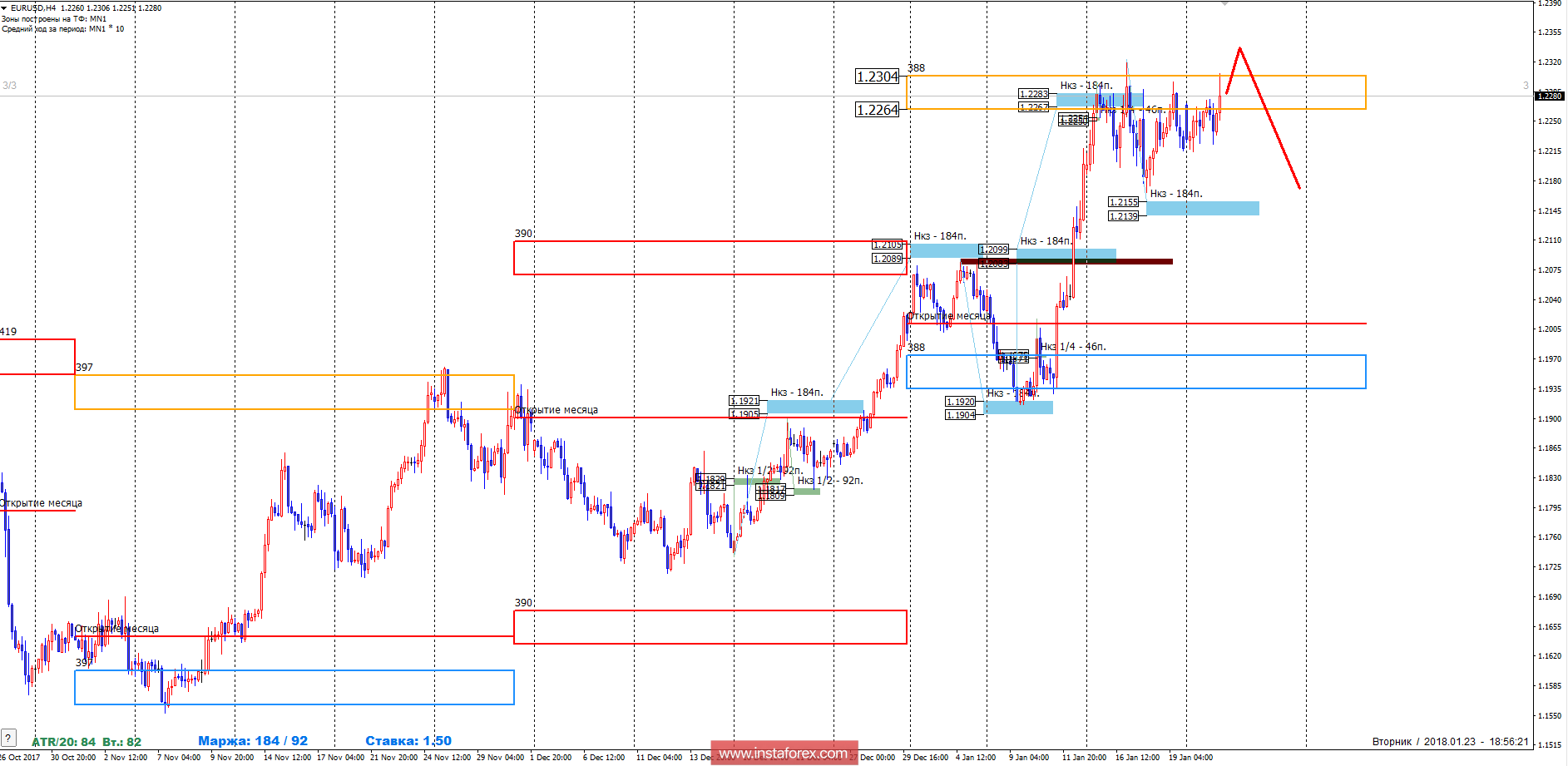

The EUR/USD pair is being traded within the monthly control zone 1.2304-1.2264 for the second week, which keeps it from further growth. Any withdrawal from the monthly control zone should be considered for the formation of a reversal pattern.

Medium-term plan.

Trade within the monthly control zone implies the search for a reversal pattern. Any violation of the structure must be used to find favorable prices for the sale, even on minor timeframes. Exceeding the limits of the monthly fault with a probability of 90% will return to the specified zone. This opens level outside the zone in finding the best prices for the sale. The upward momentum remains a medium-term trend, which indicates the need for a quick fixation of sales. The defining support is the weekly KZ at 1.2155-1.2139.

To form an alternative model, you will need to consolidate above the high of last week, which will allow us to look for more favorable prices to sell in case of a further growth.

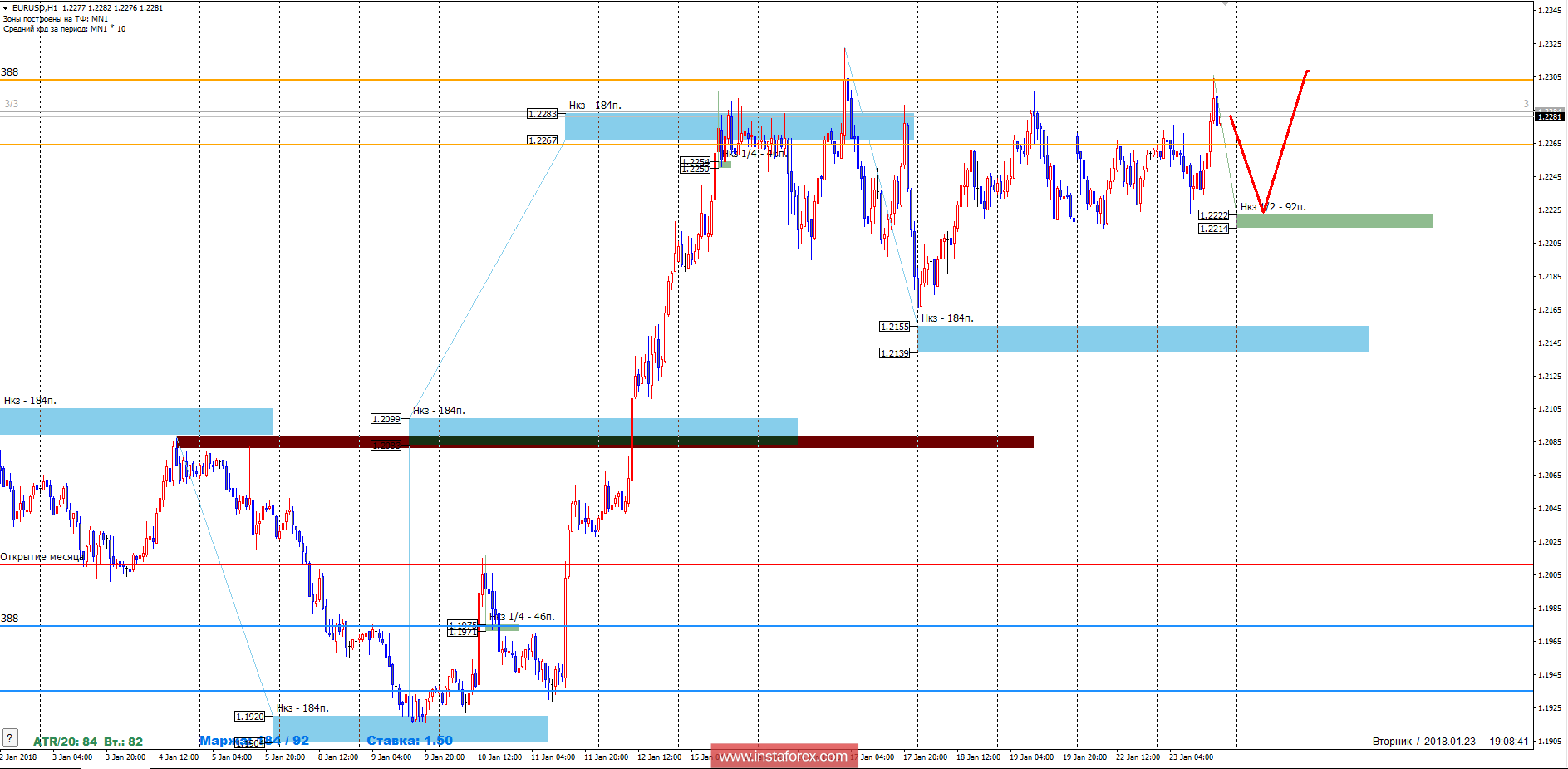

Intraday plan.

The determining support is the NKZ 1/2 at 1.2222-1.2214. The upward movement remains an impulse while the pair is trading above this zone. To disrupt the upward movement, the price needs to be closed below the level of 1.2214 during one of the American sessions. It is worth noting that the Central European Bank supports the strengthening of the euro. This is indicated by open market operations, which leads to strong support levels during medium-term growth. It is important to understand that in the conditions of the current flat, the main fixations on positions must be made at the boundaries of the range. You can leave part of the position with the possibility of a breakdown in the event that the price is out of the range.

The daytime CP is the daytime control zone. The zone formed by important data from the futures market that change several times a year.

The weekly CP is the weekly control zone. The zone formed by marks from important futures market which change several times a year.

The monthly CP is the monthly control zone. The zone is a reflection of the average volatility over the past year.