Dear colleagues.

For the EUR / USD pair, we continue to monitor the local structure for the top of January 17. The continuation of the upward movement is expected after the breakdown of 1.2395. For the GBP / USD pair, we follow the upward structure of January 16. For the USD / CHF pair, the continuation of the downward movement is expected after the breakdown of 0.9562. For the USD / JPY pair, we expect movement towards the level of 109.86. For the of EUR / JPY pair, the continuation of the upward movement is expected after passing the price of the noise range of 136.16 - 136.46. For the GBP / JPY pair, the continuation of the upward movement is expected after the breakdown of 155.35.

Forecast for January 24:

Analytical review of currency pairs in the scale of H1:

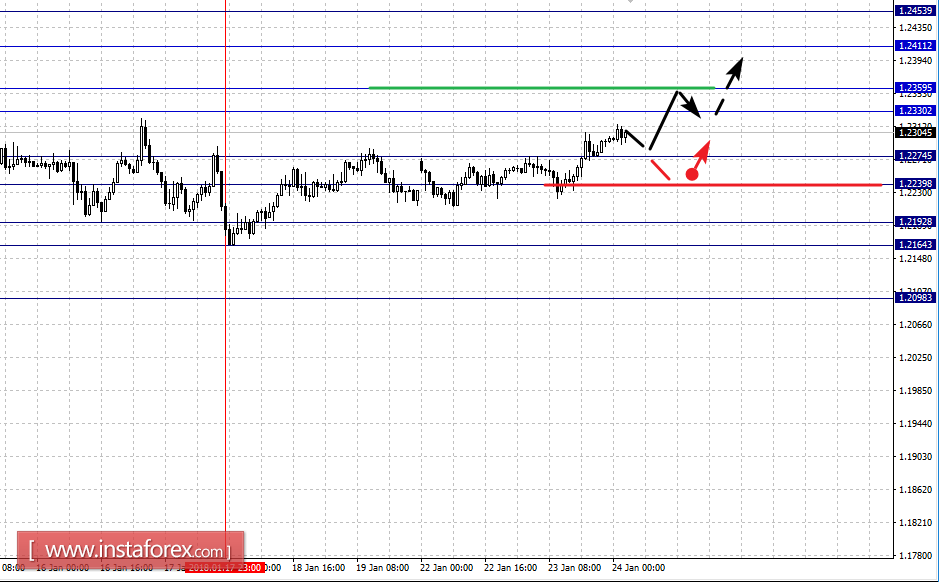

For the EUR / USD pair, the key levels on the scale of H1 are: 1.2453, 1.2411, 1.2359, 1.2330, 1.2274, 1.2239, 1.2192, 1.2164 and 1.2098. Here, we follow the development of the local upward structure of January 17. Short-term upward movement is expected in the area of 1.2330 - 1.2359. The breakdown of the last value will lead to a movement towards the level of 1.2411. Near this level, we expect the consolidation of the price. For the potential value for the top, consider the level of 1.2453. Upon reaching this level, we expect a departure towards correction.

Short-term downward movement is possible in the area of 1.2274 - 1.2239. The breakdown of the last value will lead to the development of the downward structure. Here, the target is 1.2192. The range of 1.2192 - 1.2164 is the key resistance for the downward structure. Passing passage this price will lead to a movement towards the potential target of 1.2098.

The main trend is the upward structure of January 17.

Trading recommendations:

Buy: 1.2360 Take profit: 1.2410

Buy 1.2412 Take profit: 1.2450

Sell: 1.2272 Take profit: 1.2240

Sell: 1.2236 Take profit: 1.2194

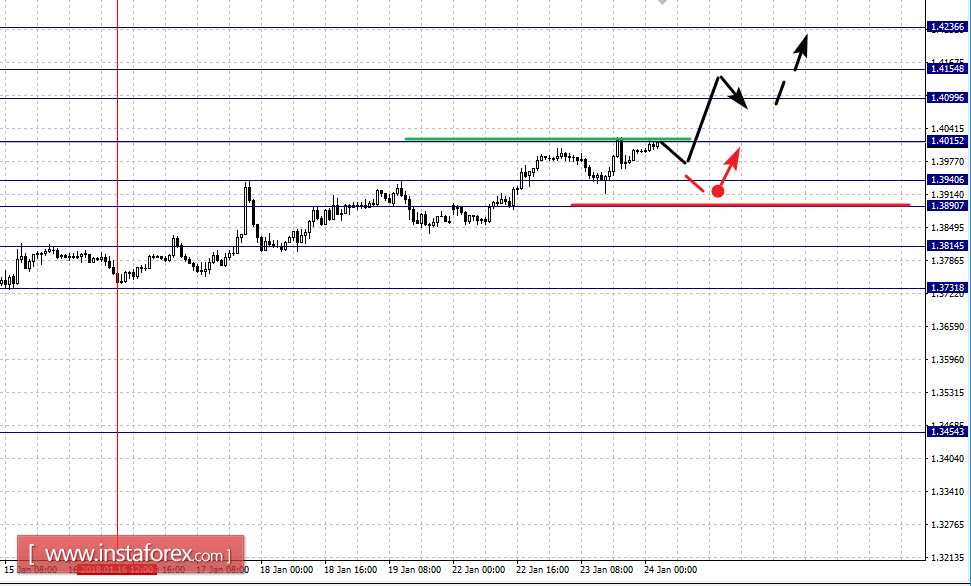

For the GBP / USD pair, the key levels on the scale of H1 are 1.4236, 1.4154, 1.4099, 1.4015, 1.3940, 1.3890, 1.3814 and 1.3731. Here, we follow the formation of the local upward structure of January 16. The continuation of the upward movement is expected after the breakdown of 1.4015. In this case, the target is 1.4099. In the area of 1.4099 - 1.4154 is the consolidation of the price. For the potential value for the top, consider the level of 1.4236. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 1.3940 - 1.3890. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3814. This level is the key support for the top. Passing the price will lead to the development of a downward structure. In this case, the target is 1.3731.

The main trend is the local upward structure of January 16.

Trading recommendations:

Buy: 1.4015 Take profit: 1.4095

Buy: 1.4155 Take profit: 1.4234

Sell: 1.3938 Take profit: 1.3892

Sell: 1.3888 Take profit: 1.3816

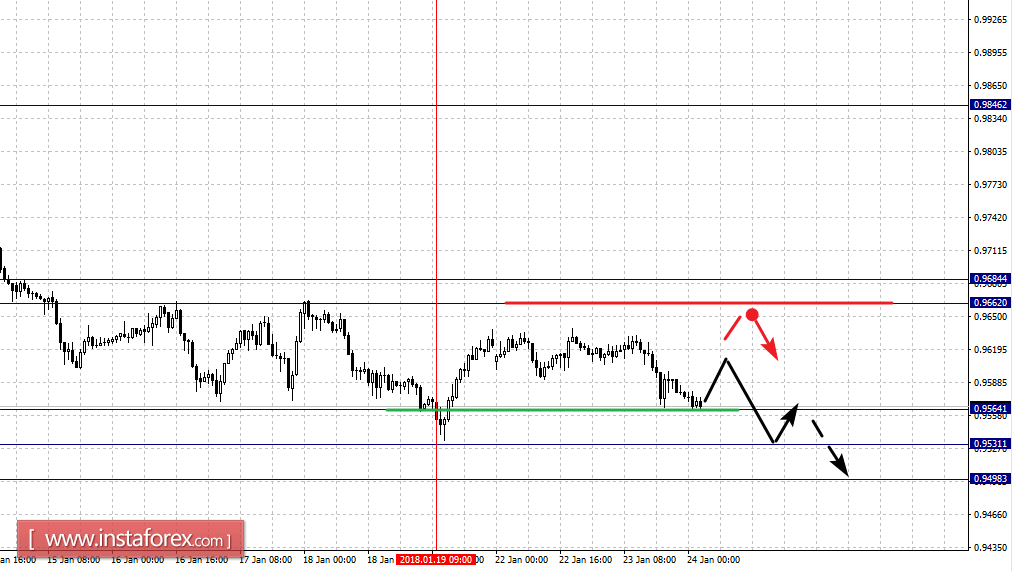

For the USD / CHF pair, the key levels in the scale of H1 are: 0.9684, 0.9662, 0.9564, 0.9531 and 0.9498. Here, we follow the downward structure from January 10. At the moment, the price is in correction and forms a small potential for the top of January 19. Continued downward movement is expected after the breakdown of 0.9564. In this case, the target is 0.9531. Near this level, we expect the consolidation of the price. For the potential value for the bottom, consider the level of 0.9498. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 0.9662 - 0.9684.

The main trend is a downward structure from January 10, the correction stage.

Trading recommendations:

Buy: 0.9662 Take profit: 0.9682

Buy: Take profit:

Sell: 0.9602 Take profit: 0.9564

Sell: 0.9562 Take profit: 0.9533

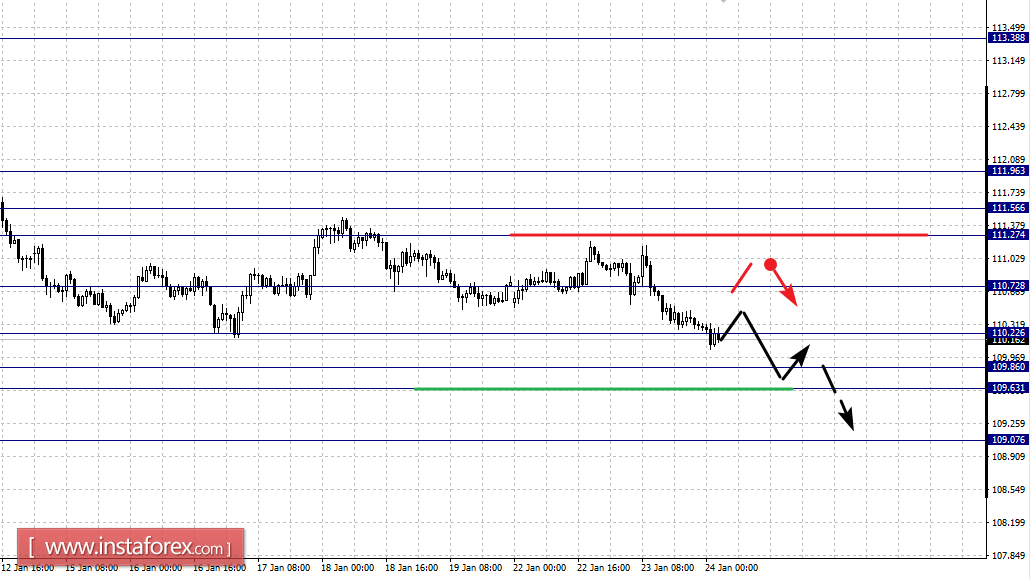

For the USD / JPY pair, the key levels on a scale are: 111.96, 111.56, 111.27, 110.72, 110.22, 109.86, 109.63 and 109.07. Here, we continue to follow the downward structure from January 8. Continued downward movement is expected after the breakdown of 110.20. In this case, the target is 109.86. In the area of 109.86 - 109.63 is the consolidation of the price. For the potential value of the bottom, consider the level of 109.07. The movement towards this level is expected after the breakdown of 109.60.

The development of the corrective movement is expected after the breakdown of 110.72. In this case, the first target is 111.27. Short-term upward movement is possible in the area of 111.27 - 111.56. The breakdown of the last value will lead to the development of an upward structure. In this case, the target is 111.96.

The main trend is the downward cycle from January 8.

Trading recommendations:

Buy: 110.74 Take profit: 111.25

Buy: 111.58 Take profit: 111.94

Sell: 110.20 Take profit: 109.88

Sell: 109.60 Take profit: 109.10

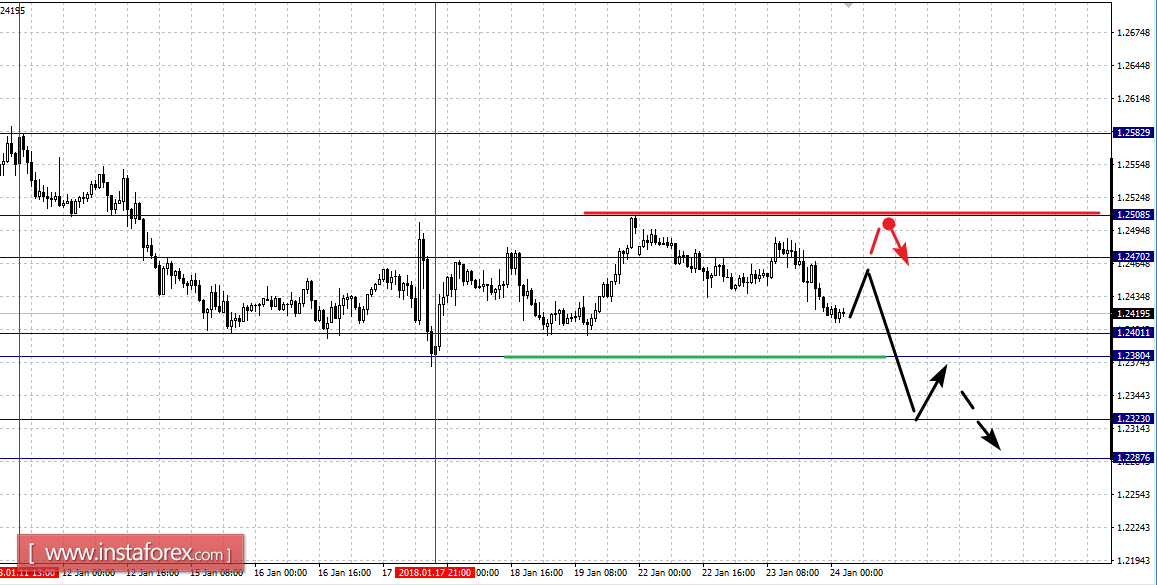

For the CAD / USD pair, the key H1 scale levels are: 1.2508, 1.2470, 1.2401, 1.2380, 1.2323 and 1.2287. Here, we follow the downward structure of January 11. The continuation of the downward movement is expected after passing the price of the noise range of 1.2401 - 1.2380. In this case, the target is 1.2323. For the potential value for the bottom, consider the level of 1.2287. Upon reaching this level, we expect consolidation and a rollback to the top.

Short-term upward movement is possible in the area of 1.2470 - 1.2508. The breakdown of the latter value will lead to the development of an upward trend. Here, the target is 1.2582. Up to this level, we expect the formation of an upward structure.

The main trend is the downward structure of January 11.

Trading recommendations:

Buy: 1.2470 Take profit: 1.2505

Buy: 1.2510 Take profit: 1.2580

Sell: 1.2380 Take profit: 1.2330

Sell: 1.2320 Take profit: 1.2290

For the AUD / USD pair, the key levels on the H1 scale are: 0.8104, 0.8063, 0.8039, 0.8013, 0.7977, 0.7957 and 0.7927. Here, we continue to follow the upward structure of January 9. Continued movement towards the top is expected after the breakdown of 0.8013. In this case, the target is 0.8039. In the area of 0.8039 - 0.8062 is the consolidation of the price. For the potential value for the top, consider the level of 0.8104. Upon reaching this level, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possible in the area of 0.7977 - 0.7957. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7927. This level is the key support for the top.

The main trend is the upward structure of January 9.

Trading recommendations:

Buy: 0.8015 Take profit: 0.8039

Buy: 0.8042 Take profit: 0.8062

Sell: 0.7977 Take profit: 0.7958

Sell: 0.7955 Take profit: 0.7930

For the EUR / JPY pair, the key levels on the scale of H1 are: 137.47, 137.06, 136.46, 136.16, 135.35, 135.03, 134.62 and 134.04. Here, we continue to follow the upward structure of January 10. Continued upward movement is expected after passing the price of the noise range of 136.161 136.46. In this case, the target is 137.06. For the potential value for the top, consider the level of 137.47. Upon reaching this level, we expect consolidation, as well as a rollback to the bottom.

Short-term downward movement is possible in the area of 135.35 - 135.03. The breakdown of the last value will lead to in-depth correction. Here, the target is 134.62. This level is the key support for the top. Passing the price will lead a downward structure. In this case, the target is 134.04.

The main trend is the upward structure of January 10.

Trading recommendations:

Buy: 136.48 Take profit: 137.05

Buy: 137.08 Take profit: 137.45

Sell: 135.03 Take profit: 134.64

Sell: 134.60 Take profit: 134.06

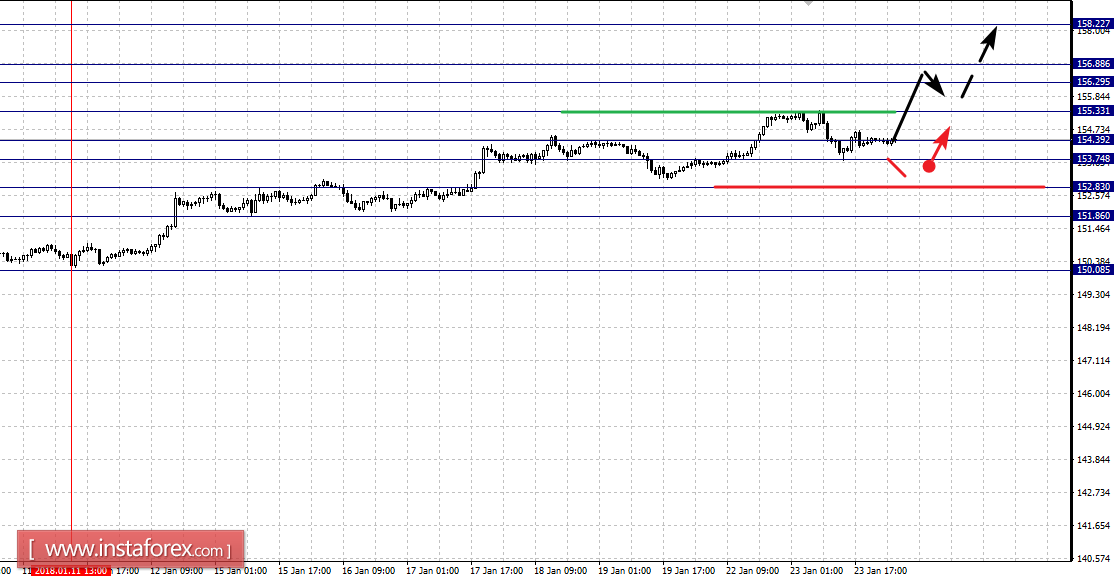

For the GBP / JPY pair, the key levels on the scale of H1 are: 158.22, 156.88, 156.29, 155.33, 154.39, 153.74, 152.83 and 151.86. Here, we follow the upward cycle of January 11. The continuation of the upward movement is expected after the breakdown of 155.33. In this case, the target is 156.29. In the area of 156.29 - 156.88 is the consolidation of the price. For the potential value for the top, consider the level of 158.22. Upon reaching this level, we expect a pullback to the bottom.

A short-term downward movement is expected in the area of 154.39 - 153.74. The breakdown of the last value will lead to an in-depth movement. Here, the target is 152.83. This level is the key support for the upward trend. Passing the price will lead to the development of a downward structure. In this case, the potential target is 151.86.

The main trend is the upward cycle of January 11.

Trading recommendations:

Buy: 155.35 Take profit: 156.29

Buy: 156.90 Take profit: 158.20

Sell: 154.39 Take profit: 153.74

Sell: 153.72 Take profit: 152.85