Overview and forecast for GBP / USD

The dominant direction of the price trend of the British pound since October 2016 continues to be set by an upward wave. By the current day, the price has overcome the upper boundary of the counter potential reversal zone, opening the way for further recovery. The next critical area of the chart is located above the current values of the course, approximately, for 5 price figures.

Today, a short-term stop of recovery is possible, with the development of the corrective phase of the movement. The most likely scenario is lateral drift, not below the support zone levels. Then, you can count on the resumption of the ascending mood of the pair. The resistance zone shows the expected upper limit of the daily variation.

The boundaries of the resistance zones:

- 1.4370 / 1.4400

The boundaries of the support zones:

- 1.4250 / 20

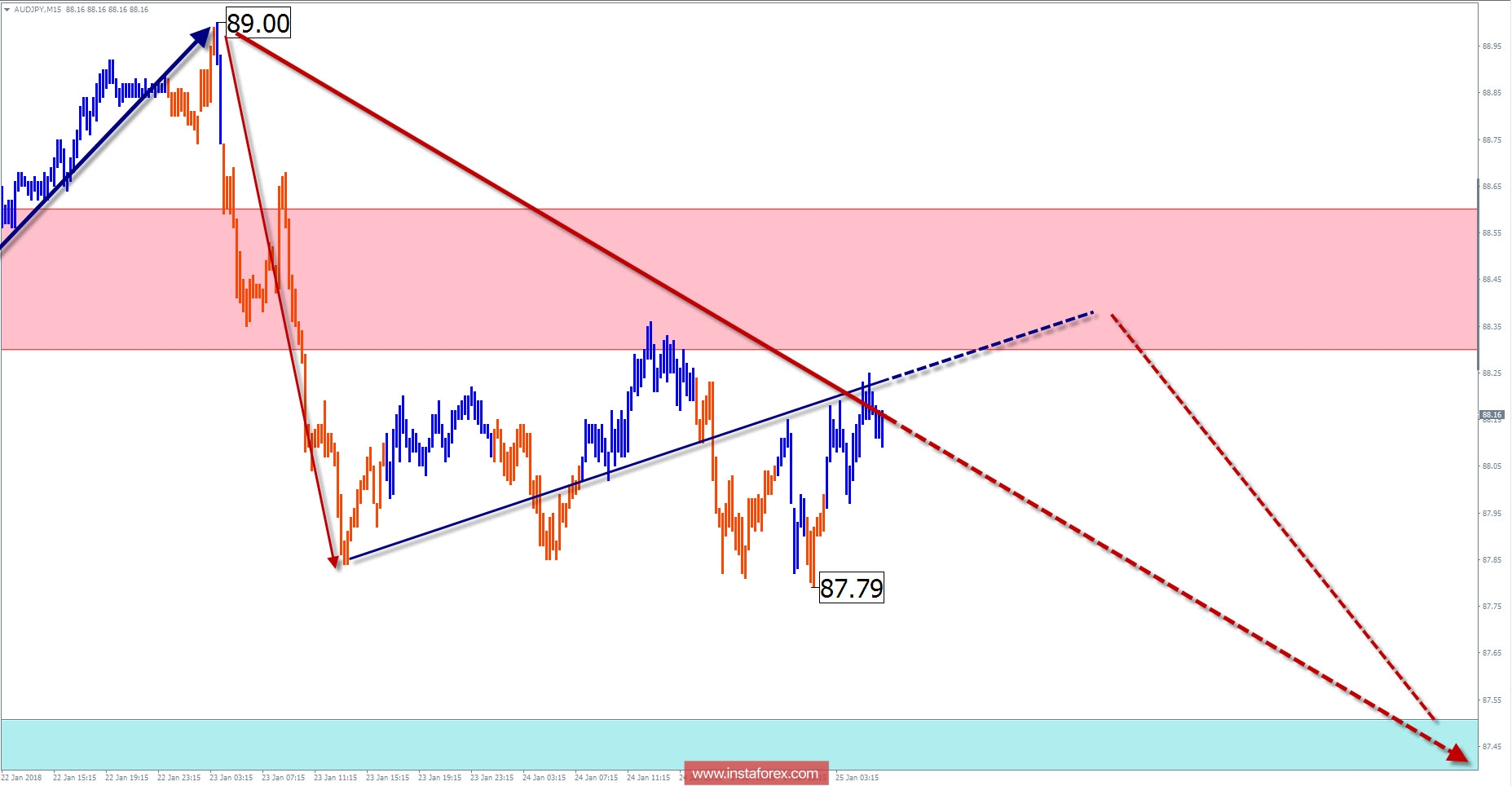

Overview and forecast for AUD / JPY

As a result of the development of a one and a half-year upward wave, the cross-country price reached the preliminary target zone. Since July of last year, the pair quotes along the lower boundary of the zone in the side price corridor.

The approach of scale indicates the date of November 24 of last year as the starting point of the last, unfinished bull wave. A week ago, the price began to form a downward wave, the potential of which indicates the possible beginning of the correction part (B).

Today, the flattering mood of the pair is most probable. In the first half of the day, it is expected to end yesterday's rise in prices. In the framework of the calculated resistance zone, one can then count on a change in the direction of the movement and the course of the price downward.

The boundaries of the resistance zones:

- 88.30 / 60

The boundaries of the support zones:

- 87.50 / 20

Explanations to the figures: For simplified wave analysis, the simplest type of wave is used in the form of a zigzag, combining 3 parts (A; B; C). Of these waves, all kinds of correction are composed and most of the impulses. At each time frame, the last, incomplete wave is analyzed.

The areas marked on the graphs are indicated by the calculation areas, where the probability of a change in the direction of motion is significantly increased. Arrows indicate the wave counting according to the technique used by the author. The solid background of the arrows indicates the structure formed, the dotted one indicates the expected wave motion.

Attention: The wave algorithm does not take into account the duration of the tool movements in time. The forecast is not a trading signal! To conduct a trade transaction, you need to confirm the signals of your trading systems.