This week, the euro/dollar pair fell into a whirlpool of extremely contradictory fundamental factors. The ECB meeting and the economic forum in Davos created a favorable ground for heightened volatility: starting the trading week at the bottom of the 22nd figure, the pair tested the 25th mark on Thursday. The engine of the upward movement of the eurusd could only be stopped by the president of the United States - and only for a few hours. During the Asian session, the pair continued its growth, despite many arguments in favor of deep correction.

On Friday, the situation is staggering on the brink. The eurusd bulls finally retreated from the 25th level, but the pair's bears could not keep the price in the area of the 23rd figure. As the "neutral" price niche, the 24th figure appeared, within whose boundaries the main trade battles took place.

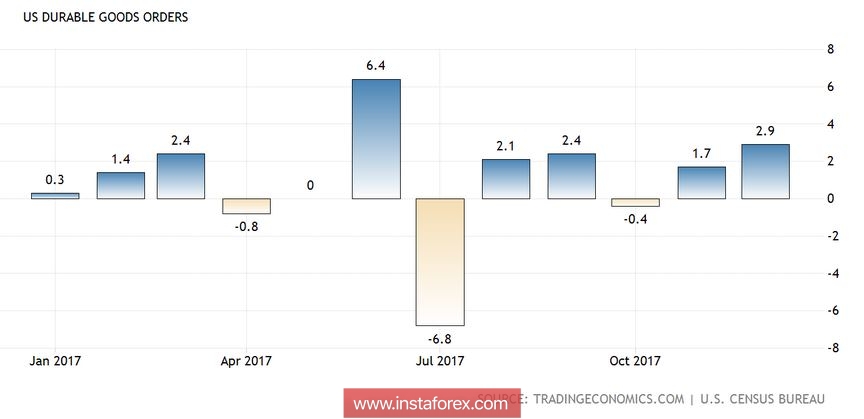

Important macroeconomic indicators, which were published on Friday in the US, could not support neither the bears nor the bulls of the pair. The release was surprisingly contradictory. On the one hand, US GDP for the fourth quarter of last year was significantly lower than the forecast (2.6% instead of 3%), while the price index of GDP grew better than expected. Data on orders for long-term goods came out in the "green". However, the balance of foreign trade, turned out to be worse than the forecast values.

Such mixed dynamics could not switch the attention of traders to the monetary policy of the United States, or rather, to its prospects. The most positive aspect of Friday's release is the dynamics of the price index of GDP, but, the slowdown of the US economy towards 2.6% has played into the hands of dollar bears, offsetting the positive effect of strong figures.

However, the US data could provide a price rebound almost to the low on Friday. In addition, we must not forget that on Friday many traders close their deals, locking in profits. Therefore, the correction within the framework of the day was quite predictable, especially on the background of ambiguous data from the United States.

The future prospects of the pair are more difficult to forecast. Next week, the first meeting of the Fed will be held this year, where members of the central bank will assess the latest developments in the country's economy. The consumer price index in annual terms slowed to 2.1%, and on a monthly basis showed extremely weak growth of 0.1%. Retail sales also showed weak dynamics, as well as indicators of average wages and personal consumption.

In other words, inflation is still a concern, and this fact will unlikely be ignored by the Fed. This will be the last meeting of the Fed for Janet Yellen: on February 3 she will be replaced by Jerome Powell. This factor must also not be forgotten: the market will assess the tonality of the accompanying statement, taking into account that in March (when the next Fed meeting is held), the general mood of the regulator's members may radically change due to personnel reshuffles. Therefore, it is by no means a fact that the "hawkish" rhetoric of the members of the Federal Reserve in January will convince traders that the regulator will adhere to the voiced position during the following months.

In addition, the market currently has somewhat reoriented its priorities regarding the importance of fundamental factors. Earlier this year, several representatives of the Fed (John Williams in particular) voiced very optimistic views - both about the prospects for monetary policy, and generally about the state of the US economy. However, the positive effect of their performances was of a short-term nature. This paradox can be explained by two reasons.

First, the market has already reached the "ceiling" of the normalization of monetary policy in the US - at least until a period of long-term pause in this process. According to representatives of the Fed, the optimal level is "just below three percent." And this is under the condition that inflation still shows itself and shows more impressionable growth this year. Even with such an optimistic scenario, traders already see the horizon of events beyond which there is uncertainty. So far, no member of the Fed has attempted to predict long-term prospects for monetary policy. On the other hand, other central banks of the world are just starting to normalize monetary policy, causing traders to take interest in the respective currencies.

Another factor of pressure on the dollar is the probability of a trade war, where the US will be "on the front line." According to many political experts, this year Trump will focus on America's foreign trade relations. In the coming months, the fate of the NAFTA (the Free Trade Agreement between Canada, the US and Mexico) will be decided, and within three months the US president should decide the fate of steel imports (most likely, manual regulation of the market will be introduced). Previously, Trump had already withdrawn the United States from negotiations on the Trans-Pacific Partnership and introduced a 30 percent tariff on the import of solar panels and washing machines. The latest statements by the US Secretary of Commerce and official representatives from Beijing suggest that the main "military actions" at the front of the trade war are ahead.