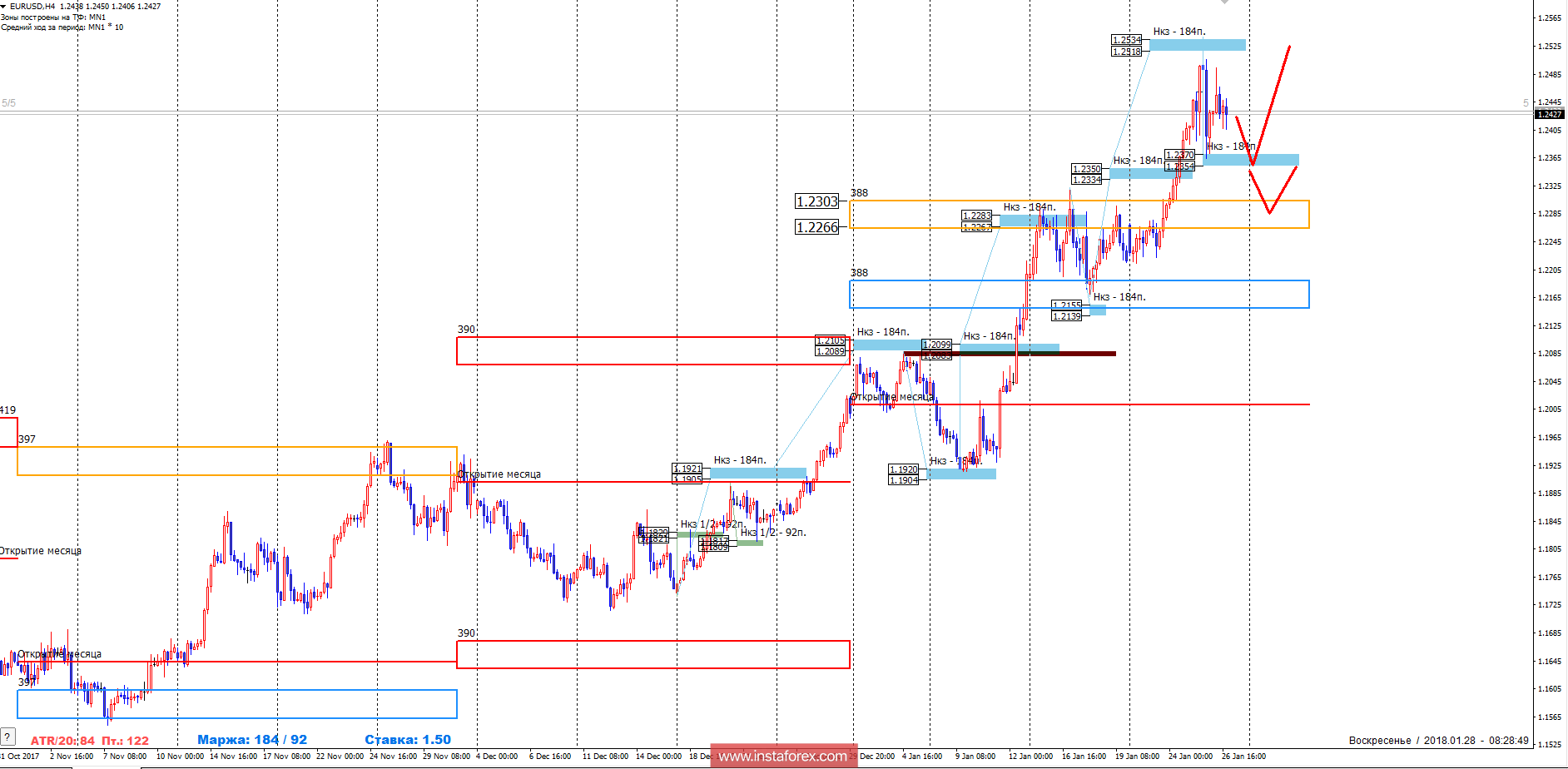

Last week, the formation of an upward medium-term model continued. The pair went beyond the monthly short-term fault of January 1.2303-1.2266, which implies the appearance of a large offer at the end of the current or early next month.

Medium-term plan.

When building a trading plan, it is necessary to take into account the fact that the upward movement is a strong medium-term impulse. This indicates the need for frequent fixations in the search of prices for sale. At the end of last week, the pair reached the weekly short-term target of 1.2534-1.2518, which allowed to observe the growth of the supply and the fall to the week-long short-term of 1.2370-1.2354, formed from the monthly maximum. At the beginning of this week, we can talk about the formation of an accumulation zone between these zones. The exit and consolidation outside of them will determine the further direction for the first half of February.

Because of going beyond the limits of monthly volatility, a downward model is more likely, which makes it possible to search for reversal patterns on younger timeframes. The work in the range between two weekly short-term is most beneficial in the current conditions.

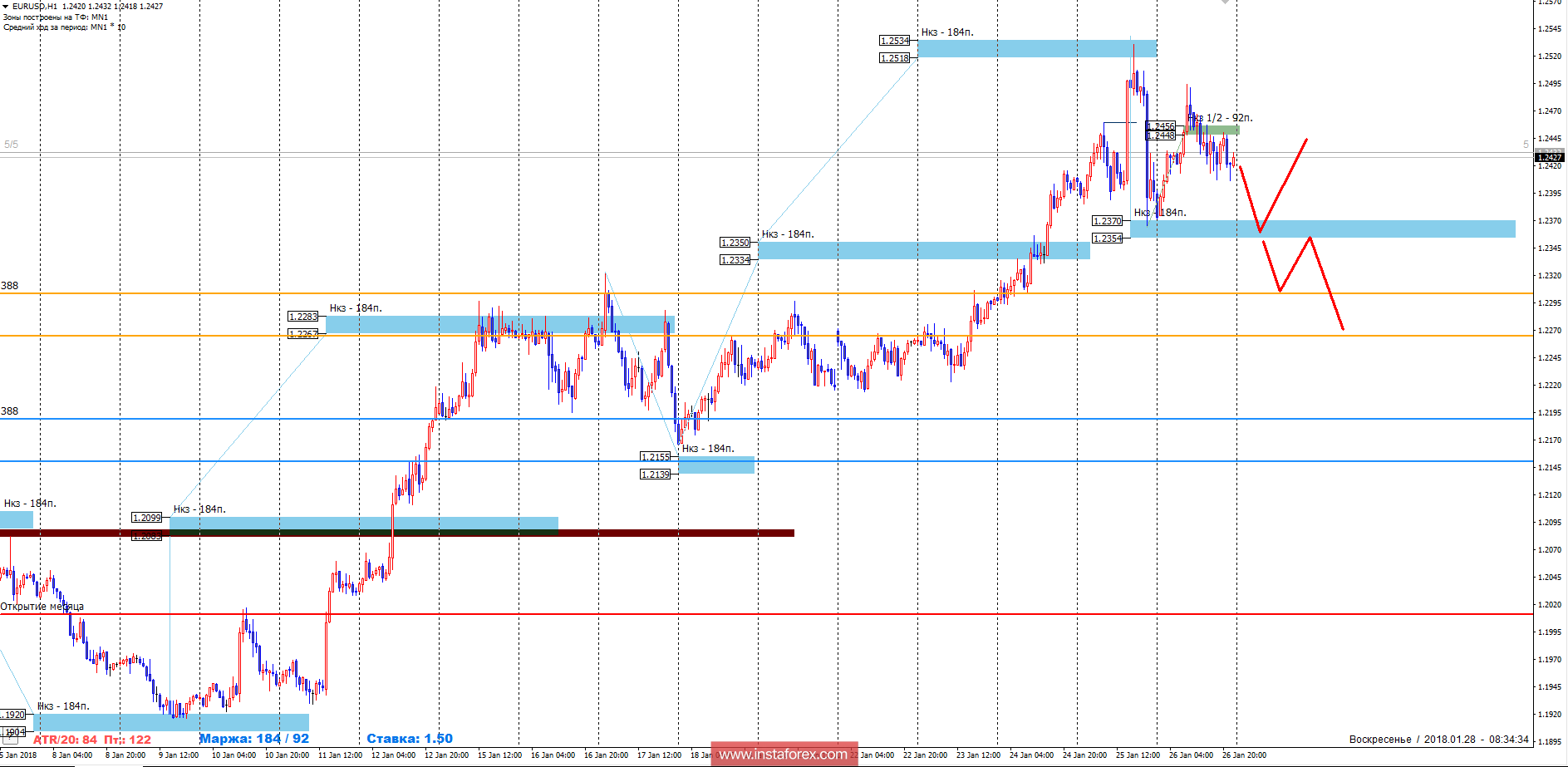

Intraday plan.

On Friday, the pair managed to win back most of Thursday's fall, which speaks of the strength of the upward movement, but the main resistance in the form of NKZ 1/2 1.2456-1.2448 did not allow the price to form a reversal pattern. While the US sessions close below 1.2456, the downward movement remains a priority within the intraday plan. The goal of the downward movement remains a weekly short-term target of 1.2370-1.2354, the test of which will determine the further priority for the week.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.