Technical Overview :

The USD/JPY pair showed a massive bullish price swing this week. The bulls were even able to reach the top level of 104.35.

The U.S. Dollar is trading higher against the Yen after reversing earlier losses. So, the USD/JPY uptrend is currently very strong.

The USD/JPY pair has been reveling some good strength over the last several months as cheap money is flowing into the markets. The USD/JPY pair is still calling for a strong bullish market as long as the trend is trading above the spot of 103.68.

Considering that the RSI remains bullish on all timeframes and the US Dollar Index is still trading in an upward channel since the 1st of Decemeber, we could see the USD/JPY pair making fresh 104.22 highs.

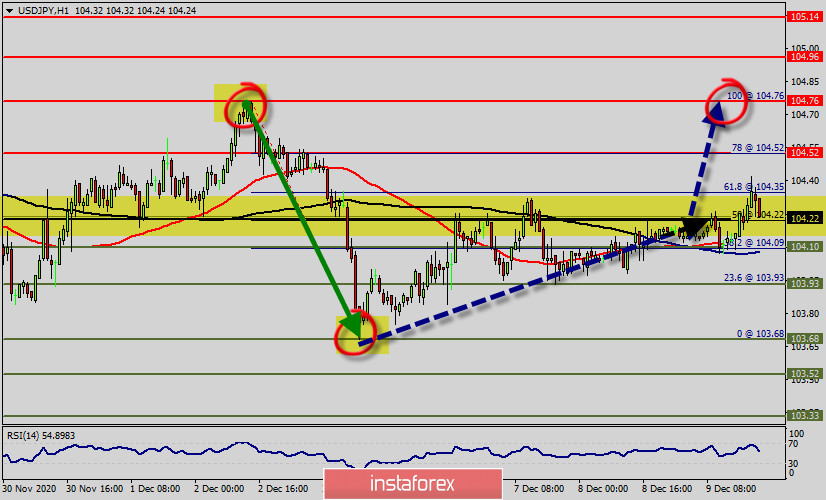

Next resistance level for the bulls to watch is at 104.76, Decemeber, 2, 2020 highs.

An additional signal in favor of reducing the USD/JPY pair currency pair will be a rebound from the trend line on the relative strength index (RSI).

The USD/JPY pair will continue to rise from the level of 104.22. The support is found at the level of 104.22, which represents the 50% Fibonacci retracement level in the H1 time frame. The daily pivot is seen at the level of 104.22.

The price is likely to form a double bottom. Today, the major support is seen at 104.10, while immediate resistance is seen at 104.52.

Accordingly, the USD/JPY pair is showing signs of strength following a breakout of a high at 104.22. So, buy above the level of 104.22 with the first target at 104.76 in order to test the daily resistance 1 and move further to 104.96.

Also, the level of 104.96 is a good place to take profit because it will form a new double top at the same time frame.

Amid the previous events, the pair is still in an uptrend; for that we expect the USD/JPY pair to climb from 104.22 to 104.96 today.

From this point, we expect the USD/JPY pair to continue moving in the bullish trend from the support level of 104.22 towards the target level of 104.76. If the pair succeeds in passing through the level of 104.76, the market will indicate the bullish opportunity above the level of 104.96 so as to reach the major target at 105.14.

At the same time, in case a reversal takes place and the USD/JPY pair breaks through the support level of 104.10, a further decline to 103.68 can occur, which would indicate a bearish market.

Overall, we still prefer the bullish scenario, which suggests that the pair will stay above the are of 103.68 today (the market is still in an uptrend).