In the foreign exchange market, the U.S. dollar finished the week in a negative territory relative to all major currencies on the large Forex market. Such dynamics are primarily determined by the growth of expectations that central banks have to raise their monetary rates on the wave of noticeable growth of national economies.

Another negative for the dollar was the publication of data on U.S. GDP for the fourth quarter on Friday. In its next revision, it showed a decline of 2.6% in the economic growth with a forecast growth of 3.0% compared to the previous values of 2.6%, which was also revised down. Presented figures have traditionally shown a slowdown in the growth of the U.S. economy by the end of the year against its recovery in the middle. Recall that in the summer the value of GDP rose to 3.2% mark.

In the wake of these values, the dollar was under pressure, which intensified after the speech of the U.S. president, Donald Trump, at the economic forum in Davos. He did not say anything significant in his speech and talked about the greatness of America and its attractiveness for investors referring only to his old slogans from the election campaign. Prior to that, he said that a strong nation needed a strong dollar, which was the reason for the suspension of its collapse, but, as it turned out, it was only for a short period of time.

Positive data on basic orders for durable goods could not support the dollar. According to the published figures, basic orders for durable goods added 0.6% in December. In November, they increased by 0.3% with a projected 0.5% increase. The volume of orders for durable goods markedly increased in the growth of 2.9% in December while an increase of 0.8% was expected. The indicator for November was revised upwards to 1.7%.

Observing such a situation on the foreign exchange markets, it seems that the short-term weakening of the US currency will continue.

Forecast of the day:

The EUR/USD pair is consolidating on the wave of waiting for the release of important data, the basic price index on personal consumption (RFE), which will be published at 12.30 London time. It can be assumed that the values of the indicator still shows some kind of upward dynamics, then it will have to locally support the dollar. On this wave, the pair could fall towards the level of 1.2300. However, if the data is negative, there is a possibility of an increase towards the 1.2535 quotations.

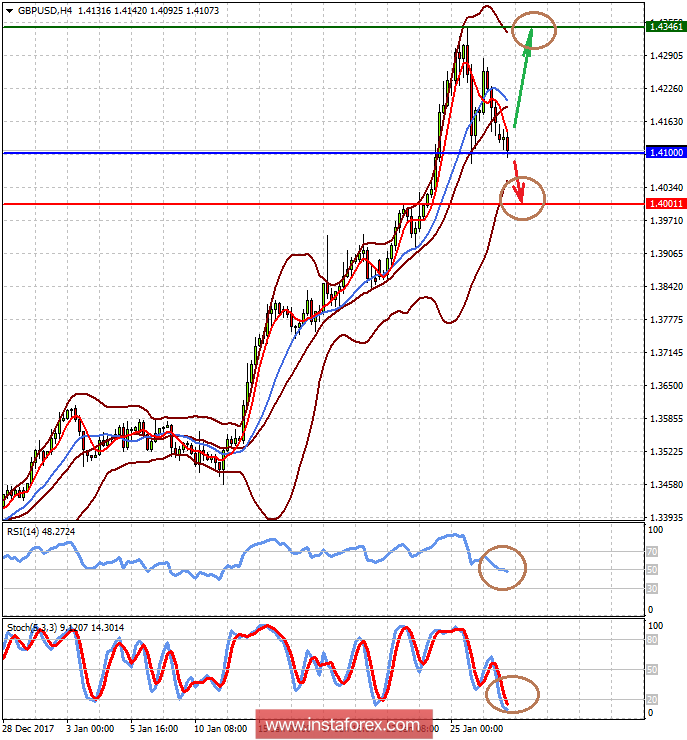

The GBP/USD pair is also consolidating above the level of 1.4100. Positive news from the U.S. will push the pair down towards 1.4000 then move upward to 1.4345.