Prior decision

- Deposit facility rate -0.50%

- Main refinancing rate 0.00%

- Marginal lending facility 0.25%

- Extends window for lowest rate on TLTROs

- Raise total amount that counterparties will be entitled to borrow in TLTRO operations from 50% to 55% of their stock of eligible loans

- Extends duration of April collateral easing to June 2022

- QE to continue at a pace of €20 billion per month

- Repo, swap lines with non-euro area central banks extended until March 2022

- Policy measures taken today will contribute to preserving favourable financing conditions over the pandemic period

- Uncertainty remains high, including with regard to the dynamics of the pandemic and timing of vaccine rollouts

Further Development

Analyzing the current trading Gold, I found that there is strong reaction of the lows at $1,824, which is good sign for further upside movement.

Watch only for long opportunities on the pullbacks with the potential targets at $1,874 and $1,896.

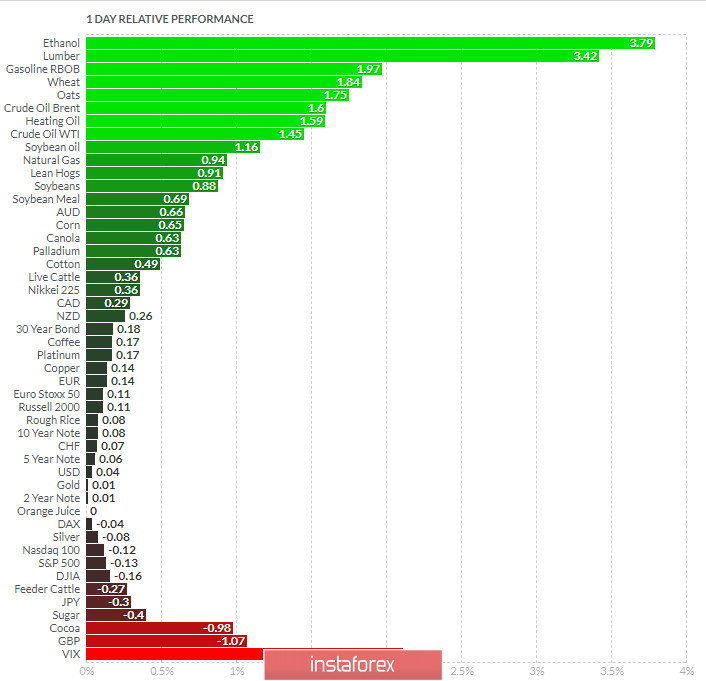

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Lumber today and on the bottom VIX and GBP.

Key levels:

Resistance: $1,874 and $1,896

Support level: $1,824