Dear colleagues.

For the EUR / USD pair, we follow the formation of a potential for a downward movement from January 25. The continuation of a downward movement is expected after the breakdown of 1.2330. For the GBP / USD pair, we have expanded the potential for a downward movement towards the level of 1.3849. For the USD / CHF pair, the price forms the potential for the top of January 25. For the USD / JPY pair, the continuation of the downward movement is expected after the breakdown at 108.30. For the EUR / JPY pair, we are monitoring the formation of the potential for the bottom of January 25. For the of GBP / JPY pair, the price forms a downward structure from January 25.

Forecast for January 30:

Analytical review of currency pairs in the scale of H1:

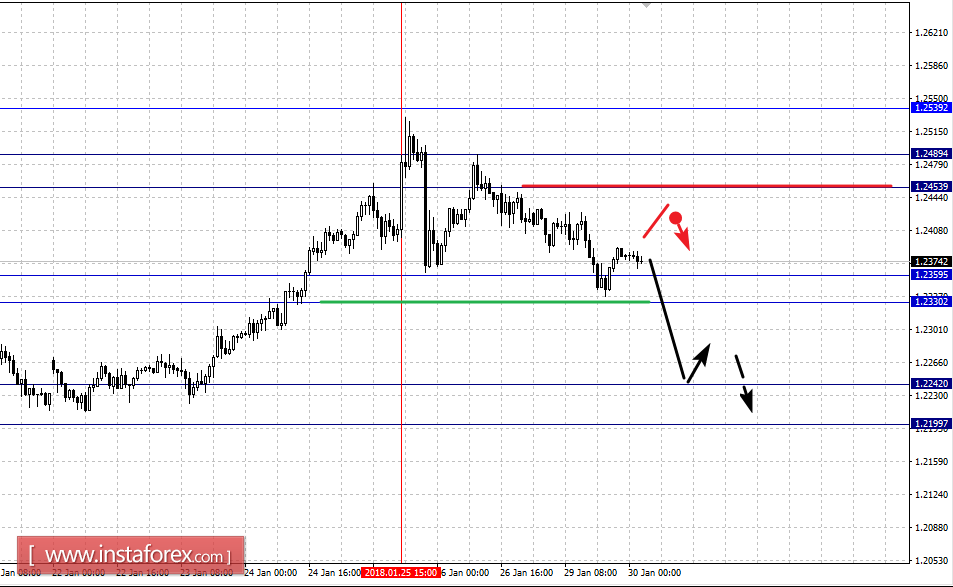

For the EUR / USD pair, the key levels on the scale of H1 are: 1.2539, 1.2489, 1.2453, 1.2359, 1.2330, 1.2242 and 1.2199. Here, the continuation of the downward movement is expected after passing the price of the noise range of 1.2359 - 1.2330. In this case, the target is 1.2242. We consider the level of 1.2199 to be the potential value for the downward movement. After reaching this level, we expect a pullback to the top.

Short-term upward movement is possible in the area of 1.2453 - 1.2489. The breakdown of the last value will allow us to count on the recovery of the upward trend. Here, the first target is 1.2539.

The main trend is the downward structure of January 25.

Trading recommendations:

Buy: 1.2453Take profit: 1.2487

Buy 1.2491 Take profit: 1.2537

Sell: 1.2330 Take profit: 1.2245

Sell: 1.2240 Take profit: 1.2205

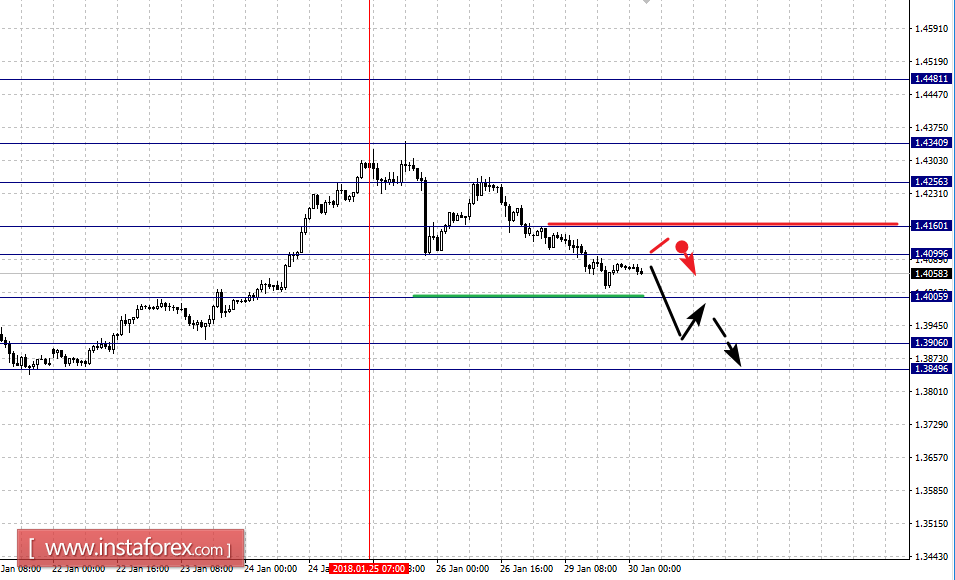

For the GBP / USD pair, the key H1 scale levels are 1.4481, 1.4340, 1.4256, 1.4160, 1.4099, 1.4005, 1.3906 and 1.3849. Here, we monitor the formation of a downward structure from January 25. The development of this level is expected after the breakdown of 1.4005. In this case, the target is 1.3906. In the area of 1.3906 - 1.3849 is the consolidation of the price.

Short-term upward movement is possible in the area of 1.4099 - 1.4160. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.4256. This level is the key support for the top. Passing the price will lead to the formation of an upward structure. In this case, the target is 1.4340.

The main trend is the downward structure of January 25.

Trading recommendations:

Buy: 1.4100 Take profit: 1.4160

Buy: 1.4162 Take profit: 1.4254

Sell: 1.4005 Take profit: 1.3910

Sell: 1.3904 Take profit: 1.3852

For the USD / CHF pair, the key levels on the scale of H1 are: 0.9595, 0.9557, 0.9482, 0.9449, 0.9408, 0.9324, 0.9263 and 0.9211. Here, we continue to monitor the formation of the potential for the top of January 25. The continuation of the upward movement is expected after the breakdown of 0.9408. In this case, the first target is 0.9449. Short-term upward movement is possible in the area of 0.9449 - 0.9482. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 0.9557. For the potential value for the top is the level of 0.9595. After reaching this level, we expect the consolidation of the price.

The level of 0.9324 is the key support for the top. Its breakdown will lead to the development of a downward structure. In this case, the first target is 0.9263. For the potential value for the bottom, consider the level of 0.9211. From this level, we expect a rollback upward.

The main trend is a downward structure from January 10, the correction stage.

Trading recommendations:

Buy: 0.9408 Take profit: 0.9448

Buy: 0.9484 Take profit: 0.9555

Sell: 0.9322 Take profit: 0.9265

Sell: 0.9260 Take profit: 0.9214

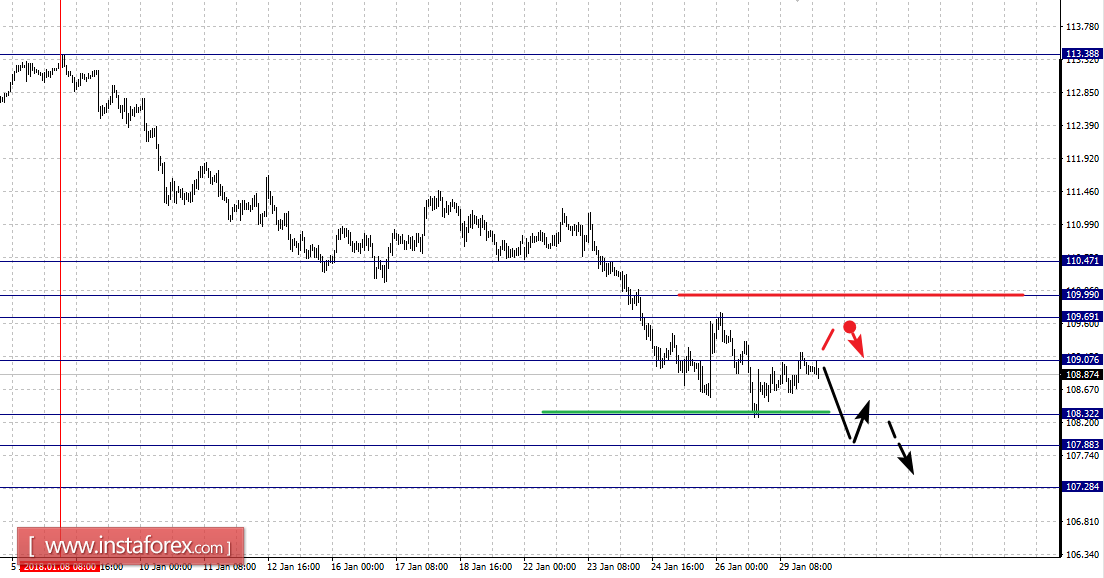

For the USD / JPY pair, the key levels on a scale are: 110.47, 109.99, 109.69, 109.07, 108.32, 107.88 and 107.28. Here, we continue to follow the downward structure from January 8. Short-term downward movement is expected in the range of 108.32 - 107.88. As a potential value for the downward cycle from January 8, we consider the level of 107.28. This level is still interesting from the medium-term perspective.

We expect the correction to go down after the breakdown of 109.07. In this case, the target is 109.69. The range of 109.69 - 109.99 is the key support for the downward structure. Passing the price will lead to the development of an upward structure. In this case, the target is 110.47.

The main trend is the downward cycle from January 8.

Trading recommendations:

Buy: 109.10 Take profit: 109.65

Buy: 110.00 Take profit: 110.45

Sell: 108.28 Take profit: 107.90

Sell: 107.85 Take profit: 107.35

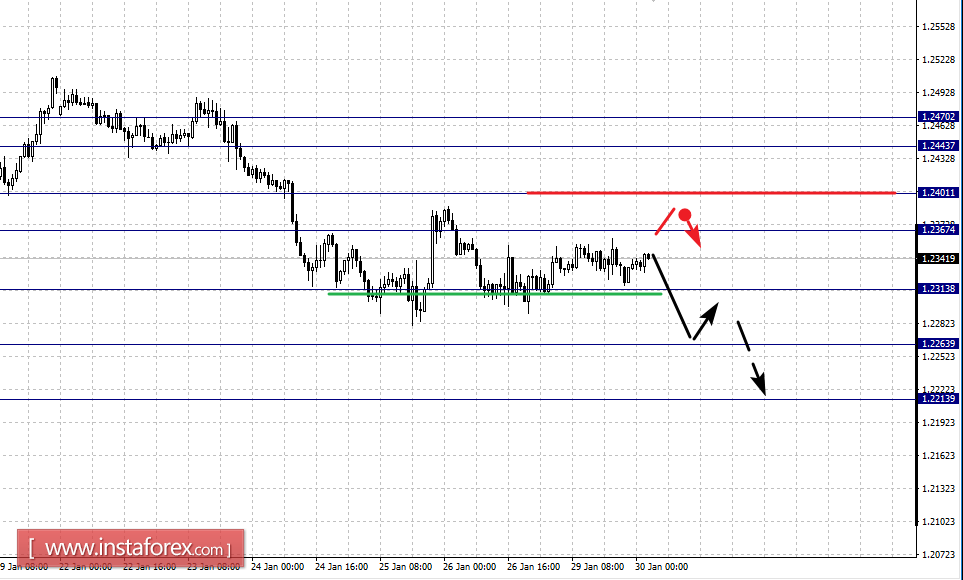

For the CAD / USD pair, the key H1 scale levels are: 1.2443, 1.2401, 1.2367, 1.2313, 1.2263 and 1.2213. Here, we continue to follow the downward structure from January 11 as the main trend. The continuation of the downward movement is expected after the breakdown of the level of 1.2313. In this case, the target is 1.2263. Near this level is the consolidation of the price. For the potential value for the bottom, consider the level of 1.2213. After reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 1.2367 - 1.2401. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2443. Up to the level of 1.2470 we expect the initial conditions for the upward cycle to be formed.

The main trend is the downward structure of January 11.

Trading recommendations:

Buy: 1.2368 Take profit: 1.2400

Buy: 1.2404 Take profit: 1.2440

Sell: 1.2310 Take profit: 1.2265

Sell: 1.2258 Take profit: 1.2220

For the AUD / USD pair, the key levels on the H1 scale are: 0.8257, 0.8210, 0.8179, 0.8140, 0.8070, 0.8039, 0.8002 and 0.7957. Here, we follow the upward structure of January 23. The continuation of the upward movement is expected after the breakdown of 0.8140. In this case, the target is 0.8179. In the area of 0.8179 - 0.8210, we expect short-term upward movement as well as the consolidation of the price. For the potential value for the top, consider the the level of 0.8257. Upon reaching this level, we expect the correction to begin.

Short-term downward movement is possible in the area of 0.8070 - 0.8039. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.8002. This level is the key support for the top.

The main trend is the local upward structure of January 23.

Trading recommendations:

Buy: 0.8140 Take profit: 0.8175

Buy: 0.8180 Take profit: 0.8207

Sell: 0.8070 Take profit: 0.8045

Sell: 0.8037 Take profit: 0.8004

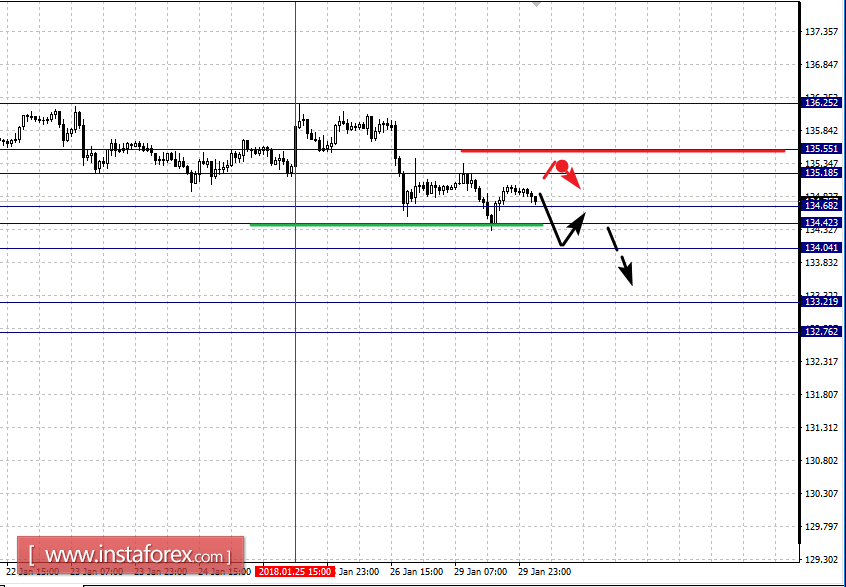

For the EUR / JPY pair, the key levels on the scale of H1 are: 136.25, 135.55, 135.18, 134.68, 134.42, 134.04, 133.21 and 132.76. Here, we follow the formation of a downward structure from January 25. The continuation of the development of the downward structure is expected after passing the noise range of 134.68 - 134.42. In this case, the target is 134.04. Near this level is the consolidation of the price. The breakthrough at 134.04 should be accompanied by a pronounced movement towards the level of 133.21. Upon reaching this level, we expect consolidation in the area of 133.21 - 132.76.

Short-term upward movement is possible in the area of 135.18 - 135.55. The breakdown of the latter value will lead to the formation of an upward structure. In this case, the first target is 136.25.

The main trend is the downward structure of January 25.

Trading recommendations:

Buy: 135.18 Take profit: 135.54

Buy: 135.57 Take profit: 136.25

Sell: 134.40 Take profit: 134.06

Sell: 134.02 Take profit: 133.25

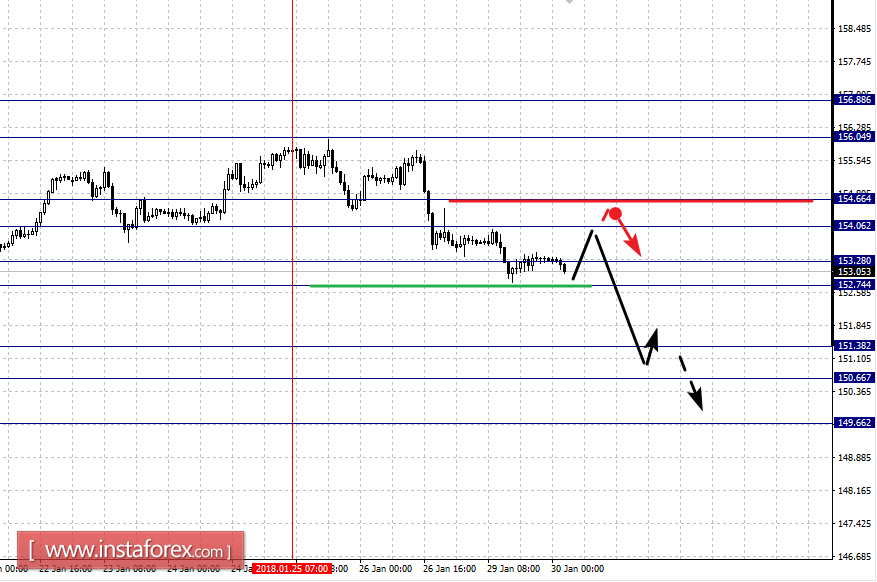

For the GBP / JPY pair, the key levels on the scale of H1 are: 156.88, 156.04, 154.66, 154.06, 153.28, 152.74, 151.38, 150.66 and 149.66. Here, we continue to monitor the formation of the downward structure from January 25. The potential has also been expanded to the level of 149.66. Short-term downward movement is expected in the area of 153.28 - 152.74. The breakdown of the last value should be accompanied by a pronounced movement towards the level of 151.38. In the area of 151.38 - 150.66 is the consolidation of the price. For the potential value for the bottom, consider the level of 149.66. Upon reaching this level, we expect a rollback upward.

Short-term upward movement is possible in the area of 154.06 - 154.66. The breakdown of the last value will lead to the formation of an upward structure. Here, the target is 156.04. The potential value for the top is the level of 156.88. Upon reaching this level, we expect the initial conditions for the upward cycle to be formed.

The main trend is the formation of a downward potential from January 25.

Trading recommendations:

Buy: 154.06 Take profit: 154.62

Buy: 154.70 Take profit: 156.00

Sell: 152.70 Take profit: 151.45

Sell: 151.35 Take profit: 150.70