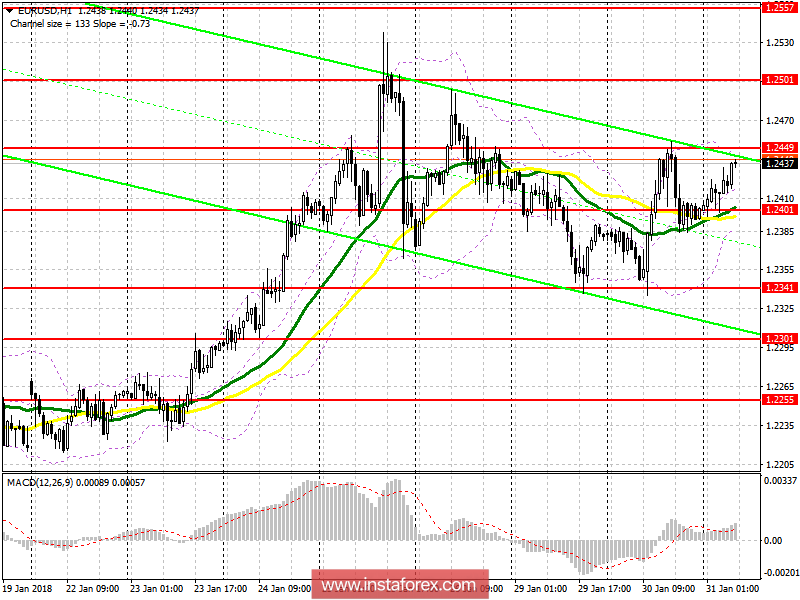

EUR / USD

To open long positions for EUR / USD, you need:

Consider new purchases of euros after the breakdown and consolidation above the level of 1.2449, together with the good data on inflation in the eurozone, which could lead to an update of the level of 1.2501 and an exit for a monthly maximum in the area of 1.2557, where I recommend fixing the profits. In the case of a decline in the euro at 1.2401 in the morning, consider the new long positions best for a rebound from 1.2341.

To open short positions for EUR / USD, you need:

The formation of a false breakout at 1.2449 and a return to this level may lead to a correction of the euro in the morning to the support area of 1.2401. Bonding below this range amid weak inflation data will lead to a sale to a stronger 1.2341 level and a support update of 1.2301, where today I recommend fixing the profit. In the case of growth above the level of 1.2449, you can sell the euro on a false breakdown of 1.2501, or on a rebound, you can immediately from the level of 1.2557.

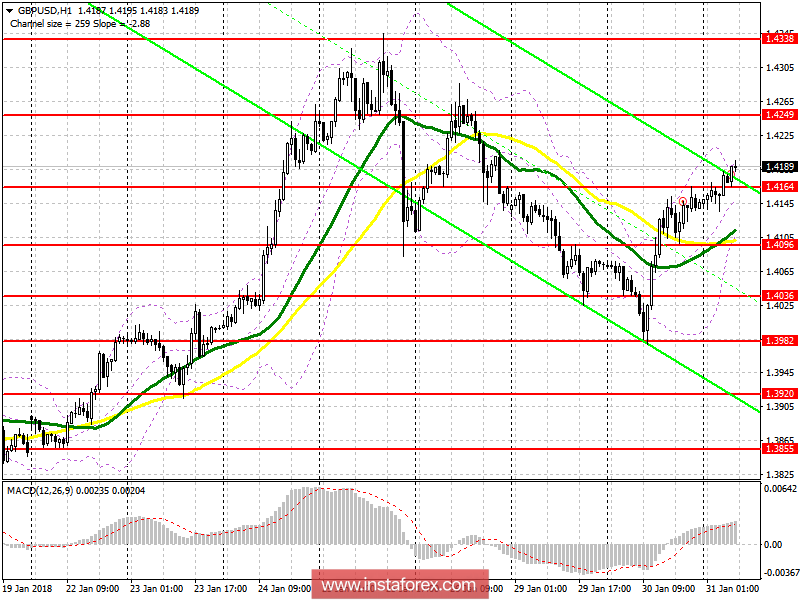

GBP / USD

To open long positions for GBP / USD, you need:

While the trade is above the level of 1.4164, we can expect the pound to continue growing with the update of 1.4249 and the main goal of the return to 1.4338, where I recommend fixing the profit. If the pound drops below the level of 1.4164 in the first half of the day, you can look for new purchases after forming a false breakout at 1.4096, or at a rebound of 1.4036.

To open short positions for GBP / USD, you need:

The return to 1.4164 will be the first signal to increase short positions in GBP / USD with the first downside target to 1.4096 area and the key upgrade target of 1.4036, where I recommend fixing the profit. In the case of further growth of the pound, you can consider sales in the area of 1.4249, or on a rebound from 1.4338.

Indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20