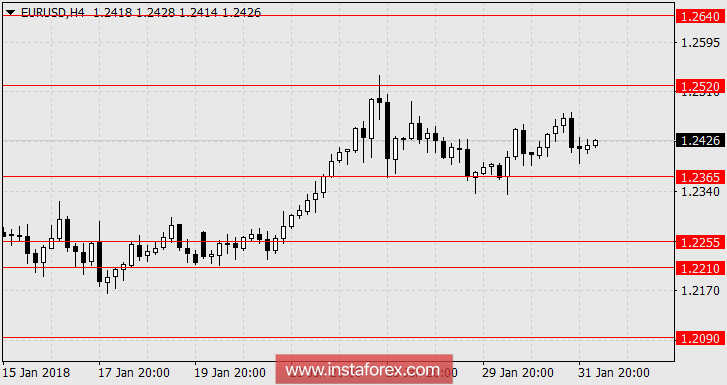

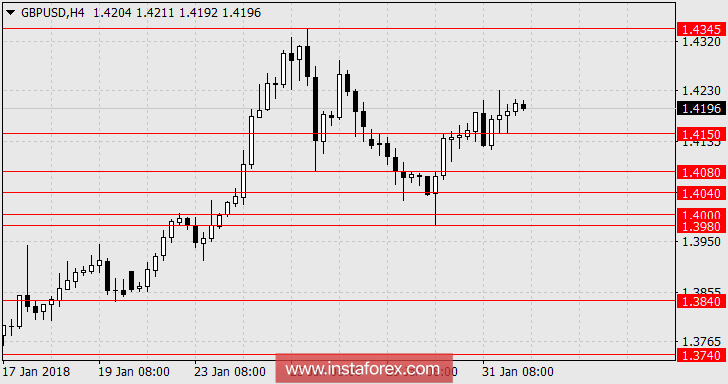

EUR / USD, GBP / USD

On Wednesday morning, there was a positive light due to moderately optimistic indicators of the euro area. The base consumer price index in the euro area for January increased from 0.9% YoY to 1.0% YoY. The total CPI fell from 1.4% to 1.3% YoY. Retail sales in Germany decreased by 1.9% last month against the 1.9% growth in November, which showed a zero change in two months, that somewhat smoothened the significant decline of the December index. The number of unemployed in Germany fell by 25 thousand against the expectation of -17 thousand, while the unemployment rate in Germany fell from 5.5% to 5.4%. Also in Italy, unemployment fell from 10.9% (revised from 11.0%) to 10.8%. Unemployment in the euro area as a whole remained at the level of 8.7%.

In the United States, the number of private sector jobs from ADP for January grew by 234 thousand against the forecast of 186 thousand and 242 thousand in December. The business activity index in Chicago's manufacturing sector for January fell from 67.6 to 65.7, but the forecast was weaker 64.2 points. Unfinished sales in the secondary real estate market in December grew by an expected 0.5% against 0.3% a month earlier. On the data, investors partially fixed the profit before the release of the Fed's accompanying statement. The stock market grew by 0.28%.

The investors' agitation was in vain, as the report did not contain any slightest hint of such changes in the policy. As a result, S & P500 closed the day with an increase of 0.05%, and the single European currency added 12 points, while the British pound gained 44 points.

Today, the final estimates of Manufacturing PMI are published for January, according to the euro area, as the main indices for Germany and the eurozone are expected to remain unchanged at 61.1 and 59.6 respectively. British Manufacturing PMI is projected to rise to 56.5 from 56.3.

According to the US, ISM Manufacturing PMI may show some weakening with the forecast at 58.7 versus 59.7 in December. Construction costs for December are expected to grow by 0.4% against 0.8% earlier. The number of applications for unemployment benefits is expected to be neutral, showing the forecast at 237K against 233K a week earlier.

We are expecting for the euro to rise to 1.2520 and further to 1.2640. The target for the British pound is 1.4345 .

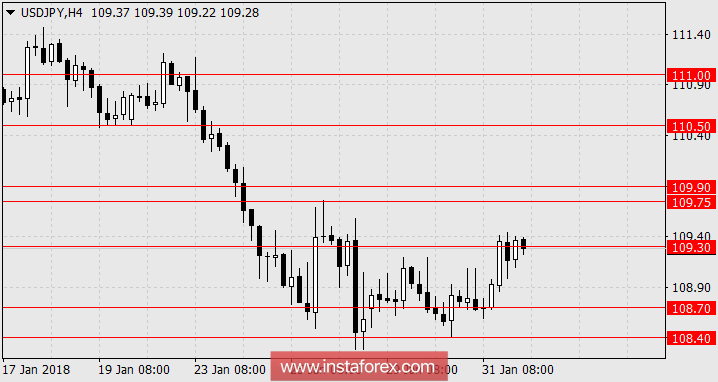

USD / JPY.

The situation of the Japanese yen begins to improve. Since the beginning of the week, the yen has traded in the range of 108.40-109.30, there is an attempt for today in order to gain a foothold above this range. This mood was present yesterday, as the data on industrial production increased by 2.7% against the forecast of 1.5%. The pace of laying out new homes in Japan has deteriorated, as the December estimate came in at -2.1% YoY against -0.4% YoY in November. The consumer confidence index in the United States remained at the same level, showing 44.7 points against the forecast of growth to 44.9. This morning, the final manufacturing. PMI for January was raised to 54.8 from 54.4. The Nikkei 225 stock index increase today at 1.23% along with the national day of APR (Asian-Pacific Region) leaders.

Tomorrow, the US predicted for optimistic economic indicators which can strengthen the growth of stock indices. Non-Farm Employment Change for January is expected to be 181 thousand against 148 thousand in December, while the growth of factory orders for the same month is 1.4%. We are expecting for the yen in the range of 109.75 / 90. Further growth is possible to 110.50. Here, the question in determining investor sentiment is, do they believe in the reliability of a local reversal?

* The presented market analysis is informative and does not constitute a guide to the transaction.