Wednesday's events in the currency markets were not stormy, probably, it could have been at another time.

The day was full of events and publications of important economic data, but this did not cause noticeable changes in the currency markets, which continued to consolidate in anticipation of new signals and economic data primarily from the euro zone, the UK and Japan.

On Tuesday, the consumer price index (CPI) came out of the eurozone, which confirmed our fears that consumer inflation in the region is starting to slow down. According to the presented data, the annual CPI showed a slowdown to 1.3% from 1.4%, which is much lower than the target level "just below 2.0%", which was previously set by the ECB, as a certain benchmark. The basic indicator of consumer inflation in annual terms added up to 1.0% from 0.9%, but the unemployment rate still remains at a high level of 8.7% and, moreover, unchanged.

It would seem that such weak figures on consumer inflation should have put pressure on the euro. But that did not happen. This behavior of the market can be explained, it seems, only in this way. Markets seem to believe that increased economic growth will force the ECB and other world central banks to ignore low inflation and take the path of the Fed, which previously stopped incentive programs and started a smooth and very cautious increase in interest rates, while still generally maintaining the cost of borrowing in States at low levels.

We can assume that as long as such sentiment prevails in the markets, this will be a strong supporting factor for the major currencies against the dollar. In our opinion, even the situation with the increase in interest rates by the Federal Reserve in March, and following the results of the January meeting, the regulator assured that it will continue to follow its plans, is unlikely to change the alignment of forces. Investors believe that the economically developed countries that are still in the stage of stimulating their economies have the potential for growth. In fact, they are in a state of catch-up, and therefore their currencies on the wave of a change in monetary rates will have the potential for growth, as it was earlier with the US dollar.

But in this situation, it should also be taken into account that a further increase in interest rates in the United States will also support the dollar, which is likely to lead not to a strong growth of major currencies, but to the continuation of the overall period of the lateral trend, at which prices will be shift from time to time from the lower boundary of the range to the upper and vice versa.

Forecast of the day:

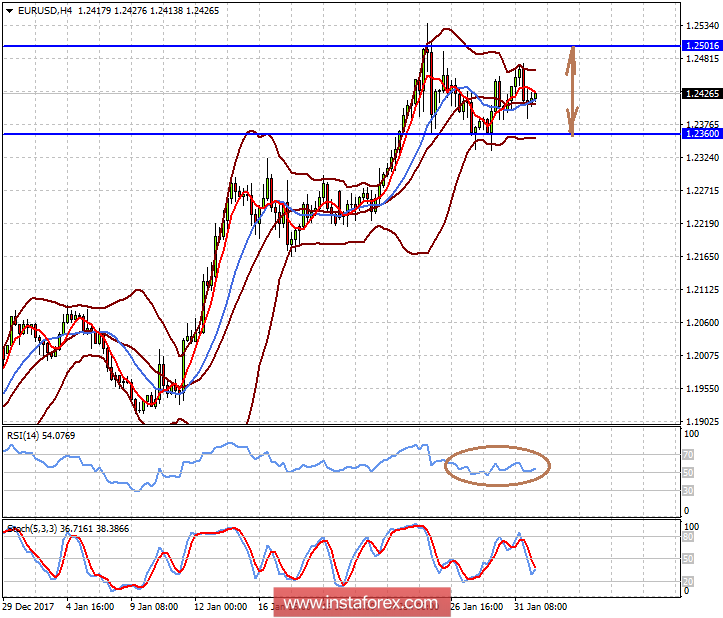

The EUR / USD pair is consolidating in the range of 1.2360-1.2500 against the backdrop of mutually exclusive factors, which on the one hand support the euro, but on the other hand, also have a positive impact on the US dollar. It is likely that today, the pair will remain in the range, if the range limits are not broken.

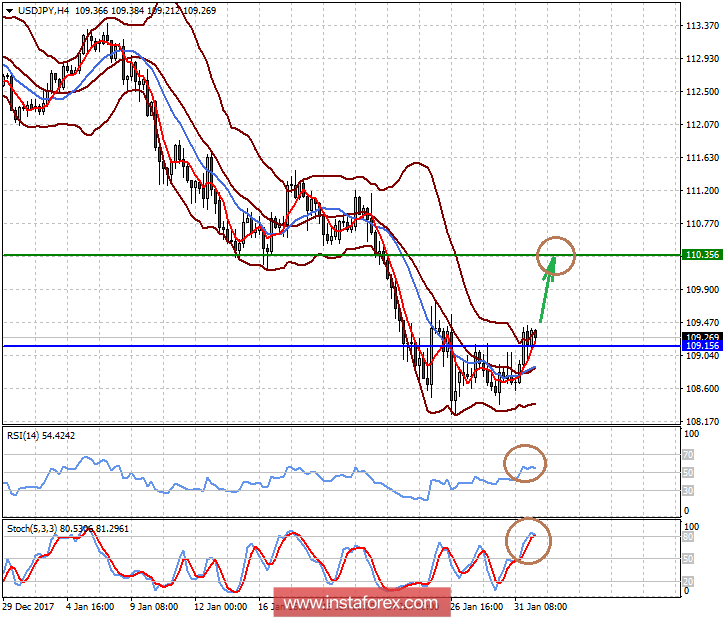

The pair USD / JPY is trading above the mark of 109.15, which gives it the opportunity for local growth to the level of 110.35.