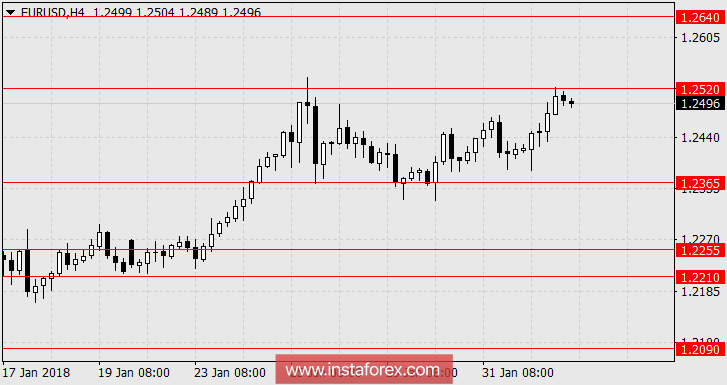

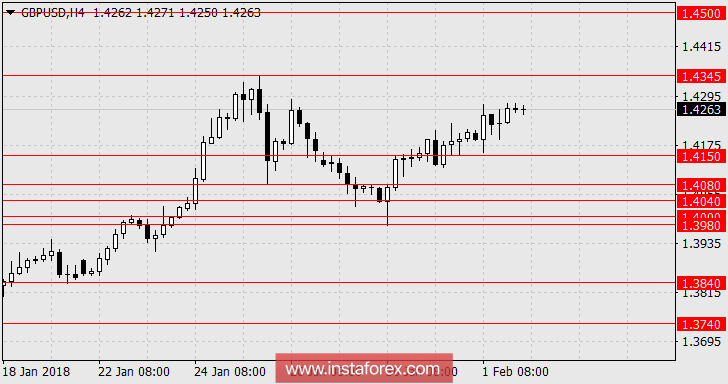

EUR / USD, GBP / USD.

The macroeconomic data for the euro area was released on Thursday and the US did not progress due to disappointment and the trend that softened the US dollar has developed. The final estimate of eurozone's manufacturing PMI for January remained at 59.6 points, while the UK housing price index increased by 0.6% in January against the forecast of 0.2%. But the British Manufacturing PMI declined from 56.2 to 55.3, which subsequently weakened the pound sterling.

In the United States, ISM Manufacturing PMI declined from 59.7 to 59.1 with expectations for a decline to 58.7. The final estimate of Manufacturing PMI by the Markit version remained at 55.5. The construction costs data appears to be optimistic with an increased in December by 0.7% with the forecast of 0.4%. Labor costs for the 4th quarter came in at 2.0% with an expectation of 0.9%, which the sufficient low unemployment indicates the available potential for further improvement of the employment quality. Also, the report of the United States Challenger Job Cuts showed a slowdown from -3.6% YoY to -2.8% YoY.

The main news for today is the labor data from the United States. The number of jobs outside the agricultural sector (Non-Farm Employment Change) is expected at 157-181 thousand to 143 thousand in December. The overall unemployment rate is projected to remain unchanged at 4.1%. The average hourly wage is expected to increase by 0.2%. The volume of factory orders for December is projected to grow by 1.4% after 1.3% in November. According to forecasts, the final estimate of January consumer confidence index from the University of Michigan will increase from 94.4 to 95.0.

Therefore, in terms of continuing risk appetites the euro is expected at the 1.2640 level, while the pound sterling at 1.4500.

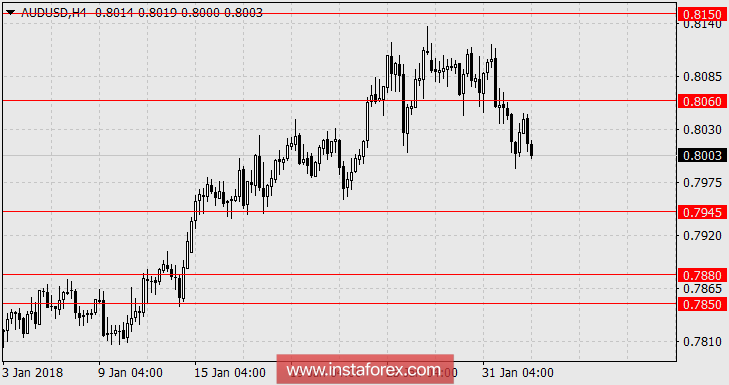

AUD / USD.

The Australian dollar falls on the fourth day against the growth of European currency, which currently shows some sluggishness with the US dollar correlation. There are no noticeable failures in the commodity markets. As the prospects of the largest investors are optimistic, in particular, Goldman Sachs sees the cost of iron ore on a three-month horizon at $ 85 per tonne and assumes an increase in the coal price from $ 165 to $ 220. Macroeconomic data The deterioration shown by the macroeconomic data seems not so significant as to deploy the "Australian" against the market. Perhaps, the reason lies in the stronger growth of US government bond yields against the weak growth (and on some securities and decline) in Australian securities. Thus, the yield on 10-year US government bonds rose from 2.658% to 2.793% for the week, while for Australian 10-year bonds fell from 2.844% to 2.818%.

Yesterday, the index for building permits in December's estimate fell by 20.0% against the forecast of -8%. Such collapses have occurred only three times over the past 34 years, the last of which in June 2012 (-21%). Export prices in the 4th quarter increased by 2.8% quarter per quarter, while imports grew by 2.0% quarter per quarter. Today, the quarterly producer price index showed an increase from 1.6% YoY to 1.7% YoY and the actual growth for the 4th quarter was 0.6% vs. the forecast of 0.2%.

In connection with the current adjustment, the investors' reaction to the expected positive US labor data may be different for today, as the Australian dollar will be sold as a weaker instrument against the US currency. We are expecting for the AUD / USD price at 0.7945 and further in the range of 0.7850 / 80.

* The presented market analysis is informative and does not constitute a guide to the transaction.