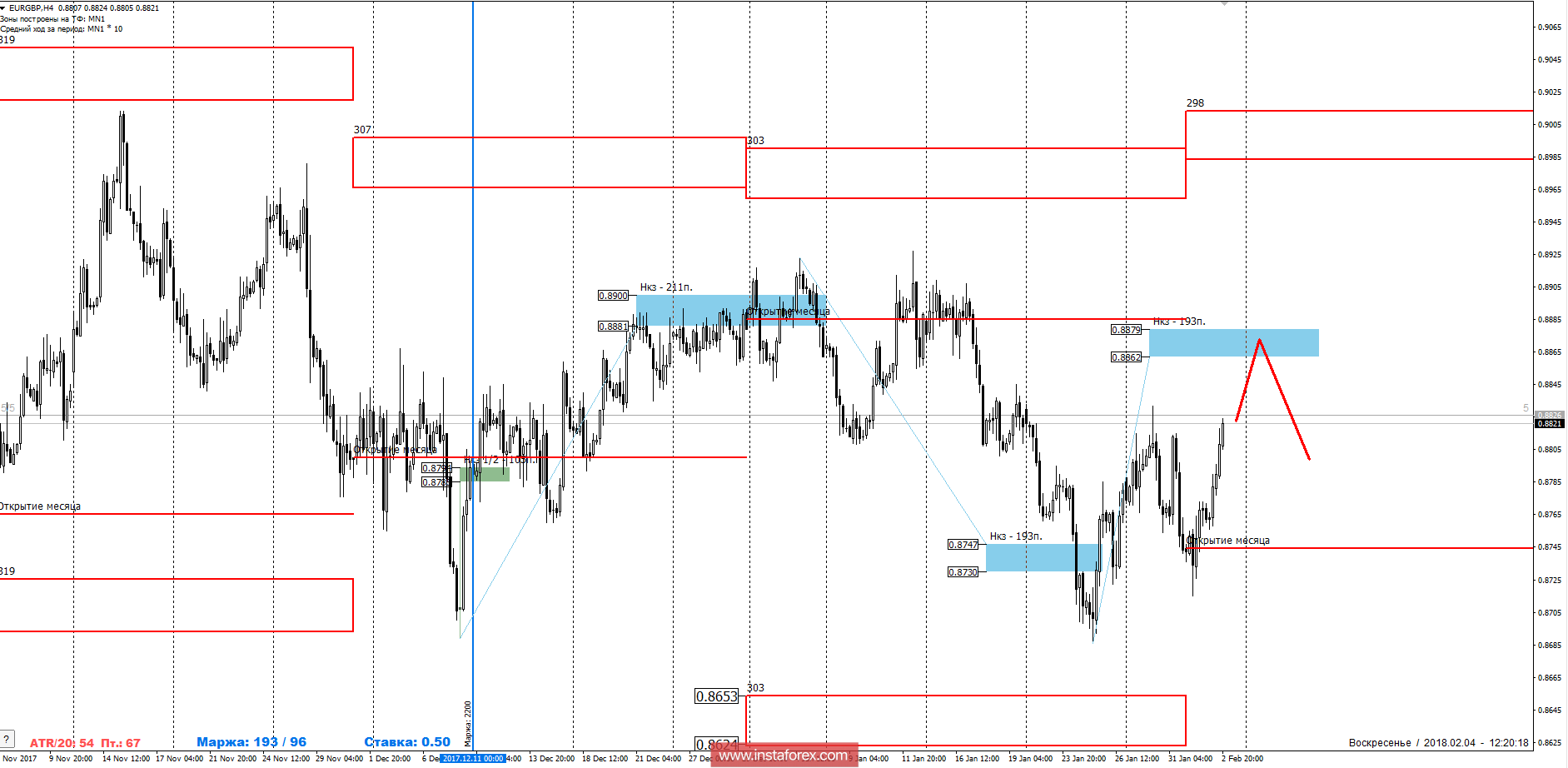

The third month the pair forms a long-term accumulation zone. The main targets are the monthly extremes of January and December. An upward movement is a priority within the framework of the flat.

Medium-term plan.

The main target of the pair's growth is the weekly control zone (KZ) 0.8879-0.8862. Reaching this zone allows fixing the majority of the purchases, and the remaining part can be kept, in case of testing the January maximum. This is possible due to the fact that the EUR/GBP pair traded in a wide range of flats, formed by monthly extremes. Purchases made last week are necessary to change into a breakeven upon achieving the first profit goals.

There are no created conditions for the formation of an alternative model. A downward reversal without reaching a weekly KZ has a low probability because it is not considered when making trading decisions without forming a reversal pattern.

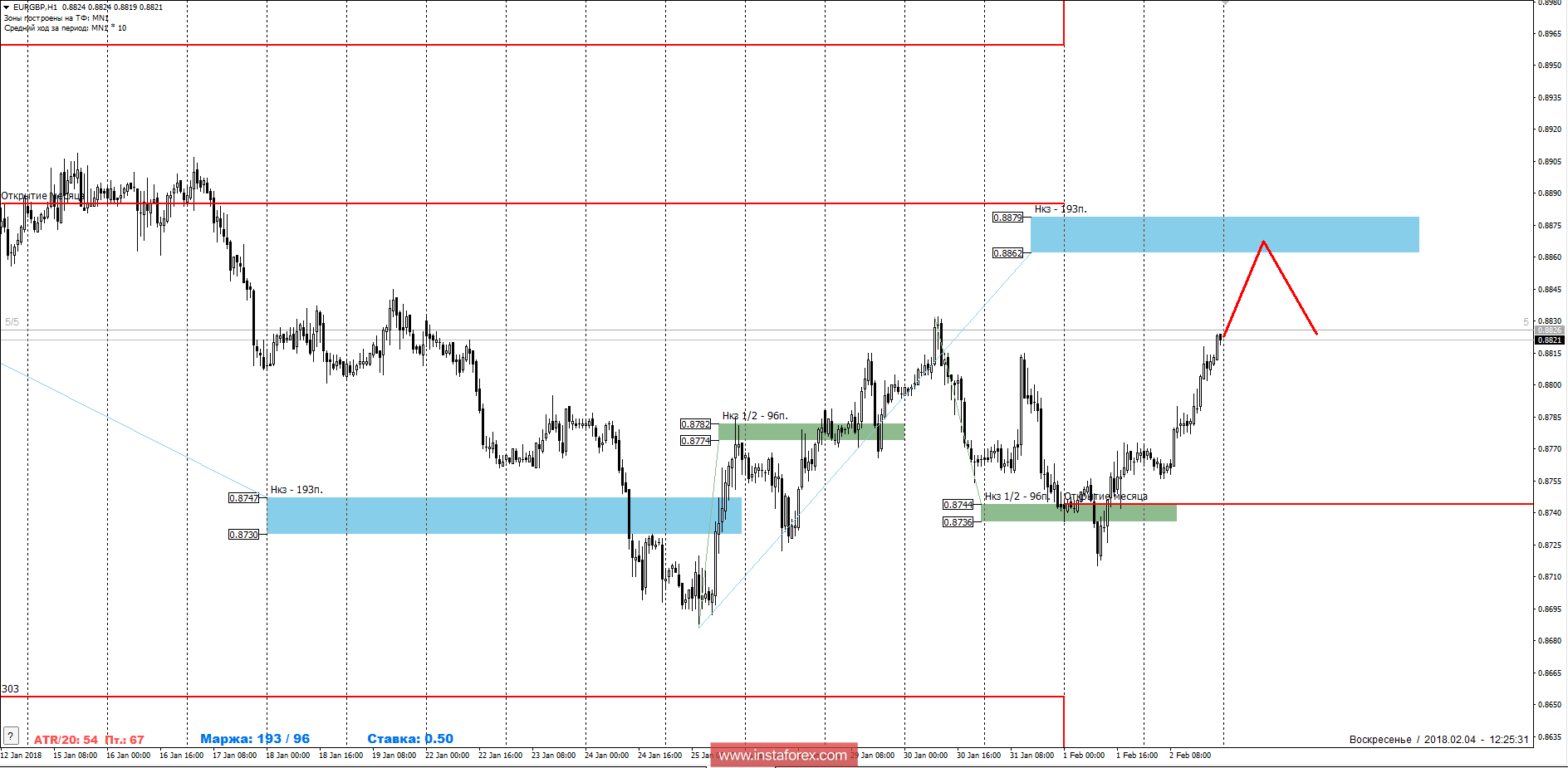

Intraday plan.

At the end of last week, there was a test of the main zone of support for the NKZ 1/2 0.8744-0.8736, where a continuation pattern of growth was formed. Purchases from the limits of this zone must be made only when the weekly KZ 0.8879-0.8862 is reached, where partial fixation of the profit is required. In case of a depreciation, it is necessary to look at favorable prices for buyers who are not yet in the position. Sales are not yet profitable to consider even inside the day.

Daytime CP is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

Weekly CP is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

Monthly CP is the monthly control zone. The zone is a reflection of the average volatility over the past year.

* The presented market analysis is informative and does not constitute a guide to the transaction.