The US dollar finally received significant support on Friday thanks to the release of strong economic data from the US, which showed that in fact, there are no barriers hindering the process of further rate hikes by the Fed.

On Friday, there were data from the labor market, the values of hourly wage growth, as well as a large package of statistics from the University of Michigan.

According to the data presented, the US economy grew 200,000 new jobs in the first month of the new year. The consensus forecast assumed an increase of 184,000. And, interestingly, upward revision was adjusted to 160,000 in the December values of this indicator. The unemployment rate remained at the previous level of 4.1%, which is also the lowest level since the beginning of the century.

If the figures for employment stick to the fact that it is still strong and the market is somehow used to it, then the continuation of the dynamics of growth in the average hourly wage in the United States is still not there. The presented values show the stability of growth since 2009. So, the indicator added 0.3% in January, and its December value was revised upward from 0.1% to 0.4%.

As for the reaction of the market, it actually reacted with purchases of the US dollar as well as sales in the US stock market and growth of yields of government bonds to the figures for wages, which may be foreshadowed by the increase in inflationary pressures, thereby contributing, perhaps, to a more active uplift interest rates of the Federal Reserve in the current year.

Indeed, the market is really thinking about the fact that the Fed can be much more active in the decision to raise rates. In essence, it turns out that the expectations of some market players regarding the Fed's capacity to pause the rate hike is now at zero. This indicates a strong change of mood which may occur in the future around the March meeting of the regulator to provide significant support to the rate of the US dollar. So far, as we have repeatedly pointed out, the dollar is constrained by market expectations that the ECB and other central banks of economically developed countries will not only stop stimulating national economies but will also probably start raising interest rates as early as next year.

We still believe that there is no reason for the confident growth of the dollar but the fact that soon everything can change is unequivocal.

Forecast of the day:

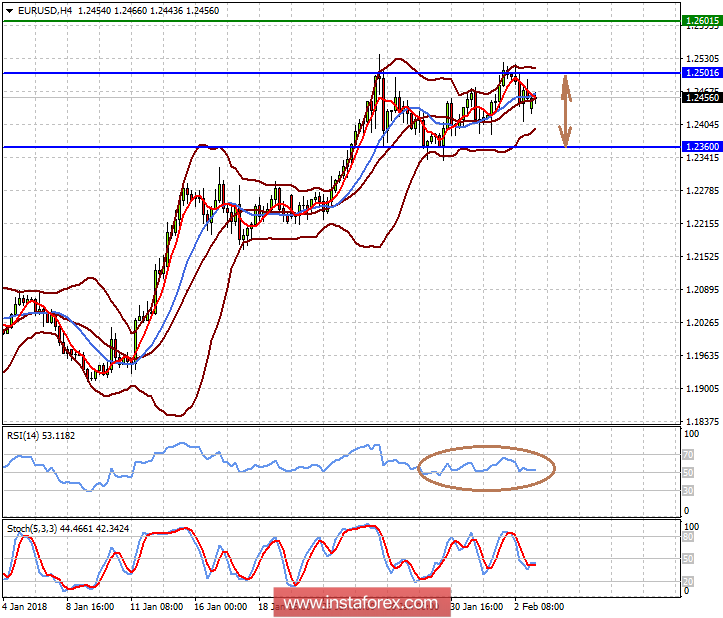

The EURUSD pair reached a local maximum in the range 1.2360-1.2500 but still remains within the area. It is likely that on Monday, it will remain there too but the general market expectations are still creeping in the euro as investors are waiting for the ECB exchange rate adjustment. So, the pair will make an attempt to break through the 1.2500 level to continue to grow to 1.2600.

The USDJPY pair is trading above the level of 109.80 but below 110.50. It can also continue to increase to 111.45 but for this to happen, it needs to grow above 110.50.