GBP / JPY pair

The main resistance level rose in the way of players to raise and it is currently the monthly level (Senkou Span B 156.32 + Fibo Kijun 157.27). The formation has a result of interaction on the monthly timeframe has a longer time frame. At the end of last week, the testing of the lower boundary of the monthly cloud resulted in a daylight drop from the level. At the moment, the preservation of a bearish sentiment may contribute to the development of a downward correction. In this case, the closest support levels are the Ichimoku day cross(Tenkan 154.26 + Kijun 153.38).

As reference point for an uptrend on junior timeframes, the target for the breakdown of the H4 cloud still remains operational. The fulfillment of the goal will lead to a couple of monthly Fibo Kijun (157.27). At the moment, the GBP/JPY has reached support 154.90 (Fibo Kijun N4 + Senkou Span B N1). Overcoming the level will form the H1 downward target will open the way to the H4 cloud and has intensified the levels of the day's cross (154.26 + 153.38).

EUR / JPY pair

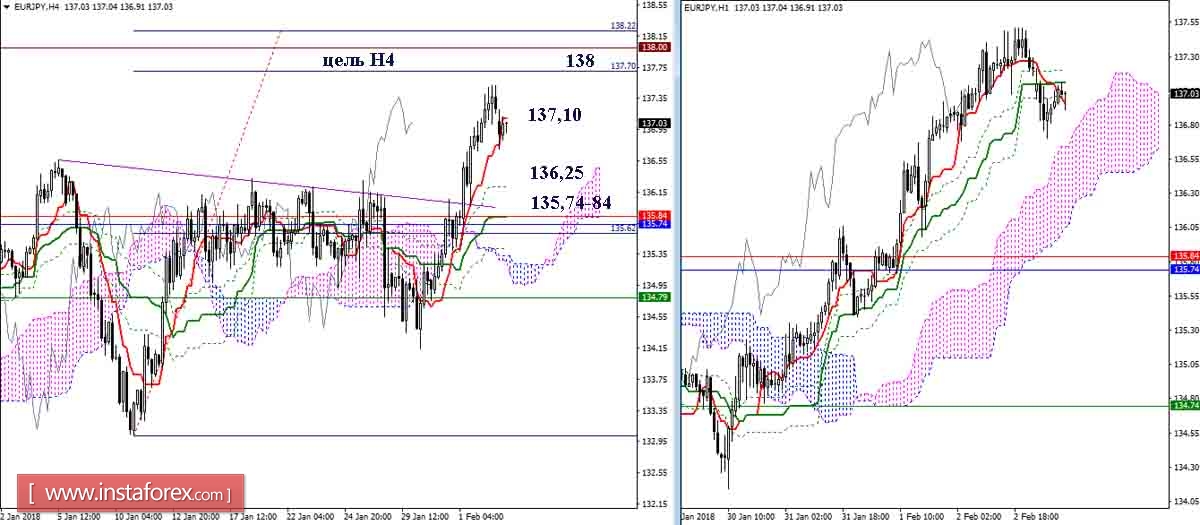

Last week, the players left the correction zone formed during the testing of the upper boundary of the monthly cloud (135.74), and restored the uptrend. Among the resistance levels that may influence the further development of bullish sentiments, it is necessary to note record levels in the region of 138 and 141. Returning to Senkou Span A (135.74), and even more so, a consolidation under it would significantly affect the result of interaction with the upper boundary month cloud.

The target for the breakdown of the H4 cloud maintains the upward direction of 138, which was reinforced by the historical level. At the moment, there is a formation of the prerequisites for the development of the downward correction, as the pair is trying to gain a foothold below the Tenkan H4 (137.10), while deploying the cross H1. If the bears are victorious in this confrontation, the following support at 136.25 (Fibo Kijun H4 + lower boundary of the H1 cloud) and 135.74-84 (Kijun H4 + high-time levels) would be significant today.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.