Overview :

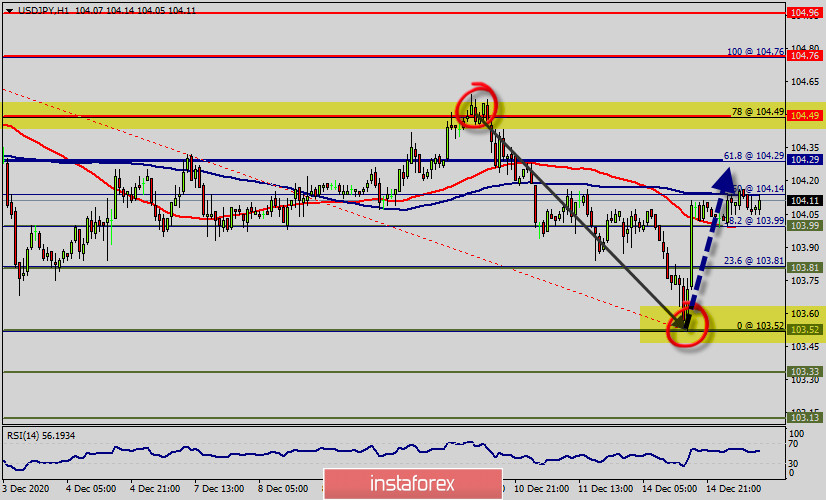

The USD/JPY pair rose from the bottom of 103.52 to the top of 104.76. The USD/JPY pair rebounded strongly after dipping to 104.09 and intraday bias is turned neutral again. Overall, the pair is staying inside the falling channel from 104.76.

The USD/JPY pair is still staying in long term falling channel that started back in 104.76 since last week. Hence, there is no clear indication of trend reversal yet.

The USD/JPY pair is as yet on the bearish side, according to intraday technical readings. The 1-hour chart shows that the latest advance stalled around a mildly bearish 50 SMA, which develops below the largest ones.

Additionally, the RSI is still calling for a strong bearish market as well as the current price is also above the moving average 100 SMA and 50 SMA. Also, if the trend is buoyant, then the currency pair strength will be defined as following: USD is in an uptrend and Yen is in a downtrend.

The Relative Strength Index (RSI) is considered overbought because it is set around 70. Dropped perfectly, remain bearish for another drop nearly 104.76.

Price has dropped absolutely perfectly from our selling area and has since made an intermediate recovery. We're back to testing our major resistance again and we look to sell below 104.76 or/and 104.49.

The pair bounced from a critical support level, with the bearish potential set to increaseas long as the trend sets below the spot of 104.76 - 104.49.

However, if the pair fails to pass through the level of 104.76, the market will indicate a bearish opportunity below the strong resistance level of 104.76 (the level of 104.76 coincides with the double top too). Since there is nothing new in this market, it is not bullish yet.

Break of 104.00 will target 103.81 first. Break there will resume the whole decline to 103.52 low. For now, break of 104.00 support is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

The down trend could still extend through 103.33 low. On the upside, break of 104.76 resistance is needed to be the first signal of medium term reversal. On the other hand, outlook will remain bearish

Trading recommendations :

According to previous events, the USD/JPY pair is trading between the level of 104.76 and the 103.52 level (those levels coincided with the top price and bottom point respectively). It should be noted that the 104.76 price (around double top at the level of 104.76) will act as a strong resistance on December 15, 20120. Therefore, it will be too gainful to sell short below 104.76 and look for further downside with 103.81, 103.52 and 103.33 targets. It should also be reminded that stop loss must never exceed the maximum exposure amounts. Thus, stop loss should be placed at the 105.10 level today.