In the latest Bank of Canada statement they kept interest rates unchanged at 0.25% and their QE program unaltered too at $4 billion per week. The Bank of Canada recognised that the recovery was well underway and will adjust its QE purchases as required to help bring inflation back on target.

Future projections

In terms of future projections the Bank of Canada is following the Federal Reserve and the Reserve Bank of Australia with no interest rates hikes seen until 2023.

The Bank of Canada recognized that economic momentum heading into the fourth quarter appears to be stronger than was expected in October but, in recent weeks, record high cases of COVID-19 in many parts of Canada are forcing re-impositions of restrictions. The Bank of Canada is expecting that to drag growth lower for the first quarter of 2021. The Bank of Canada is expecting a delay in the recovery as the vaccine takes time to roll out. All in all it was a holding statement and there was nothing obviously actionable from it.

Further Development

Analyzing the current trading chart of Goild, I found that Gold tested my first upside target at the price of $1846 and that is heading for the bigger upside breakout towards $1,864 and $1,875.

My advice is to watch for potential buying opportunities due to strong ups cycle on the Gold. Next upward target is set at the price of $1,864.

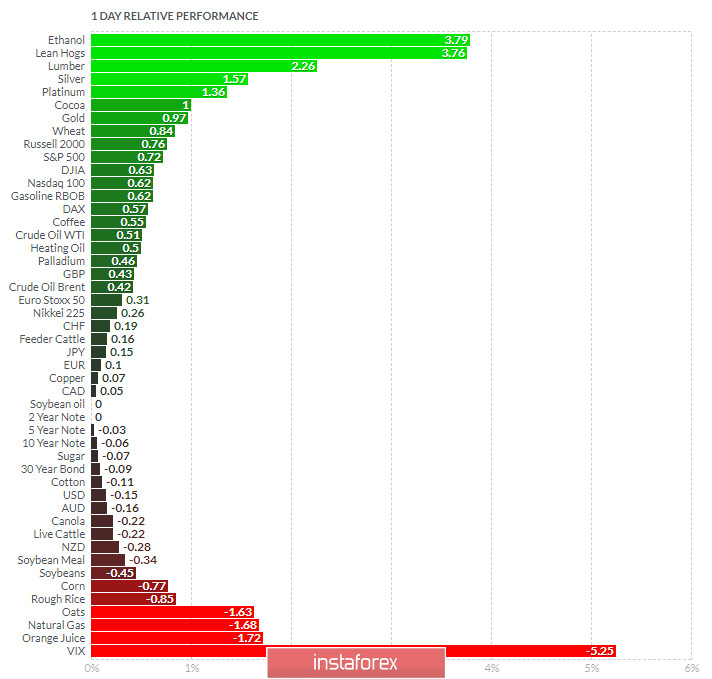

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Lean Hogs today and on the bottom VIX and Orange Juice.

Key Levels:

Resistance: $1,846, $1,864 and $1,875

Support level: $1,837