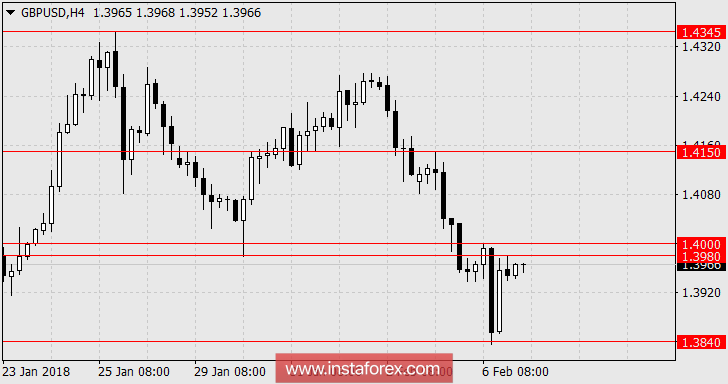

EUR / USD, GBP / USD.

On Tuesday, the euro and the pound showed higher volatility with some hints of declining mood, but the closing of the day for both currencies was insignificant. A good indicator of markets recovery was the growth of stock indices, as the Dow Jones increased by 2.33%, and the S & P500 to 1.74%. During the first half of the day, the single European currency gained more than 80 points on the positive data of industrial orders growth in Germany for the month of December, up by 3.8% against expectations of 0.6%. Since the opening of the American session, the US dollar has appreciably strengthened to all currencies and to its closure has returned to the opening of the day. But these were purely technical factors associated with repositioning. The US trade balance for December amounted to -53.1 billion dollars against the forecast of -52.1 billion. The head of the Federal Reserve Bank of St. Louis, James Bullard spoke and hinted that the interest rate in March may not increase since the relationship between employment and inflation almost disappeared in the recent years. If this was an attempt to keep the markets from panicking, then it was a successful attempt, since expectations for the rate hike in March fell to 64.8%. On Monday, the head of the Federal Reserve Bank of Minneapolis, Neil Kashkari acted promptly and stated that there was no bubble in the stock market and it was not visible even beyond the horizon.

Today, the macroeconomic data is estimated to be positive for the euro and the British pound, it can not be assumed for the growth of these currencies, but the trends are not yet strong. France's trade balance for December is expected to improve by -5.7 billion euros against -4.8 billion euros. Germany's industrial production of the same month is projected to decline by 0.7% against the previous growth of 3.4%, which can be interpreted as a natural correction. Using the same analogy, the expected reduction in Italy's retail sales from 1.1% to -0.1% in December can be taken neutrally. In the United States, consumer lending for December is expected to decrease from $ 28.0 billion to $ 19.9 billion. At 1:30 London time, the president of the Federal Reserve Bank of New York, William Dudley will have his speech. I think he will also make an attempt to calm the markets. Moreover, the Treasury for today will conduct an auction to place a 10-year government bonds for $ 24 billion and tomorrow will be placed 30-year securities worth $ 16 billion.

The pound is supported by the expectations for the Bank of England meeting tomorrow, which showed hints about the next rate increase in May.

Therefore, we are optimistic that fears from the markets will move away and we are expecting for the euro to rise to 1.2520, and the British pound is rising to 1.4150. Representatives of the Central Banks are trying together to "replace the batteries" in the financial markets..see the review of February 5 ).

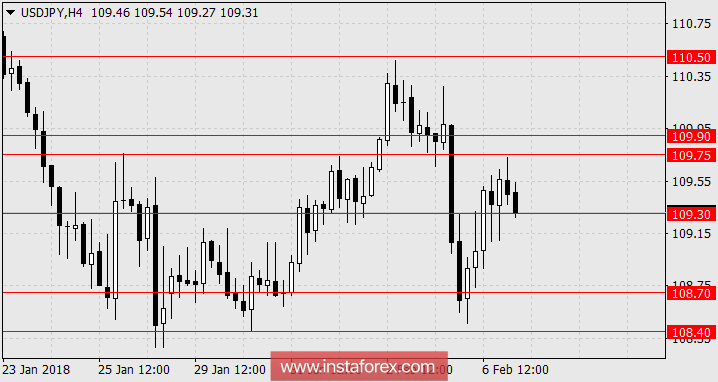

USD / JPY.

The Japanese yen quickly recovered from the shock of "black Monday" faster than other world currencies. Today, data on wages in Japan will be issued, the average pay reduced the growth rate from 0.9% YoY to 0.7% YoY (as expected), overtime payments decreased in December from 2.6% YoY to 0.9% YoY. The stock indices of the ATP are still mixed, showing the Japanese Nikkei225 + at 1.66%, the China A50 at -1.71%, the Australian S & P / ASX200 at + 0.88%, and the South Korean Kospi SEU at -0.60%. The growth of the Japanese market quality indicates that Toyota (4.2%), as the market leader reported record profits for the 2nd / 4th quarters of last year (operating profit rose 54%).

But the Japanese market is expected to withstand tomorrow the balance of payments data for December, which is projected to decrease from 1.347 trillion yen to 1.018 trillion yen. While the Chinese trade balance figures are expected to decrease from 54.69 billion dollars to 54.10 billion dollars.

We are expecting for consolidation in the range of 109.30 / 75.

* The presented market analysis is informative and does not constitute a guide to the transaction.