Weak data on the German economy and the report of the European Commission put pressure on the European currency, which fell against the US dollar in the morning.

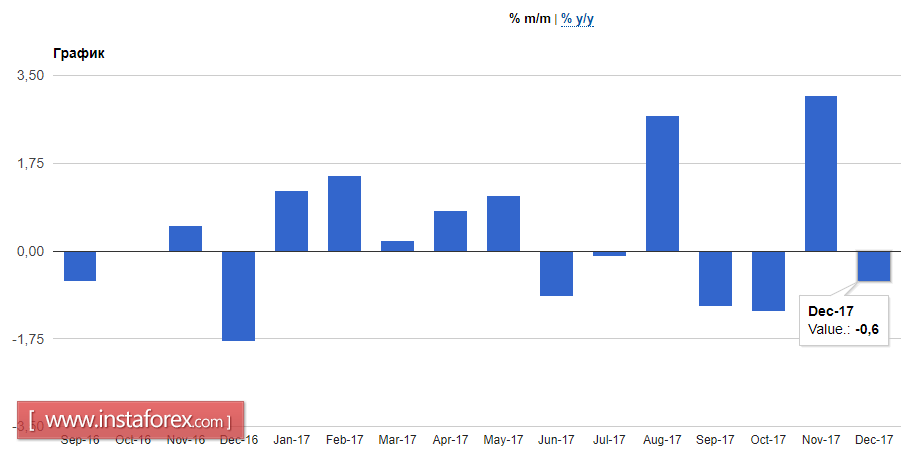

According to the report of the country's Ministry of Economy, industrial production in Germany for the month of December last year decreased by 0.6% compared to November. Despite this, production orders still indicate high activity, which will support production in the coming months. Among the leaders of the fall the construction sector is the one that can be significantly noted. Economists predicted a fall in production by 0.5%.

In comparison with the same period of the previous year, industrial production in December grew by 6.5%.

Good news today came in the form of the agreement. Thanks to this agreement, the Social Democrats and Conservatives both recognize the creation of a coalition in Germany. As it became known, German Chancellor Angela Merkel and her conservative party reached an agreement with the center-left Social Democratic Party on the formation of a coalition government. Olaf Scholz of the Social Democratic Party of Germany will head the Ministry of Finance.

The report of the European Commission put pressure on the euro despite the positive revision of forecasts in many key areas.

The report indicates that the European Commission increased the forecast for GDP growth in the eurozone for the year of 2018 to 2.3% from 2.1%, and for the year of 2019 to 2% from 1.9%. The European Commission also raised the forecast for inflation in the eurozone for 2018 to 1.5% from 1.4% while for 2019, the forecast remained unchanged at 1.6%.

It is expected that the improvement of the labor market situation and good moods in the economy will support economic growth. Also, a favorable investment climate is forecasted against the background of strong demand, capacity utilization, and availability of financing.

Negative factors include Brexit, geopolitical tensions, as well as protectionism from the US, which can create significant risks for the prospects of economic growth in the region.

Today, a number of statements by representatives of the Federal Reserve took place.

Robert Kaplan, like his other colleagues, said today that some correction in the stock market is a healthy phenomenon. He also suggested that the neutral interest rate is likely to be lower than before.

Another representative of the Fed, William Dudley, drew attention to the fact that significant progress has been achieved in purifying the banking culture. However, much remains to be done.