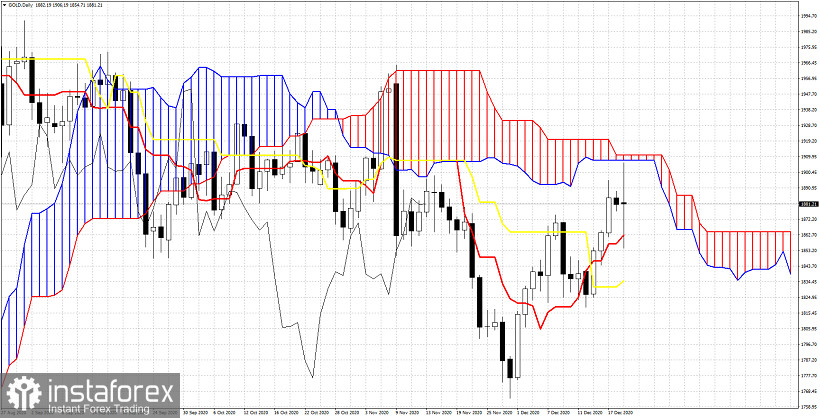

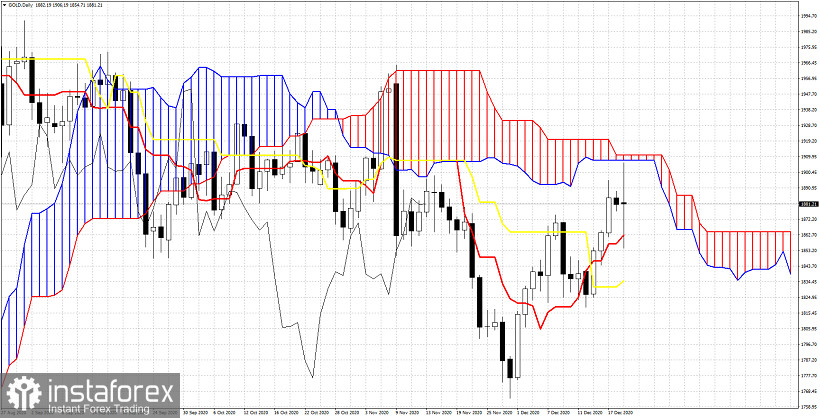

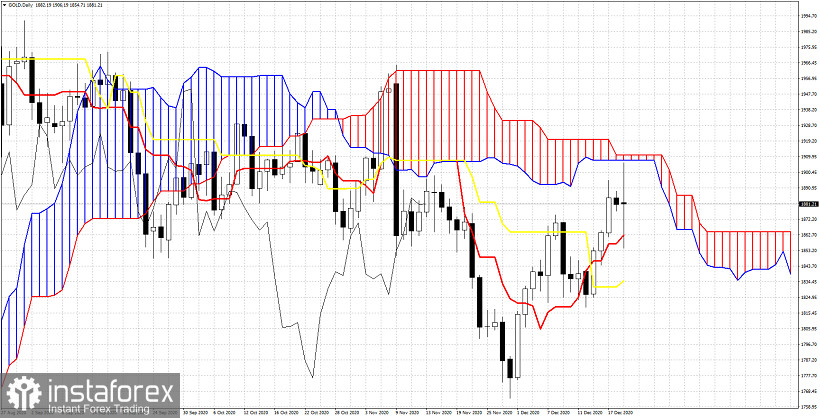

Gold price pushed higher today above $1,900 but only for a short time as selling pressure pushed price back below $1,900 towards $1,855. Gold is now trading at $1,880 still below key cloud resistance.

Gold price remains below the Ichimoku cloud resistance at $1,907. This is a bearish sign. Bulls need to break above the cloud in order to hope for a move higher. A rejection here would be a bearish sign. Earlier today we had a rejection, however the pressure on price was short lived as price bounced strongly off $1,855 area back to $1,880. Price is above both the tenkan-sen and the kijun-sen indicators. This is supportive of the bullish scenario. The Chikou span (black line indicator) is trying to break above the candlestick pattern. There is no clear indication from that indicator yet. Support is at $1,862. Bulls do not want to see a daily close below that level. On the other hand bears need to break below today's lows. This would be the first step towards a bigger move lower. As we explained in previous posts it was not a good idea to be long around the key resistance of $1,900 and traders should wait for a pull back. Was today's pull back towards $1,855 the pull back we expected? Was it so much short lived? If this is the case then we should expect Gold to move higher towards $2,000 from current levels. Breaking and staying above $1,900 would be the first step for a move towards new higher highs.