The optimism about Brexit continues to support GBP / USD giving bullish momentum and also giving it bullish strength in global equity markets and putting some downward pressure on USDX US dollar, which acts as a safe haven.

The Irish Foreign Minister. Simon Coveney said there was a last minute problem related to language about fishing rights. This data prevented the British pound from exceeding its high of 1.3619 leaving a double top, on the other hand, the growing conviction of the market that a Brexit trade agreement will be announced in a few hours supports the prospects of a new bullish movement in the short term for the GBP / USD.

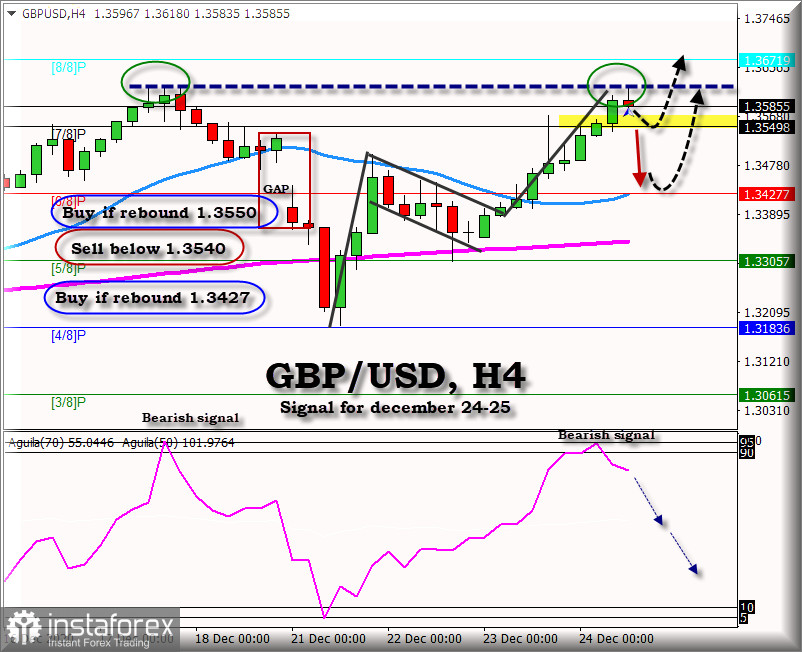

On a technical level, on the 4-hour charts we note that the GBP / USD is trading above 7/8 Murray and slightly making a correction after double-toping at 1.3620.

Since the market optimism is bullish, we should expect a correction to a new bullish wave, with targets at 1.3670 and 1.3790, strong resistance zone on 4-hour charts.

The eagle indicator is showing an overbought signal, and has touched the 95 area, the British pound is most likely to fall back to take a new bullish momentum and break its monthly maximum of 1.3625.

Our recommendation remains bullish for this pair, until the Brexit deal is finalized, so if you see it pull back to the 7/8 of 0f murray support at 1.3549, it would be a good point to buy with targets at 1.3620 and 1.3670 (8/8 murray).

On the contrary, if the GBP / USD breaks the 1.3549 zone, and trades below that level, we should expect a rebound from the 21-period SMA around 1.3427, which also coincides with the 6/8 of Murray strong support.

Trading tip for GBP/USD for December 24 – 25

Buy if rebound 1.3550 (7/8) with take profit at 1.3620 and 1.3670 (8/8), Stop below 1.3510.

Sell below 1.3540 (7/8 murray), with take profit at 1.3417 (6/8 and SMA 21), stop loss above 1.3575.

Buy if rebound at 1.3427 (SMA 21), with take profit 1.3549 and 1.3670, stop loss below 1.3390.