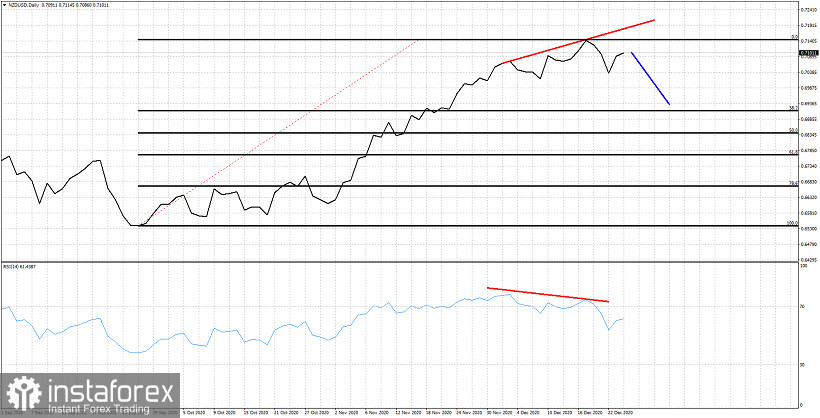

NZDUSD is trading at 0.71 and our expectations remain bearish. We continue to expect a move lower towards 0.69 and the 38% Fibonacci retracement. Price is vulnerable to a move lower and this is portrayed by the bearish RSI divergence.

Blue line -expected path

Black lines -Fibonacci retracement levels

We believe it is most probable to have seen a short-term top at least at recent highs of 0.7168. Short-term support is at 0.7025-0.70 area. Breaking below this level will increase pressure on NZDUSD and eventually push price lower towards 0.69 which is our first target area for a pull back, The RSI bearish divergence is just a warning sign and not a reversal sign. However at current levels we prefer to at least be neutral if not bearish.