Euro continued trading in a narrow side range in the first half of the day after the release of a number of fundamental statistics for the eurozone, as well as statements by the official of the European Central Bank, Jens Weidmann.

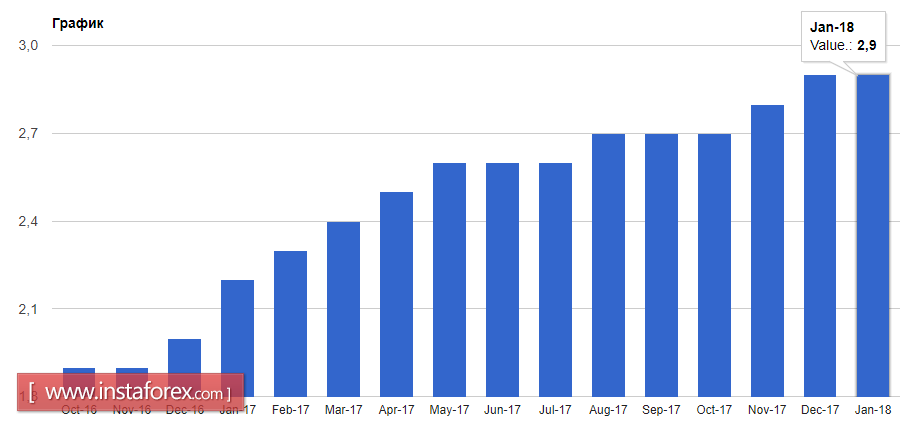

According to the data, lending in the euro area increased in January. As indicated in the report of the European Central Bank, lending to companies in January this year increased by 3.4% compared with the same period in 2017. Meanwhile, household lending increased by 2.9%. The monetary aggregate M3 grew by 4.6% compared to the same period of the previous year. The data were in line with the forecasts of analysts. The growth in lending points to a stable state of households and eurozone companies, which will positively affect the growth of the economy as a whole.

The index of sentiment in the economy of the eurozone, despite its slight decline, remained virtually unchanged, which indicates the retention of investor confidence. According to the report of the European Commission, the sentiment index in February was at 114.1 points against 114.9 points in January.

In the speech of the president of the central bank of Germany Jens Weidmann, there was also nothing unusual. Weidmann said that a number of signs indicate a steady increase in domestic price pressures, and a strong economy confirms the fact that inflation is moving towards the target level.

The official of the ECB also noted that the recent strengthening of the euro will not lead to changes in the soft monetary policy, since the trend of the euro partly reflects the reaction to improving the prospects for economic growth.

Weidmann also noted the fact that exchange rates now have less impact on inflation than before.

In general, the conclusions of the head of one of Germany's leading banks coincide with yesterday's statements of ECB President Mario Draghi, who also spoke about keeping the monetary policy unchanged for the near future.

Such statements, of course, run counter to investors who are betting on further strengthening of the euro, and if today the new head of the Fed signals about his propensity for tight monetary policy of the US, the pressure on risky assets may increase.

As for the technical picture of the EURUSD pair, breaking the lower limit of the side channel in the 1.2280 area will lead to a larger selling of the trading instrument with the main goal of output and update of the medium-term support levels of 1.2240 and 1.2200, which will be a decisive factor in the further growth of the US dollar against the euro.