Gold struggled to consolidate its intraday gains and faced rejection near the $1,900 mark. USD selling bias provided a lift to the dollar-denominated commodity.

The selling bias surrounding the US dollar picked up the pace on the first day of a new trading week after US President Donald Trump signed a $2.3 trillion COVID-19 relief and government funding bill. This was seen as one of the key factors that provided a modest lift to the dollar-denominated commodity and pushed spot prices to four-day highs.

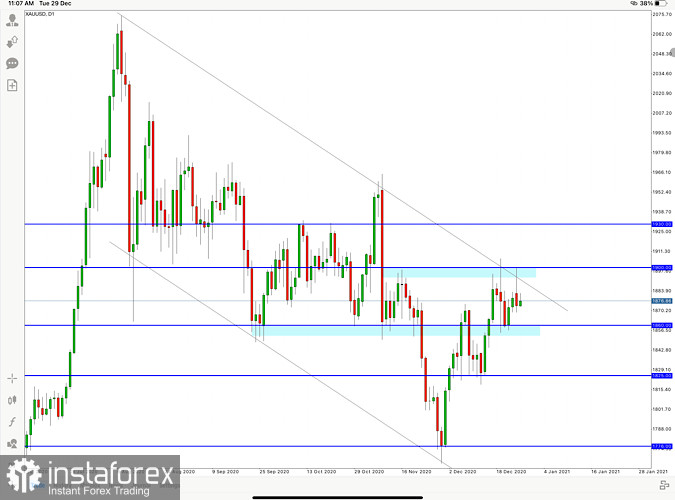

However, gold lacked any follow-through near the $1,900 round-figure mark. Despite the two-way price moves, the yellow metal remained well within the last week's broader trading range. The $1,900 round figure mark coincides with the upper boundary of a bearish channel which serves as immediate resistance. Acceptance above this level could open doorways to the next barrier which resides at $1,930.

On the flip side, the recent doji formations highlight indecision. The fact that this pattern has appeared after a couple of weeks of strength indicates that there could possibly be a change in price direction. If the price holds near the given levels, it could later consolidate in a range of $1,900 to $1,860 before a clear direction of a breakout is seen. The market sentiment remains mixed leading to a rather flat price movement at the moment.