GBP / USD pair

To open long positions for GBP / USD pair, you need:

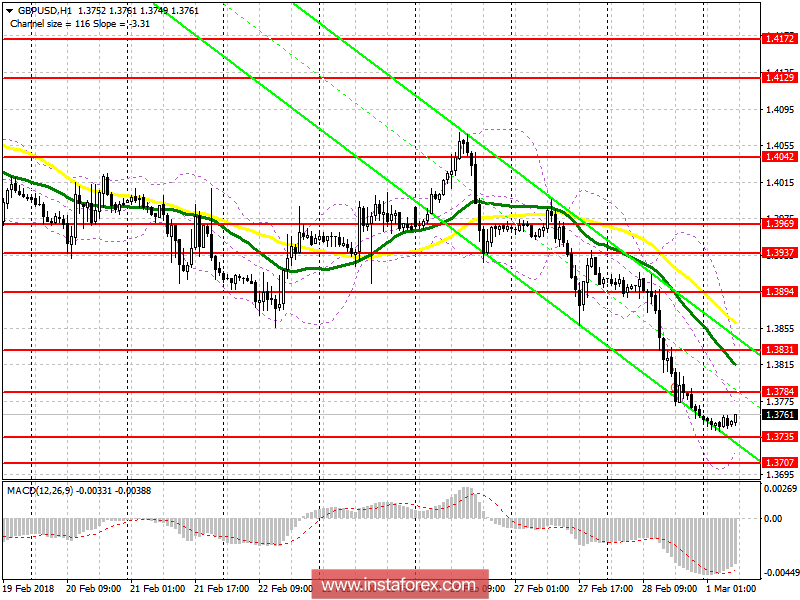

It is best to consider buying the pound after forming a false breakout in the support area of 1.3735 with confirmation of its divergence on the MACD indicator. The main goal will be consolidation above 1.3784, which will lead to the renewal of the resistance at 1.3831, where fixing profits are recommended. In the case of a further decline in the pound, long positions are best considered for a rebound from the level of 1.3648.

To open short positions for GBP / USD, you need:

The formation of a false breakout at 1.3784 will be the first signal for the opening of short positions. A breakout and consolidation below 1.3735 will lead to a further drop in the British pound with the main purpose of updating support at 1.3707 and 1.3648, where fixing profits are recommended. If the GBP / USD pair rises above the area of 1.3784 in the morning, it is recommended to return in selling only for a rebound of 1.3831.

Indicators desciption

- MA (average sliding) 50 days - yellow

- MA (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20