EUR / USD, GBP / USD.

There was something special in the markets yesterday. The media started talking about the beginning of the trade war between the US and Europe. First, the news agency, Reuters spread rumors about the possible faster curtailment of the monetary incentives, whereas the ECB's minutes last week clearly stated that the monetary policy was not considered further than the prospect for September this year. Macroeconomic indicators came out stronger for the dollar. Personal income of consumers in January increased by 0.4% against the forecast of 0.3%, while consumer spending increased by the expected 0.2%. ISM Manufacturing PMI for February increased from 59.1 to 60.8. Expenses for construction in January showed zero growth against the forecast of 0.3% increase. The PMI for February was raised to 58. 6 from 58.5. The unemployment rate for December was downward from 8.7% to 8.6%, and the January measurement remained at the same level.

Then, the news (+ 25%) and aluminum (+ 10%) by the US President Trump. Stock markets collapsed; S & P500 -1.33%, Dow Jones -1.68%. Concurrently, the dollar fell, which confirms the yesterday's comment about the break of risk correlations with the currency market. The US government bond yields declined, which in fact confirms the genuine market understanding of J. Powell's speech in Congress. As Powell did not give any hint for the fourfold increase in the rate this year. The 5-year security yield fell from 2.667% to 2.576% within two and a half days. The market expectation on the rate hike in March firmly remains at 84.5%.

British investors are entirely focused on the speech of Theresa May today, which will be a response to the EU's statement on the transparency borders in Ireland. There is also an impending situation right up to the withdrawal of the UK from the EU without a trade agreement or without a transition period. May's speech is scheduled at 8:00 PM London time. Yesterday, the UK lending data came out to be neutral. The number of issued permits for mortgage lending in January rose from 62 thousand to 67 thousand, but the net volume of new loans to individuals shrank from 5.1 billion pounds to 4.7 billion pounds. Manufacturing PMI declined last month from 55.3 to 55.2. Today, Construction PMI is expected to increase from 50.2 to 50.5, but the possibility of a negative figure has increased. At 10:00 AM London time, the Bank of England Governor Mark Carney will talk about the crypto-currency.

In the euro area the retail sales in Germany in January will be released with a forecast of 0.8% against -1.9% in December, import prices in Germany are expected to grow by 0.4%. In the United States, the consumer confidence index for the University of Michigan version of the previous month could fall from 99.9 to 99.4.

Consequently, the beginning of the massive dollar strengthening that was talked about yesterday, coincided with the announcement of Trump regarding the trade war of Europe, Latin America and China (the largest producers of metal). This is enough to consider the further strengthening of the dollar in the medium term.

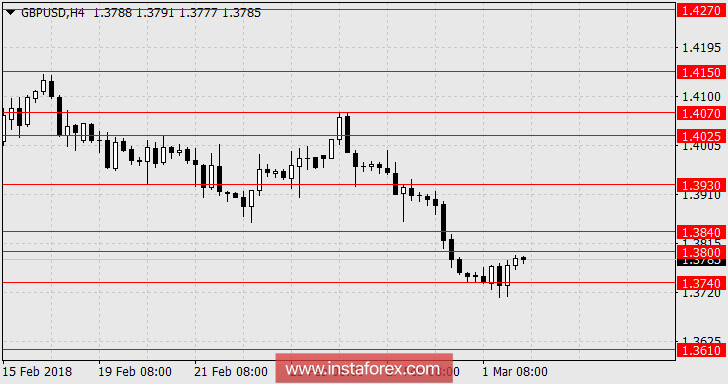

We are expecting for the decline of the euro to 1.2120, and the fall of the British pound to 1.3610.

* The presented market analysis is informative and does not constitute a guide to the transaction.