A kaleidoscope of fundamental events for the euro-dollar pair is changing quite quickly. Macroeconomics again fades into the background, passing the baton to political factors.

Contrary to the hopes of many traders, Jerome Powell could not fundamentally change the mood of the market, although initially, the preponderance was clearly in the direction of the US currency. During his first speech in Congress, the head of the Federal Reserve gave hope to the bulls of the dollar for a fourfold increase in the rate. Powell's restrained optimism was perceived by the market as a "green light" to accelerate the rate of increase in rates, after which the dollar went up to the basket of major currencies.

However, yesterday the head of the Fed added a "fly in the ointment" in a barrel of general optimism. Powell criticized the growth rate of wages in the country, and therefore expressed concern about the increase in inflation rates. This thesis was very unexpected, given his comments during the first speech in the Senate when he predicted the achievement of a 2% target CPI in the framework of this year.

Nevertheless, the fact remains that Powell focused his attention on the weak growth of wages, while allowing the further growth of the US labor market. This means that in the near future, the decline in the unemployment rate and the growth in the number of people employed in the non-agricultural sector will indirectly affect the dollar. Thus, the main focus of traders will be on the inflationary indicator of Non-farms, namely on the average hourly wage level.

It should be noted that this indicator has recently demonstrated modest dynamics, being in the region of 0.3-0.4%. I tis also important to note that yesterday, the index of spending on personal consumption was published. It also showed a weak growth of only 0.3%. All this suggests that the probability of a four-fold increase in the rate this year is still small and the market is unjustifiably ahead of events, misinterpreting the first speech of the head of the Fed. If the above indicators do not show impulse growth, the regulator will most likely stick to the baseline scenario, even with the further strengthening of the labor market.

Such conclusions that was derived from yesterday weakened the US currency. Pressure on the dollar had other fundamental factors. First, a new staff scandal broke out in the White House: the communications director of the presidential administration, Hope Hicks, unexpectedly announced her resignation despite being previously called "one of Trump's most reliable assistants." The second downward factor for the dollar was the insider information that the US president will sign a rise in tariffs for imports of steel and aluminum (25% and 10% respectively) next week. And although primarily commodity currencies will be at the forefront of this decision, the dollar will also feel its consequences. China has repeatedly stated that this Trump maneuver will not remain "unanswered." In other words, the US president will take another step towards a full-fledged trade war, the consequences of which are difficult to predict.

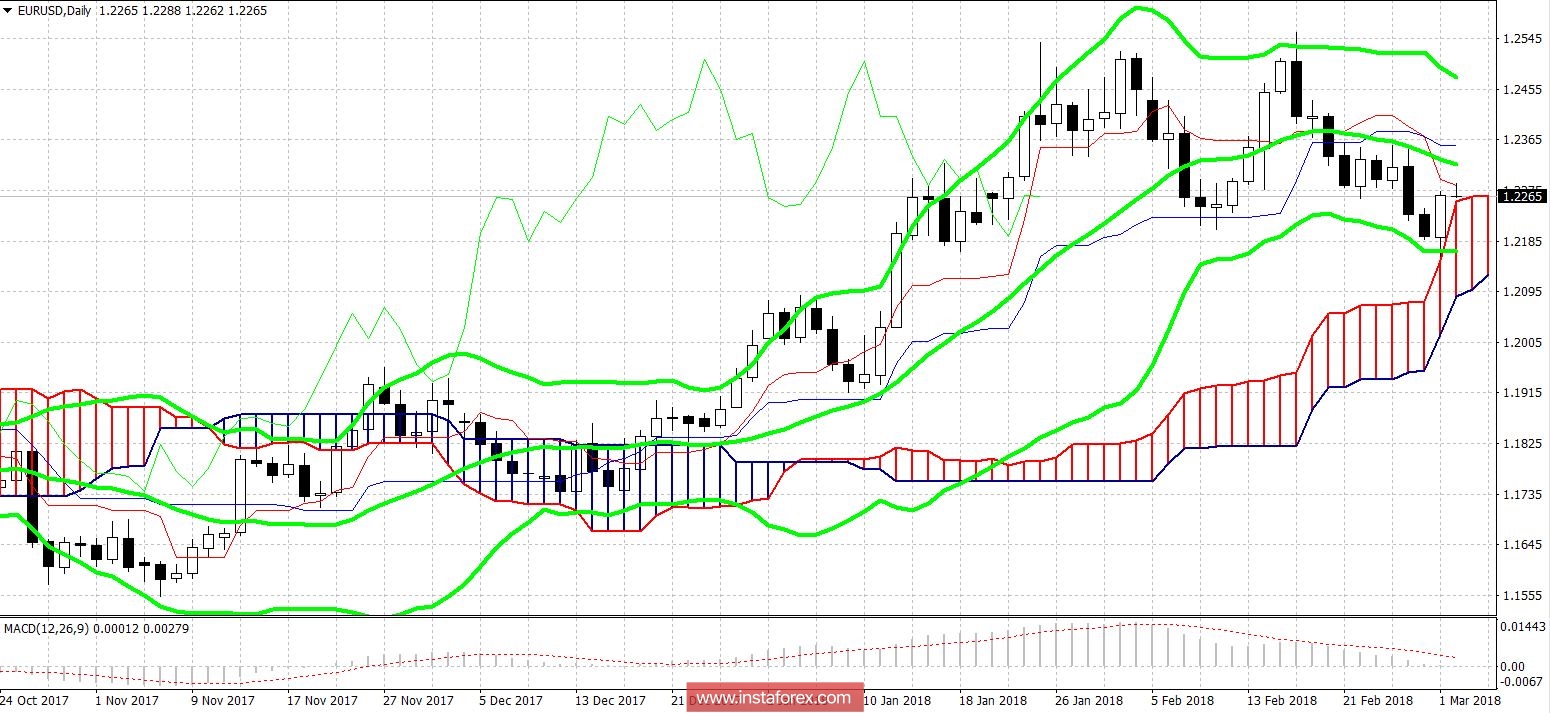

As you can see, the fundamental background for the dollar quickly turned into gloomy colors. Although, two days ago the greenback actively increased its positions. However, as a result, the EURUSD pair remained clamped in the price range of 1.22-1.2350 in anticipation of the following news impulses. Now the pair's prospects are largely dependent on European political events.

On the weekend, traders of the EURUSD pair will not be bored: in Italy, parliamentary elections will be held while in Germany, the announcement of the "verdict" of the coalition will be made. It is worth noting that the sympathies of the Italian voters belong to the ambitious party, "Movement of Five Stars," whose members are Eurosceptics. Another popular party is the "League of the North", which openly calls for an exit from the EU. However, the new law on the electoral system is unlikely to allow members of these parties to form a parliamentary majority and government. Subsequently, this means that they are also limited in influencing Italy's foreign policy. Under the new law, those parties that win at least three percent of the vote, as well as coalitions that have at least 10% of the vote, go to the Italian parliament. This means that the composition of the future government will most likely be from coalitions of pro-European parties. However, among these parties there are also "dissidents" criticizing Brussels. So, the euro's reaction to the results of the Italian elections is difficult to foresee.

However, the situation in Germany is more predictable. It is important to note that ordinary members of the SPD now vote for (or against) the coalition agreement with the party of Angela Merkel. The results of the poll indicate that the coalition will be supported by about 55% of the Social Democrats. The leadership of the party predicts 60% support. On March 4, the results of this vote will be known. If the results are at the level of forecasts, the euro will receive some support. However, if the SPD members, contrary to sociology, say "no", the European currency will collapse all over the market.