Nikkei 225 breaks above 27,000 for the first time since 1991

The late rally into the year-end in the equities space is turning into a bit of a precursor for next year as we're seeing stocks get a sort of head start amid thinner liquidity conditions in trading this week.

The Nikkei closed higher by a stunning 2.7% today before the final day of trading tomorrow and while window dressing may be part of a factor, the jump today breaks the consolidation period since the pause after the November rally.

Further Development

Analyzing the current trading chart of Gold, I found that there is the consolidation period, which is normal during the late December due to lower volatility and liquidity but there is still chance for higher prices.

Watch for potential buying opportunities on the dips with the the targets at $1,895 and $1,905.

Stochastic oscillator is showing potential bull cross, which is sign for another up cycle...

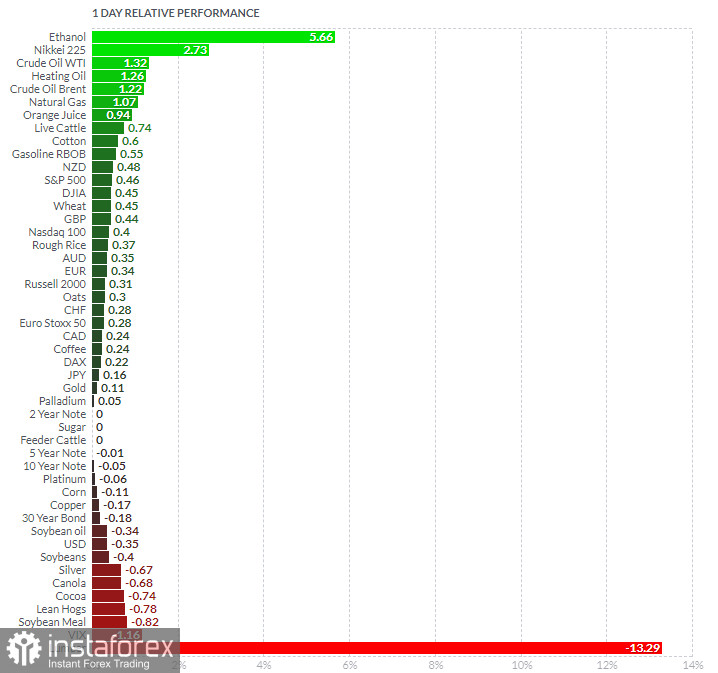

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Nikkei today and on the bottom Lumber and VIX.

Gold is slightly positive for the day, which is sign for the continuation.

Key Levels:

Resistance: $1,895 and $1,905

Support level: $1,870