Last week was rich in important and fateful events. The first one was J. Powell's first ever speech as head of the Federal Reserve on Tuesday. The second was the revelation that the American regulator will continue to raise interest rates amid concern which happened on Thursday. It is probable that the explosive nature of inflation will occur in the future. Then third is the news that the presidential administration is going to introduce new duties on the import of aluminum and steel which frightened the market players. These events caused high volatility in equity markets, government bonds, and the foreign exchange market.

An important result of Powell's two speeches before the congressmen and then before the senators on the Banking Committee was the statement that the Fed continues to consider the process of raising interest rates as necessary against the backdrop of a strong labor market condition, wage growth, the prospects for rising inflation, and the growth of US and world economies. This supported the dollar and led to its growth in relation to all major currencies. It should be acknowledged that its increase turned out to be local and was stopped by news about the desire of D. Trump to introduce protective customs duties on imports of steel and aluminum with a rise of those by 10% and 25%, respectively.

These news scared the investors as it threatened the escalation of the conflict between the US and the EU until the trade war, as stated on Friday by the head of the European Commission, JK. Juncker. In the wake of these news, the US stock market fell. Although, it compensated for its losses. However, the yields of government bonds soared while the dollar was under pressure, as any negative economic and geopolitical news during Trump's presidency is perceived not in favor of the US currency.

Despite this, the continued growth in yields of government bonds and the yield of 10-year Treasuries has already risen again close to the level of 2.9%, adding 2.35% on Friday. This may lead to the resumption of the strengthening of the dollar, which will primarily receive support for the currencies of countries with the developing economy.

As for its dynamics in relation to major currencies, it can get resistance on still strong expectations that the ECB and other major world central banks will stop stimulating and moving to tightening monetary policies.

Forecast of the day:

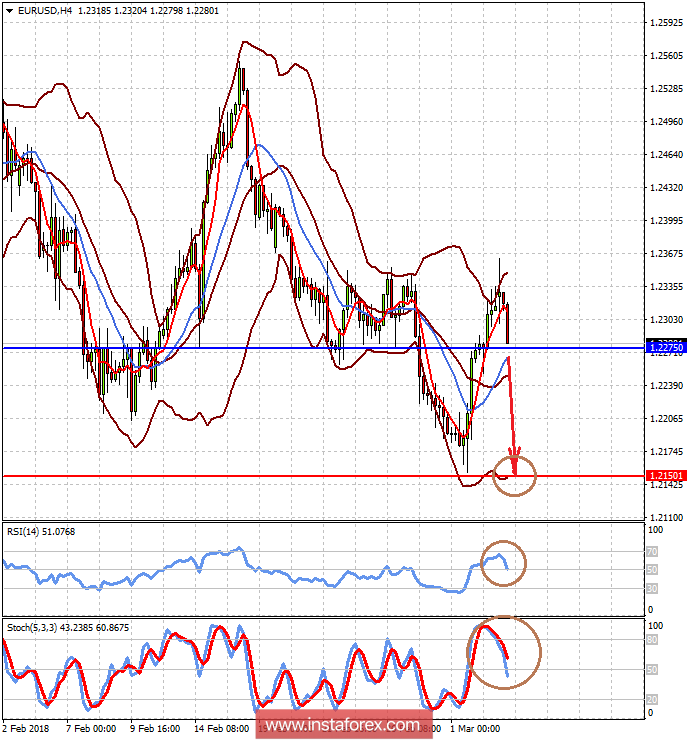

The EURUSD pair is trading above the level of 1.2275. Overcoming this level will be the reason for the local price decrease to 1.2150 amid the strengthening of the yield growth of US Treasury bonds.

The AUDUSD pair overcomes the level of 0.7745, which may cause its fall to the level of 0.7690.