The downward movement remains an impulse for the second week, which indicates pressure on the course from the side of the national bank. At the end of last week, the pair tested the intermediate goal, which led to a slight increase in demand.

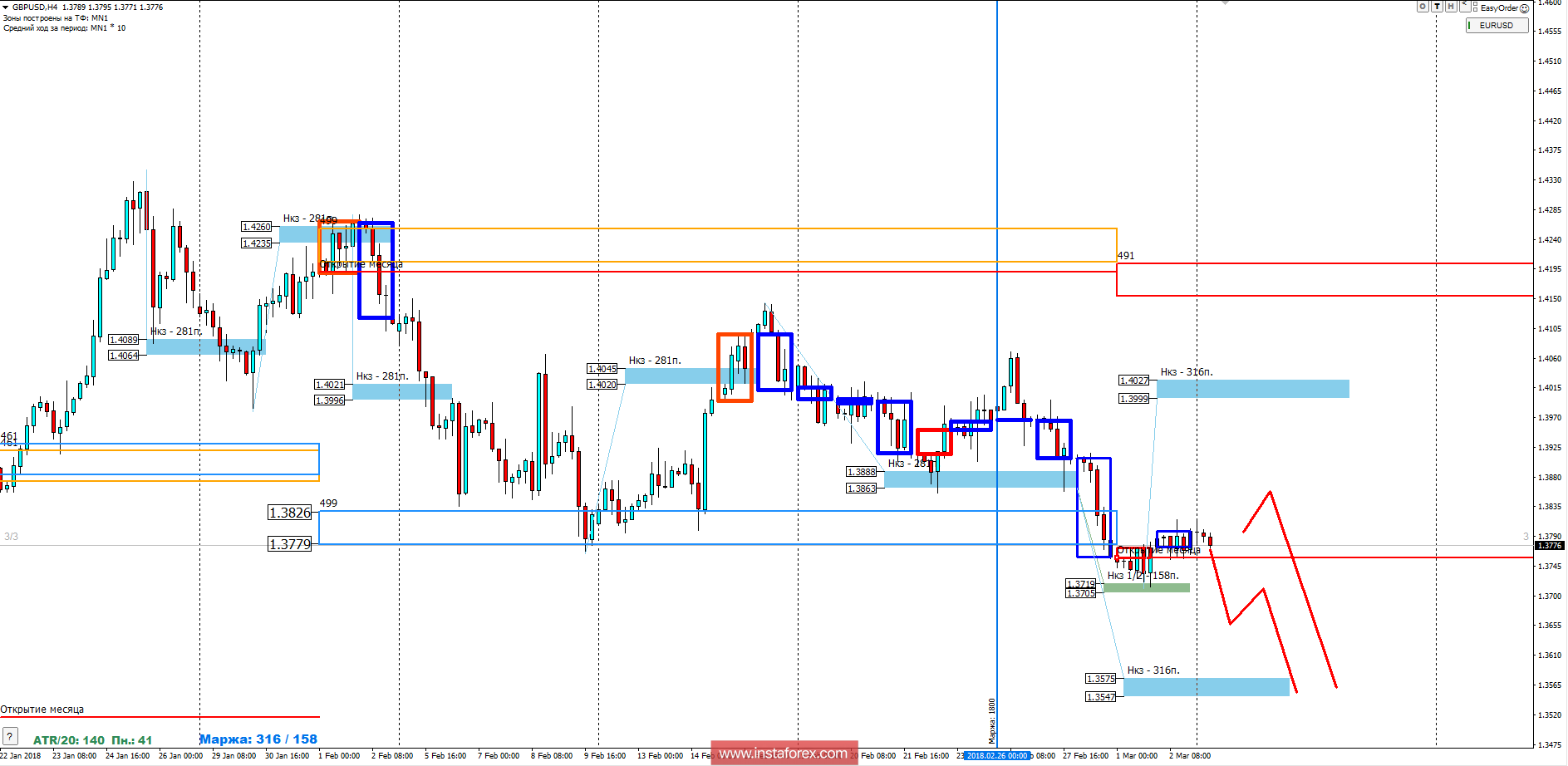

Medium-term plan.

The upward movement that began last week may allow obtaining favorable prices for the sale of the instrument. Growth to a minimum of two weeks ago will be the best model for opening a short position. The renewal of the March minimum will be only the first goal of the bearish impulse. The main goal of the fall for the current week is a weekly short-term short-term strike of 1.3575-1.3547 and the test of which will allow closing most of the sales.

An alternative model for this week will be an upward movement, the goal of which will be the weekly short-term of 1.4027-1.3999. This will become possible after the formation of the reversal model on the junior timeframe.

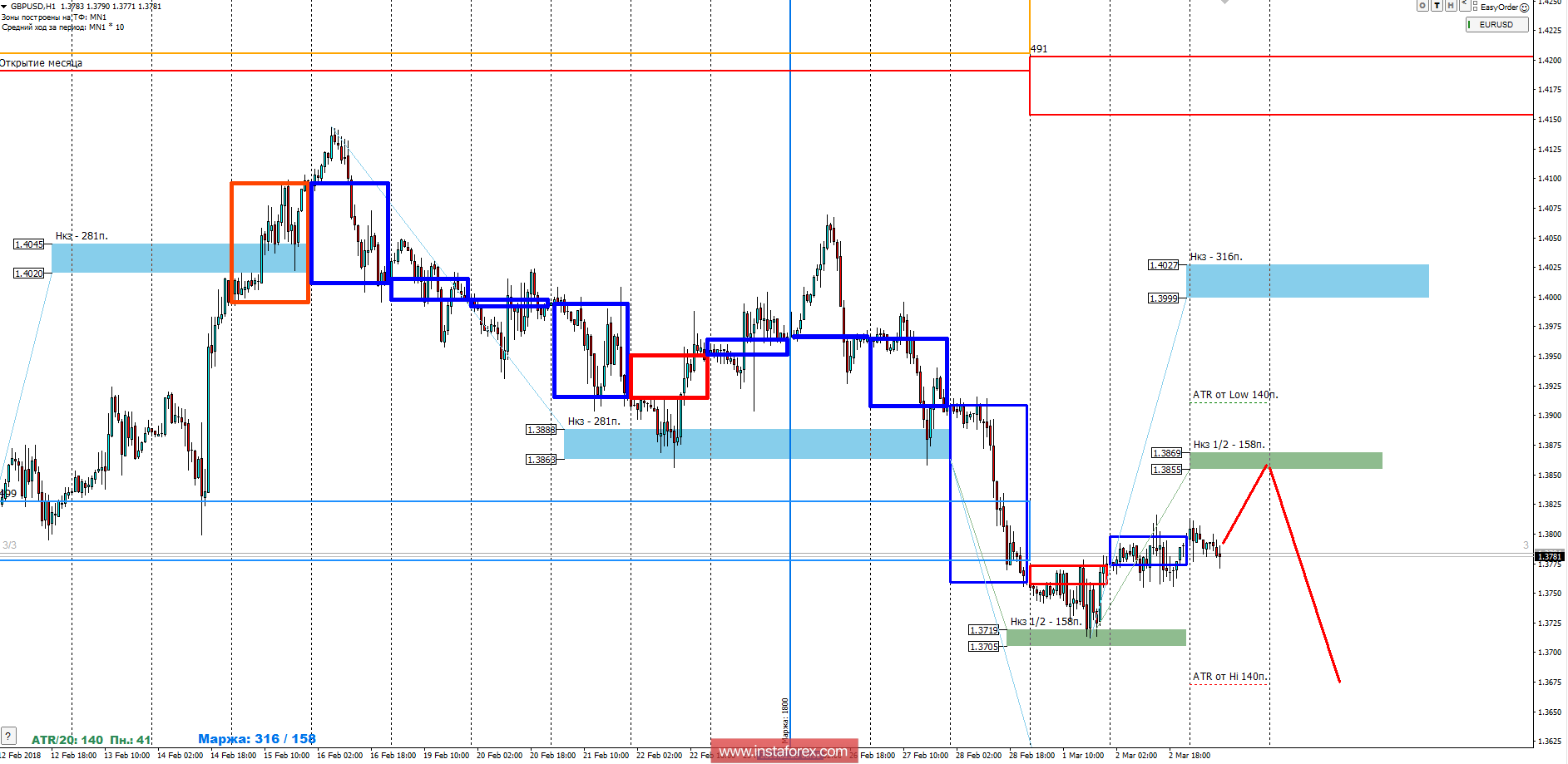

Intraday plan.

The determining resistance is the control zone in 1/2 of 1.3869-1.3855. While the pair is trading below this zone, the downward movement will remain an impulse. The test of this zone 1/2 will give an opportunity to sell at favorable prices. In the mid-day course, this area can be considered as the goal for today. Priority movement is the fall and update of the monthly minimum, which also fits into the average daily rate.

The daytime CP is the daytime control zone. The zone formed by important data from the futures market that change several times a year.

The weekly CP is the weekly control zone. The zone is formed by marks from important futures market which change several times a year.

The monthly CP is the monthly control zone. The zone is a reflection of the average volatility over the past year.