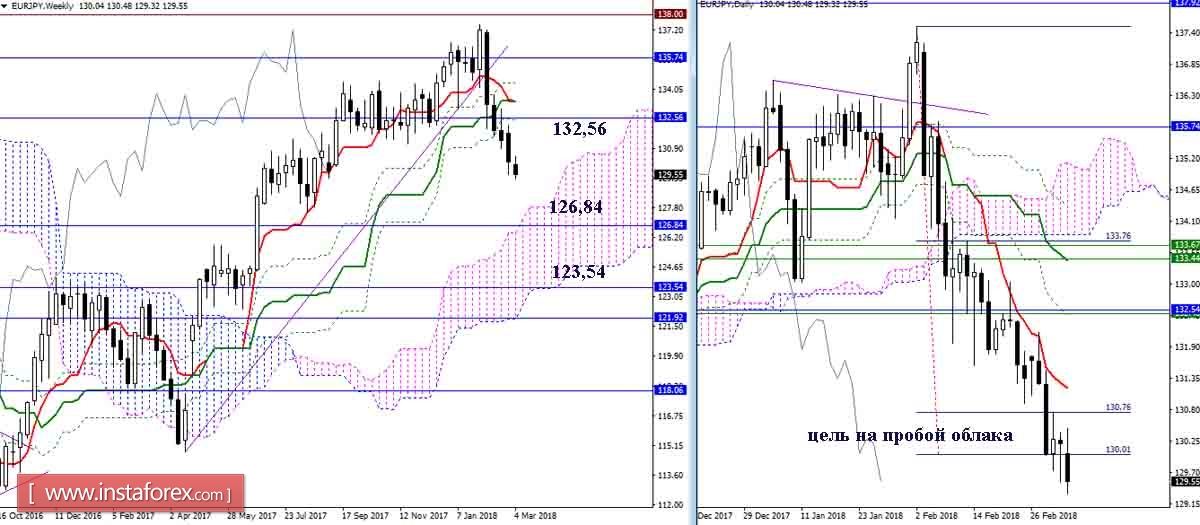

EUR / JPY pair

Older timeframes

Last week, the pair worked out a day target for the breakdown of the cloud, while the bears closed the month, implementing a corrective decline to support the monthly Tenkan (129.95). Upon the onset of March, the monthly short-term trend changed its location (132.56) and turned from support to resistance. In case of retest, it will strengthen the day and week cross Ichimoku. The main guideline for continuing the decline in this situation is the implementation of a monthly correction (126.84 Fibo Kijun + 123.54 Kijun).

N4 - H1 Timeframes

At the moment, the initiative and the advantages are on the side of players to decline, but if the pair can regain area 130 and reliably secure above, then the existing balance of power will change. As a result, when restoring positions on the path of players to rise, it will be possible to consider the next nearest resistance to be at 130.76 and 131.17. A rise above the indicated levels will allow us to speak about the strengthening of bullish sentiments at older time intervals.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.