With the possibility of a trade war, I have repeatedly said that, in the spring of this year, the administration of the White House of the USA will continue its protectionist policy and will again instigate trade wars with the European Union.

The European Central Bank has already taken a number of steps, saying that in the near future it is not going to make changes in the monetary policy. First of all, we are talking about the protection of inflation, which has been growing for quite some time both in the US and in the eurozone.

The introduction of new duties on the part of the United States can significantly increase the pace of inflationary growth within the country. This is what is the number of experts referred to, arguing on the introduction of duties on imported steel from the US side.

Yesterday, the President of U.S., Donald Trump, said that the introduction of new duties on imported steel depends on the NAFTA negotiations. According to his statement, the cancellation of duties will not occur until the signing of a new and fair trade agreement between the NAFTA parties.

The answer from the E.U. did not take long. They proposed introducing import duties on a number of American goods, such as bourbon, jeans, and motorcycles of the Harley-Davidson brand.

In any case, all these measures will not support the European currency, since Europe will most likely lose in the fight against the U.S. for accelerating inflationary growth, which will cause a certain demand for the U.S. dollar, as experts will again talk about further raising interest rates in the US.

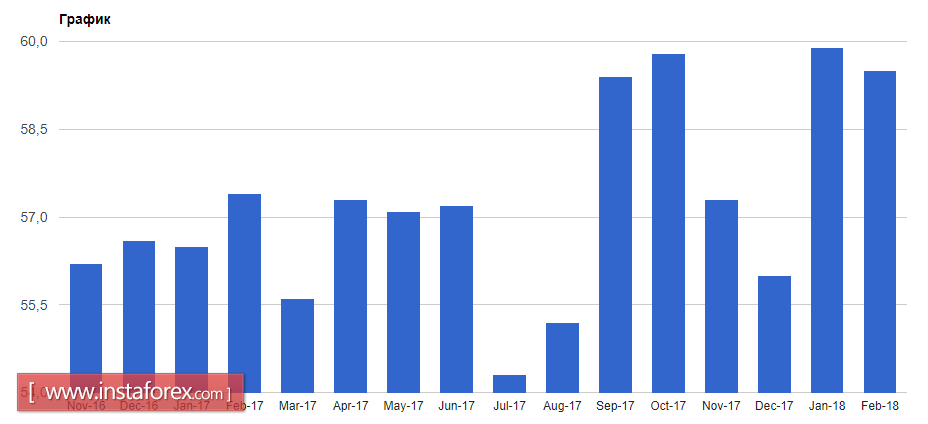

Yesterday it became known that business activity in the United States grew at a good pace in the month of February this year. As indicated in the report, this happened against the background of the growth of new orders.

According to IHS Markit, the final index of supply managers for the U.S. service sector was 55.9 points against 53.3 points in January. The value of the index above 50 indicates an increase in activity. The final composite PMI index was 55.8 points in February 2018 against 53.8 points in January.

As for the technical picture of the EUR / USD pair, it remains practically unchanged.

Buyers continue to struggle in the resistance range at 1.2340-1.2350. A breakout will lead to the resumption of the growth of the trading instrument with the main purpose of updating the new highs of 1.2410 and 1.2460. In the case of a return to the range of 1.2340, the sale of the euro will be kept only by the lower boundary of the side channel in the area of 1.2270-80.