The US dollar remains under pressure due to the growing uncertainty factor in the issue of customs duties. In recent days, it lost its advantage and can continue to smoothly weaken, if this state of affairs continues.

The dollar remains hostage to the state policy of President D. Trump, who seeks in virtually all ways to revive the national economy, which, like many of the economies of the West and Japan, has been the victims of globalization. The president's aspirations to revive the national commodity producer are encountering strong resistance from both political and economic circles within the country. The resistance is very strong and is connected with the high level of financial interests of opponents of Trump, which leads to political attacks on his figure. And the dollar became the victim of all this struggle.

In connection with this state of affairs, the question arises. And what is still waiting for the US currency in the near future?

In our view, the dynamics of the dollar will depend on three important conditions. First, what will be the result of the new epic with customs duties. The uncertainty factor in this issue will weigh on the rate of the US currency. The second condition is the continuation of the increase in interest rates of the Fed. This will be a positive supporting factor for him. And the third condition is the activity of the Central Bank, whose currencies are traded against the dollar and enter its basket in the issue of active exchange rate changes in monetary policy and raising interest rates.

We believe that the dollar has reasons for growth in the future. The basis for this will be a decision to raise customs duties that will lead to increased inflationary pressures and the Fed will have to raise rates more actively at the same time, the ECB, the Bank of England and the Central Bank of Japan and many others, for example, the CBA may slow down somewhat with the process of raising rates and refusing measures stimulation, precisely because of the likely US trade war with a number of exporters, which include the EU, China, Canada, Mexico and others. The dollar will experience pressure on one side due to a probable trade war, but at the same time, it will be attractive due to the growth of interest rates. Who will finally win this competition fears or high rates, it seems to us, still high rates, if, of course, economic growth in the US continues.

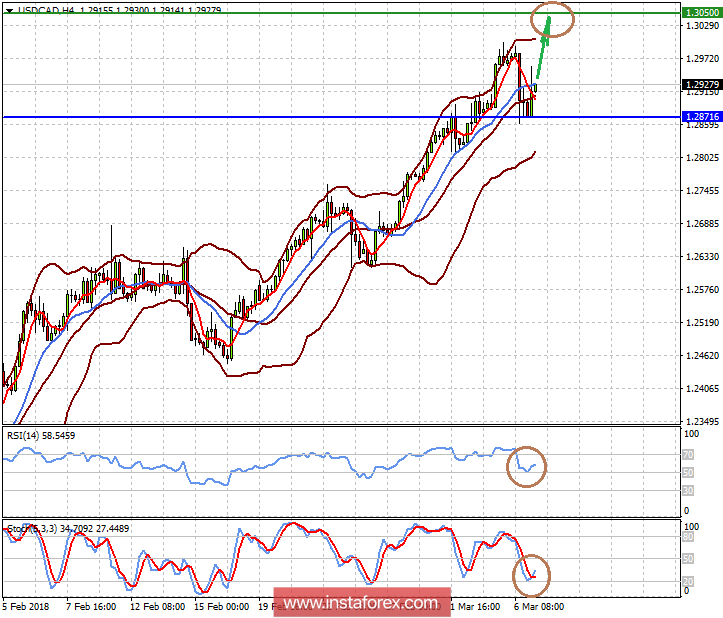

And this week, we are waiting for the local growth of the dollar on the wave of a soft statement by the CBA of Canada and the ECB, as well as the projected positive data from the US labor market.

Forecast of the day:

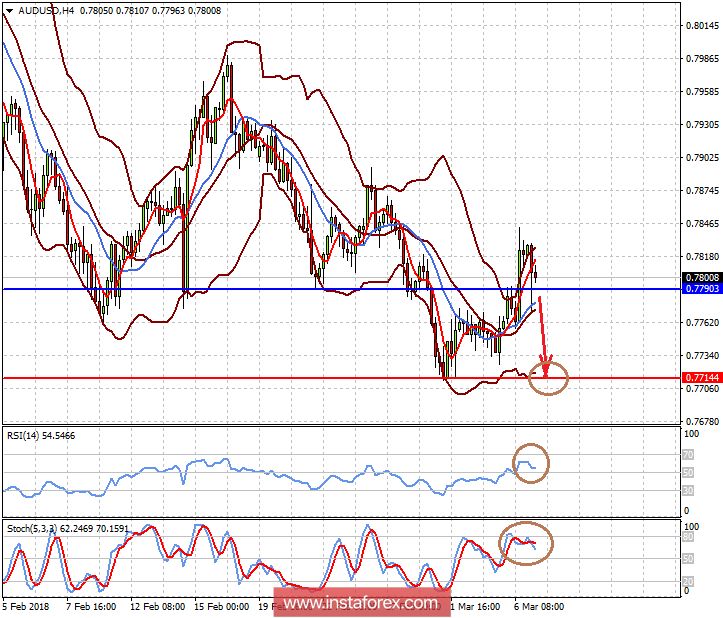

The AUD / USD currency pair may be under pressure on a wave of strong data from ADP. A price decline below 0.7790 could lead to a drop to 0.7700-15.

The USD / CAD currency pair is located above the level of 1.2870. We expect that today, the CBA will not raise rates, and its statement may be "soft." On this wave and strong data from ADP, the pair can continue to rise to 1.3050.