Overview :

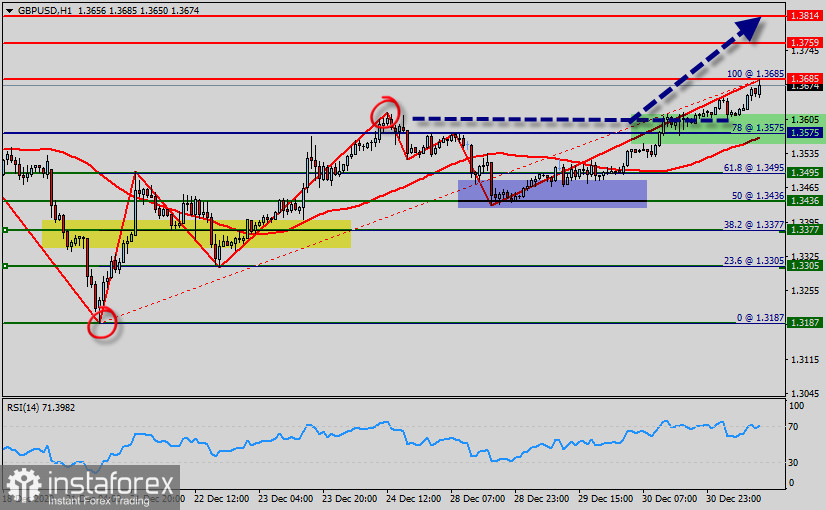

The GBP/USD pair broke resistance, which turned into strong support at 1.3575.

Right now, the pair is trading above this level. It is likely to trade in a higher range as long as it remains above the support (1.3575), which is expected to act as a major support today.

Therefore, there is a possibility that the GBP/USD pair will move upwards and the structure does not look corrective. The trend is still below the 100 EMA for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside.

From this point of view, the first resistance level is seen at 1.3759 followed by 1.3814, while daily support 1 is seen at 1.3575 (78% Fibonacci retracement).

According to the previous events, the GBP/USD pair is still moving between the levels of 1.3575 and 1.3759; so we expect a range of 184 pips from the end of 2020 to the first week of 2021.

Consequently, buy above the level of 1.3575 with the first target at 1.3759 so as to test the daily resistance 1 and further to 1.3814. Besides, the level of 1.3814 is a good place to take profit because it will form a new double top in 2021.

On the contrary, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.3575, a further decline to 1.3436 can occur, which would indicate a bearish market.

Overall, we still prefer the bullish scenario, which suggests that the pair will stay above the zone of 1.3575.